A look at whether DeepTech VCs actually invest in advanced technology companies, how their investment styles and portfolios compare, capital raised, and the GPs’ perceptions of their own portfolios.

Investors that allocate to specific strategies want to ensure that those strategies are correctly implemented. If you’re leaning into consumer packaged goods or enterprise software investments, but your selected strategic funds invest elsewhere — then not only can your portfolio construction be thrown off but you’re not fully accessing your desired tilts. And you may miss on outperformance if your tilts prove correct. (Or if you’re tilting for impact, the impact of your capital will be blunted).

For example, many are aware of public market concerns around “greenwashing” with ESG funds. Recent years have seen a proliferation of ETFs and other investment vehicles that market ESG strategies (environmental, social, and governance), but poorly or weakly implement those strategies. This misrepresentation is frequently referred to as ‘greenwashing’ — where a fund hypes its environmental screens yet under the hood, is focused on basic box ticking. This is how some ESG funds may have significant holdings in polluters such as Chevron or BHP…the prospectus may boil down to “Well, we also look at governance. We asked these companies whether they had any governance and they said yes. So of course we invested in them.”

This challenge of ‘strategy washing’ spans assets classes across both public and private markets. Including venture capital. While many VCs hold true to their investment thesis, others suffer from thesis drift over time. And some may actively massage their strategy to capture a particular zeitgeist such as ‘big data’, ‘the cloud’, ‘SoLoMo,’ etc. Artificial Intelligence is particularly ripe for this today — some startups (and funds) are truly advancing AI, while others are applying basic statistics to some data and calling it science. But in reality, they’re AI washing.

Lipstick on a Robot: Do DeepTech VCs Science Wash?

In the course of researching our DeepTech Investment Report, we were keenly aware of ‘science-washing’ risk with DeepTech VCs. We witnessed several funds proactively position themselves as expert DeepTech investors, but in practice their portfolios were scattered or barely built on science.

So we developed our “DeepTech Concentration Score” (DTC) to assess VC portfolios to what degree they were invested in DeepTech, and determine the prevalence of science washing. While we initially built this score for our report, we have continued to apply our model to DeepTech VCs since publishing the report this Spring. This has built an incredible database that helps us parse and surface funds by sectors, technologies, and of course…concentration in DeepTech.

Today, we have assessed over 7,000 individual startup companies that comprise the portfolios of 400+ DeepTech VC firms. Funds are selected for scoring by either proactively positioning themselves as investing in advanced technologies or by those in the DeepTech community mentioning them as DeepTech investors. Portfolio companies are assessed on their degree of advanced tech legitimacy by reviewing each company’s website across a host of parameters, including keywords, indication of R&D, and utilization of advanced technologies. (For a detailed description of our methodology and approach, see our report.)

DeepTech Portfolios — Where Firms Fall

The first question we sought to answer with this score is ‘What percent of funds are actually committed to DeepTech investing?’ That is, how many VCs are extensively investing in DeepTech startups, versus those moderately investing, versus firms barely investing in DeepTech at all.

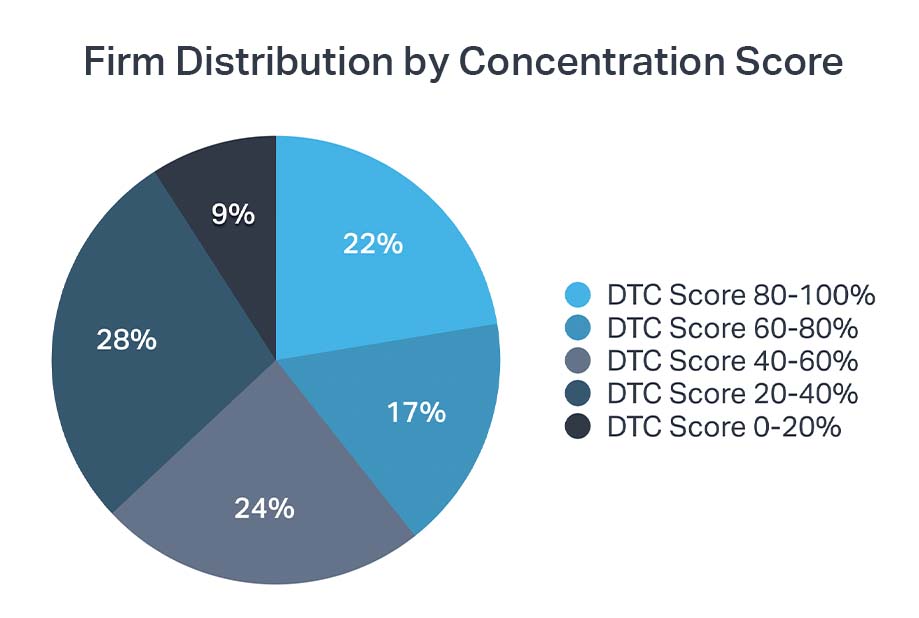

To do this, we segmented every VC firm by its DTC Score into five groups or ‘quintiles’ tied to a range of DeepTech concentration. The top quintile consists of funds where 80% or more of the portfolio is classified as ‘DeepTech’ and the bottom quintile contains funds with less than 20% of the portfolio in DeepTech. For 9% of VCs in our dataset, we were unable to calculate a DTC Score due to lack of portfolio data (either the firms were new or did not publicly list their investments).

Today, about 22% of firms in our dataset have DeepTech portfolio concentrations in the highest quintile, meaning 80% or more of their portfolio consisted of DeepTech companies. And the majority of DeepTech firms have at least half of their portfolios in DeepTech deals.

The majority of funds in our analysis are moderately to fully committed to DeepTech investing. Among the most DeepTech-committed firms, in cases where they had less-technically advanced investments, those companies were often complementary to their DeepTech thesis in some way. For example, an aerospace fund may have invested in a marketplace for aerospace parts, or a CleanTech fund may have invested in software that manages carbon credits.

Investment Style and DeepTech Concentration Scores

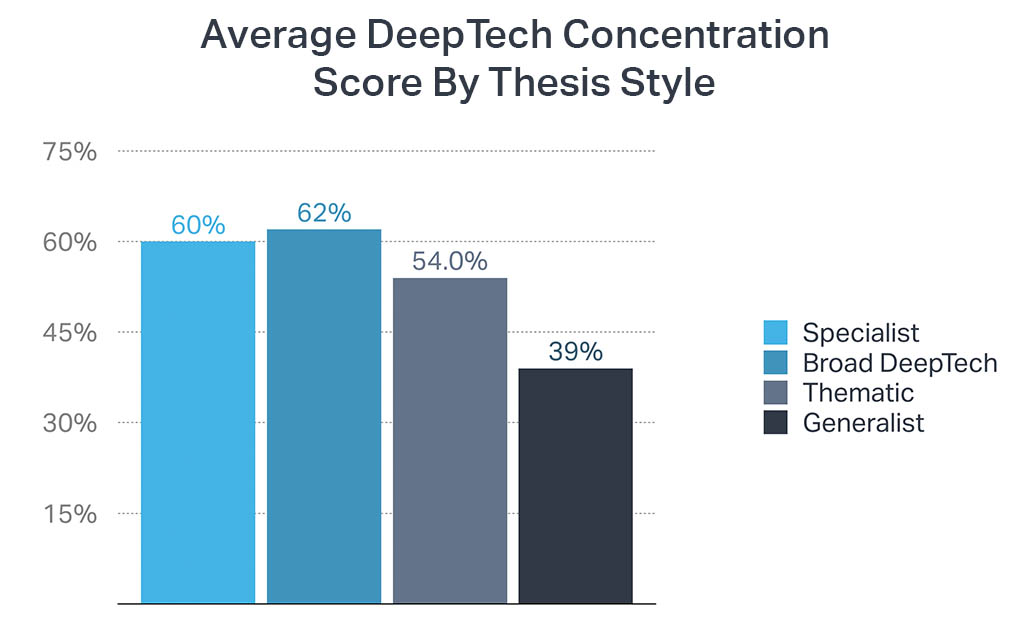

Different investment thesis styles correspond with different patterns around DTC scores. VCs falling in the top quintiles tend to have either Specialist or Broad DeepTech theses. That is — they either invest in a few specific fields such as EnergyTech or “Robotics and Drones”, etc…or they broadly diversify across advanced technologies and sectors.

Funds that fall in the middle quintiles are more likely to be Thematic. These are VCs that have a thesis built around an overarching theme or vision such as ‘advancing the UN’s Social Development Goals,’ ‘striving for a cleaner environment,’ ‘health and wellness,’ ‘founders of a certain background,’ etc. Thematic firms generally consider deals across a range of technologies or disciplines (including less technically-advanced startups such as marketplaces or SaaS), so long as a company contributes to the thematic vision of the firm.

VCs in the lower quintiles are more likely to be generalist VCs that proactively invest in DeepTech. This is usually driven by one or two partners at the firm who are particularly focused on advanced technologies. Or the firm may just be a generalist that is comfortable with greater technical risk. Of course — some of these bottom quintile VCs are actually just science-washing.

Fund Sizes and DeepTech Concentration

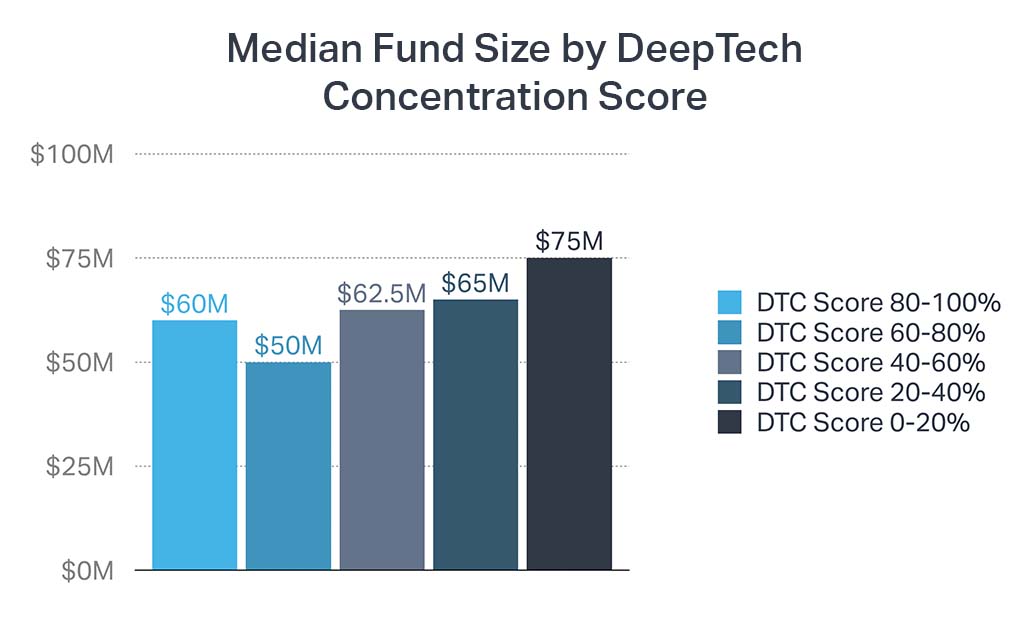

One particularly concerning trend for DeepTech is that, as DeepTech concentration goes up, the median (and average) fund size trends down.

Firms at higher DTC Scores tend to make fewer investments as well, suggesting that the more DeepTech-focused firms follow stronger conviction strategies and have smaller portfolios. This makes sense given the combined dynamics of smaller funds and slightly larger deal sizes common with DeepTech startups.

It’s interesting to note that firms with a more moderate DeepTech concentration tend towards larger fund sizes. With the exception of a few large outlier funds such as Lux, Playground, and DCVC — very few DeepTech “pure play” firms have been able to achieve larger fund sizes to date.

Do VCs Pass the Mirror Test? How they Score Themselves

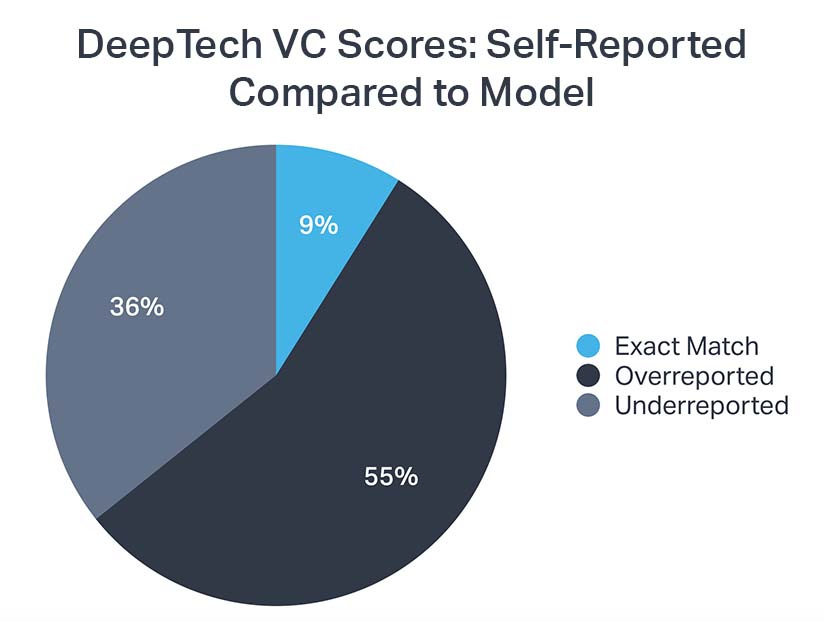

For a subset of venture firms, we were able to interview or survey them about their perceived portfolio concentration in DeepTech. We compared their self-reported score (which tended to end in increments of 5 or 10, ex: 80%, 95%) to our model’s score of their portfolio. (Curious where your firm falls? Contact us with your firm name and how you’d score your portfolio and we’ll tell you where our model places you).

About 55% of firms overreported their score (in other words, they believed they were more concentrated in DeepTech than our model scored them) while 35% actually underreported. And almost 10% of respondents self-reported the exact same score as they received from our model.

In terms of accuracy, nearly 60% of all respondents were within 15 percentage points of our model’s score in either direction: meaning their self-assessment of their portfolio was fairly in line with our DTC score. Of VCs who overreported…nearly a third overreported by 30 percentage points or more (suggesting they see themselves as much more DeepTech oriented than the model, and may not be accurately representing their strategies to LPs or startups).

DeepTech Concentration Scores: A Key Variable for VC Analysis

Through the course of our DeepTech research, we’ve used the DTC Score to help surface patterns and insights around VC funds. Analysis covers geographic distribution, fundraising, portfolio construction, management and partner backgrounds, and much more. Select components of this analysis can be found in our full DeepTech Investing Report, while others are available via custom research engagements.

For interested LPs, we can refine the model to fit particular parameters of importance or build a custom set of screens. Please reach out to us if you’d like to discuss further.