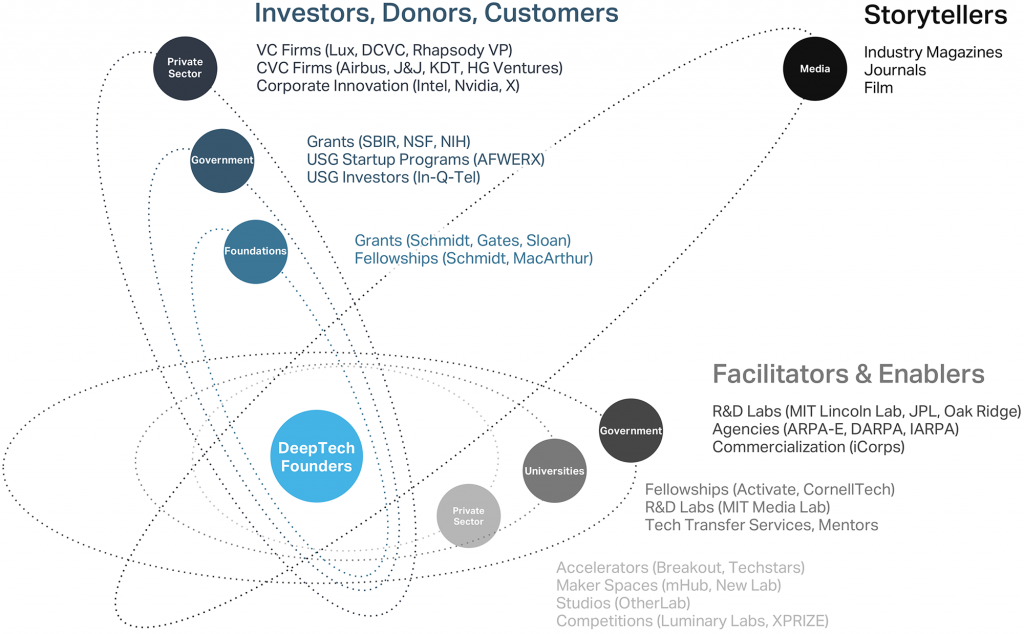

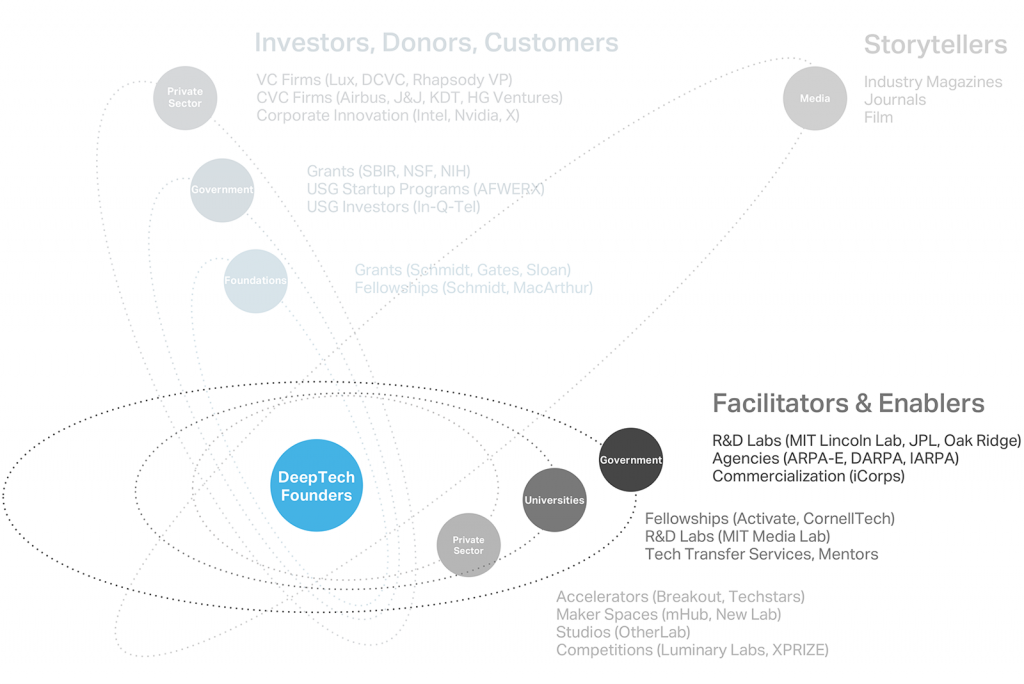

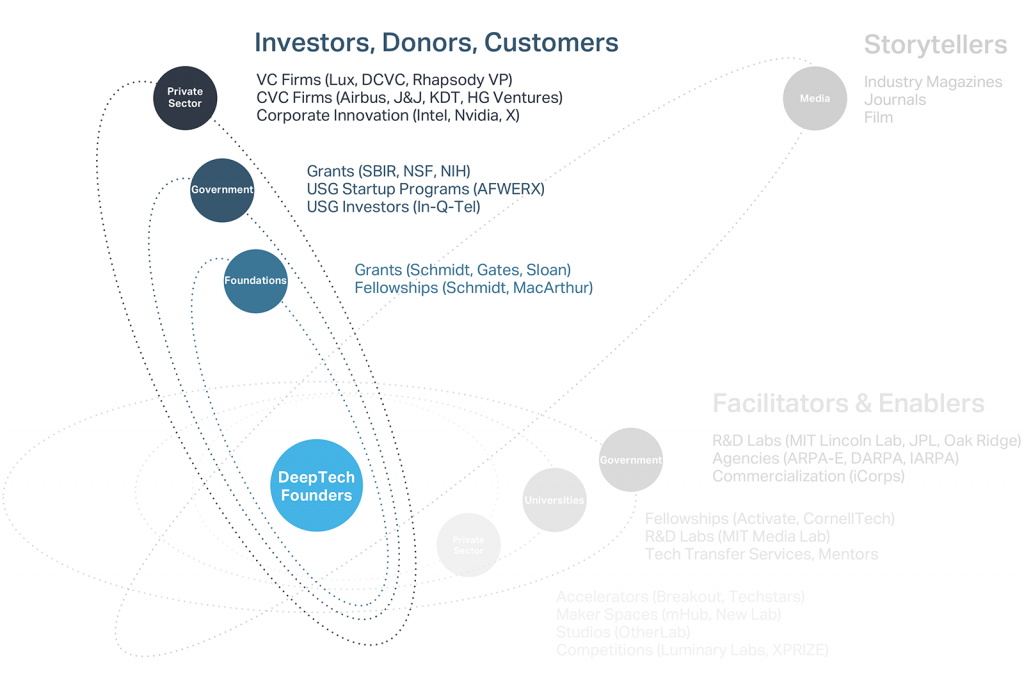

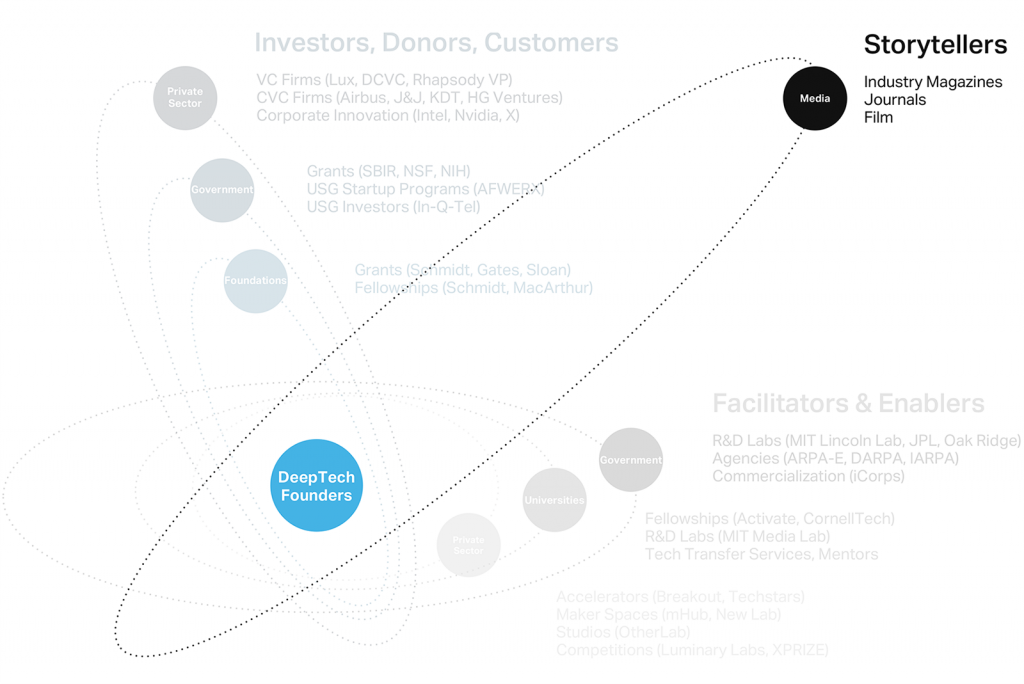

From universities to government agencies to venture capital, LPs, corporates and beyond — DeepTech entrepreneurs are surrounded by a complex solar system of support and capital. This article both visualizes and explores the components of the DeepTech startup ecosystem.

Much has been said and written about startup ecosystems over the years. From books on building startup communities, to annual rankings on ecosystem health and growth, to recurring talks at festivals on ecosystem development — there’s a plethora of resources. But much less is said about the DeepTech startup ecosystem and the capital stack that fuels it.

In the course of research for our DeepTech Investing Report, we needed to ascertain the types of support and investment scaffolded around scientific entrepreneurs. We realized that the DeepTech ecosystem is an incredibly rich and nuanced tapestry of nodes and networks that form a constellation around advanced technology startups. We think of it as an orbital system — with different types and clusters of support orbiting around the DeepTech founders, each with its own paths, speeds, and priorities. Following is a guide to help funders and founders alike better navigate DeepTech.

(Note that this analysis focuses on the United States. Internationally the landscape is similar yet even more complex.)

A Complex Solar System

DeepTech encompasses multiple, highly diverse, ecosystems with a dynamic group of key players. Cooperation, support, and a ‘pay-it-forward’ mentality of helping others is alive and present in these ecosystems; it’s evocative of Silicon Valley in the 1970s and 1980s (rather than the more cut-throat / ‘rising tide sinks my competitors’ mindset that’s become more common today). In part, this mentality is influenced by the universal recognition of just how difficult it is to succeed. The DeepTech community wants to see more winners.

These ecosystems overlap, but don’t always communicate well with each other. Certain organizations are better onramps into an overlapping ecosystem than others. Every entity and ecosystem also has its own distinct motivations and rules that shape how it supports (and sometimes inadvertently hinders) scientific entrepreneurs. Each ecosystem is also complex; requiring effort and expertise to fluently navigate, and the people building DeepTech companies aren’t always equipped to do so.

Ecosystems can support DeepTech companies in multiple ways. Some facilitate and enable, providing the foundations and launchpads for DeepTech companies to get started. Others underwrite, buy, or invest, providing the capital for DeepTech companies to flourish. And some do a bit of both.

Facilitators and Enablers

Facilitators and Enablers tend to focus on founder development and success as their primary goals. They work at the very earliest stages of the innovator’s journey, sometimes well before a company has been conceived, much less established. They span the public and private sectors, but tend to be mission-aligned, motivated more by the advancement of science and the growth of the community than by financial returns. While similar to the Facilitators and Enablers supporting other startup entrepreneurs, they are distinct in two ways. First, Universities and Government, particularly the Federal Government, play outsized roles in this field. Conversely, private sector organizations (Accelerators, Maker Spaces, Startup Studios, etc.) are fewer than their peers in the software world, making these startups more reliant on university and government support, particularly in the earliest stages.

Universities

Universities play a critically important role, particularly at technology inception. They offer fellowships, labs, mentors, and a path to intellectual property. But they also bring their own games and politics. Universities have become the primary channel for government-supported R&D, but in order to access this capital and the laboratories it funds, you must embark and remain on the academic track. This track has inertia. It’s guided and guarded by professors, most of whom have decided to stay on the track to its ultimate destination of basic research. They’re focused more on output (publications, awards) than outcomes, and are often less motivated or equipped to support and encourage commercialization of a technology. To start a DeepTech company requires one to leave academia for the private sector; some universities and professors exert tremendous pressure on their graduate students to remain in academia.

Graduate students and PhD students live and die by their advisors. Some professors are outstanding advocates for whatever a student chooses to pursue, while others may be hell-bent on their own research priorities. A student’s research and career options can come down to luck, as these professors choose to open or close doors. When students leave the university, they often lose access to its labs and resources. We heard numerous comments that “Grad School Dropouts make the best entrepreneurs”, but they typically lose access to critical resources the day they leave campus.

For those who decide to leave, it’s not so easy to take their innovations with them. University Technology Transfer offices frequently hinder licensing of R&D into founder and investor-friendly formats. Most Tech Transfer offices have optimized for Life Sciences. Our interviewees consistently reiterated that this Life Sciences licensing approach does not work for the rest of DeepTech and dissuades investors from getting involved. Anecdotally, DeepTech VCs informed us that the worst offices to work with typically have the most lawyers on staff.

There is awareness of these challenges and efforts being made to resolve them. CornellTech (on New York City’s Roosevelt Island) is experimenting with alternative programs and frameworks. They’ve completed several successful pilots, including offering a Runway Program for post-docs to continue their research with an eye towards commercialization, a graduate STEM program that integrates business education, and a fast-track technology licensing agreement that is founder-friendly. Alternatively, a group of tenured faculty at OSU are looking at ways to raise awareness and shift motivations among university faculty to increase focus on commercialization and entrepreneurship. And new fellowships are being tested at Berkeley and MIT via Activate/Cyclotron Road.

Foundations

Foundations and other philanthropic organizations help fill unique and pervasive gaps. Through grants and fellowships, they provide critical lifelines for DeepTech companies and scientific entrepreneurs as they navigate longer-than-usual “Valleys of Death”. Their support is almost always tied to their specific mission, which shapes the lens through which they view the world.

Some are well-resourced, such as those of Schmidt Futures, the Bill & Melinda Gates Foundation, and the Alfred P. Sloan Foundation. Others are donor-driven, and may struggle to consistently harness sufficient capital to support their DeepTech missions. Organizations like New Harvest (cellular agriculture) are leveraging the power of stories and passionate supporters to harness capital for their DeepTech mission.

The role of challenge grants is somewhat unique to the DeepTech field. Often framed by the term “Grand Challenges” or the UN SDGs, these are competitions designed to draw more talent into the field via the mechanism of a grant program focused on a particular problem or issue. With a history of programs like the old Westinghouse Scholars, XPRIZE is one of the most well-known challenge grant programs today. Newcomers like Luminary Labs are taking a slightly different approach to this work by serving as a strategy and innovation consultancy, using mechanisms including prize-based challenges to identify and motivate scientific innovators.

Accelerators, Maker Spaces & Studios

DeepTech accelerator programs are few and far between. While there are hundreds of accelerators across the U.S., only a handful specialize in DeepTech. Programs like Hax (Hardware program in San Francisco, Shenzhen), WXR (AR/VR program conducted virtually) and Techstars (such as their Starburst program in Los Angeles or their HardTech program in Indianapolis) also offer early-stage capital. Additional accelerators in DeepTech are gradually emerging, but they’re relatively rare and can be costly to get started.

Maker Spaces provide guidance and lab-like facilities outside of a university framework. New Lab (New York), mHub (Chicago), and Playground Ventures (Silicon Valley – a fund first with its own maker space) provide space and specialized machinery for advanced manufacturing and prototyping. Such organizations can be key partners for DeepTech founders in their earliest days, but their spaces are few and far between and expensive to build (each of the three examples have benefitted from government and/or corporate support to facilitate buildout and operations). Most maker spaces in the U.S. are designed for consumer prototyping rather than DeepTech.

Startup Studios exist in this field as in others, though again there are very few. The combination of expertise and access makes this a more specialized field. Examples include OtherLab and M34, who offer some combination of capital, mentoring, and additional resources.

Beyond capital, these entities also offer a sense of community and ‘shared struggle’… a key membership draw. Scientific entrepreneurs benefit from being around each other, and can leverage each other’s specializations to think through hurdles.

Investors, Donors, and Customers

There are various capital sources for DeepTech entrepreneurs that are explored in much greater depth in our report. But at a high level, these organizations and firms provide the fuel for these startup rockets to take off. Philanthropic and other Patient Capital organizations are donors to help seed founders and ideas — with capital spanning from basic research grants all the way through successful commercialization. Government and corporations serve as early customers. And there are a wide range of investors from venture capitalists to corporations to family offices who enable DeepTech startups to scale.

Within venture capital, there are a few category leaders with larger investment funds: some that focus on many kinds of DeepTech, some that specialize (such as in EnergyTech) and some large generalist-VCs who may be known for their software investments but are also comfortable with DeepTech. Then there’s a long tail of smaller, emerging managers who make up the bulk of DeepTech investors. Collectively, these VCs are a fraction of the overall U.S. venture market.

Institutional investors such as pensions, endowments, and family offices typically intersect with DeepTech as Limited Partners in investment funds. Some family offices prefer to do direct deals, and some families play an outsized role in supporting impact-oriented DeepTech companies (such as combating climate change or finding a cure for a specific disease). Those mission-oriented families leverage their investable capital for good, sometimes augmenting the mission of their personal foundations and expanding their legacy.

The U.S. Government is a tremendous resource that spans the DeepTech lifecycle. The USG is the country’s largest pre-seed investor and largest customer for many, though its presence sometimes poses challenges for commercialization (e.g. “dual use” technologies). SBIR is commonly referred to as America’s Seed Fund, and backs an enormous number of promising DeepTech startups each year. State and local governments are players as well, but their capacity is smaller and activity is inconsistent. Later in a company lifecycle, government plays a critical role as a pilot customer with early contracts for DeepTech startups.

Finally, there’s the corporations themselves. Many are potential buyers or early adopters for commercial pilots. Some have their own venture capital arms. Others are Limited Partners in DeepTech funds, leaning on the expert VCs to select, support, and ultimately surface key innovations that fuel strategic needs and business units. Invariably, they are critical parts of the DeepTech community.

Media

Storytelling is crucial, but often ignored. At the end of the day, DeepTech can be an insular ecosystem and the scientist’s journey a lonely, solitary existence. Media outlets and journals can offer DeepTech a channel to the outside world. Communicating the transformational potential and breakthroughs of these companies not only helps attract future scientists, but it can also preserve or expand government budgets, bolster citizens support, and inspire investors to look closer.

Media coverage of DeepTech today is limited in scope. Large funding milestones may be picked up by startup publications like TechCrunch. Big exits may garner coverage from newspapers. Magazines such as Scientific American, Popular Science, Quanta Magazine, and the MIT Technology Review reach audiences of varying sophistication. And podcasts such as as Ben Joff’s DeepTech Podcast dig deeper into the capital environment, featuring DeepTech investors from around the world.

Hollywood plays a role as well. Film can be a powerful medium to inspire younger audiences and shape the perspectives of adults. But the stories and how they are told matter: consider Elizabeth Holmes and the Theranos debacle (Bad Blood); John Nash and his code-breaking saga (A Beautiful Mind); or Tony Stark and his many inventions (Ironman and the Marvel Universe). Each has a unique narrative, resonates with a specific audience, and has consequences for the viewer and the DeepTech community.

Founders

At the heart of the DeepTech ecosystem are the founders themselves. These individuals sit at the center of all other players and organizations of the DeepTech ecosystem. These founders face two challenges that distinguish them from their counterparts in software.

Scientists vs. Entrepreneurs

These founders are scientists and inventors first, which means they often lack business-building skills. It’s a rare combination to find a scientist who is sufficiently intellectually athletic to also excel at the business components. The scientist-founder is key because, as one investor said “no matter how great of an entrepreneur you are, that entrepreneurship prowess won’t get the physics to work.”

Through training programs and careful mentorship, they can learn the skills and strategies to help them build a company. But most still benefit from co-founders or early team additions with critical business and sales skills to help commercialize the technology. Finding that right match is not easy, these scientific entrepreneurs “need business counterparts who support them and do not undermine their vision or autonomy,” clarifies one VC we met with in the course of our research.

In Network vs. Out

It’s a common assumption that all DeepTech entrepreneurs start in a university lab, that’s not necessarily true. They usually have strong technical backgrounds, but educational attainment varies and they’re not necessarily coming straight from academia. Many have PhDs, many have Masters degrees. Some are graduate level-dropouts or PhD-dropouts, still others pursue their DeepTech companies during their Post-Doc programs.

Less often, they are professors who decide to commercialize their research. More likely, a professor may be partially involved as an advisor or scientific officer, but the company and product is led by someone else who was involved in the research.

In other areas where the engineering is multidisciplinary / more complex, “founders tend to hail from industry or a corporate environment,” noted several investors. For these companies, the quality of scientific talent must be excellent. But it must be balanced with equally talented business and go-to-market talent as well. But there are a significant number of “out-of-network” founders, working outside the typical institutions. Boston Consulting Group / HelloTomorrow’s “Dawn of the DeepTech Ecosystem” report found that only 30% of DeepTech companies were university spin-outs. Today it is difficult to track these founders and they have far fewer resources available to them. This is both a challenge and an opportunity.

The DeepTech Investing Report

For those interested in reading further on the topic, our DeepTech Investing Report carefully unpacks the state of the investment ecosystem surrounding scientific entrepreneurs. If you’re interested in discussing DeepTech, venture capital sourcing and strategies, a particular field of interest, or potential custom research, please reach out.