The state of gender diversity at the intersection of STEM and venture capital — women investing in DeepTech more frequently have advanced degrees yet consistently raise smaller funds than their male counterparts.

Today marks the 100th anniversary of the ratification of the 19th Amendment in the United States — granting women the right to vote. Recognizing this moment as an important time to reflect on progress — while knowing we still have far to go — we took a deep dive into DeepTech to add to the conversation around the challenges faced by women in venture capital and STEM. We hope this article sheds further light on the state of women in venture capital, and encourages LPs to examine and overcome biases.

According to Different’s proprietary data – originally gathered to inform our DeepTech Investing Report – about 16% of decision-making partners at DeepTech VC firms are women.[1] Given that both venture capital and STEM have long been notorious for a lack of gender diversity, 16% could be considered impressive, especially given it is on par with the rate of women in VC more broadly, which our internal data pins at 16.3%. And given that the segment of venture capital dedicated to DeepTech is compounded by structural biases and barriers challenging women in STEM, this parity with the rest of venture is even more commendable.[2]

But that is where the optimism ends. In an industry dominated by white men who all know each other via concentric networks, our data reveals a persistent bias in both evaluation and funding of women DeepTech VCs.

“I just don’t think you’re technical enough…”

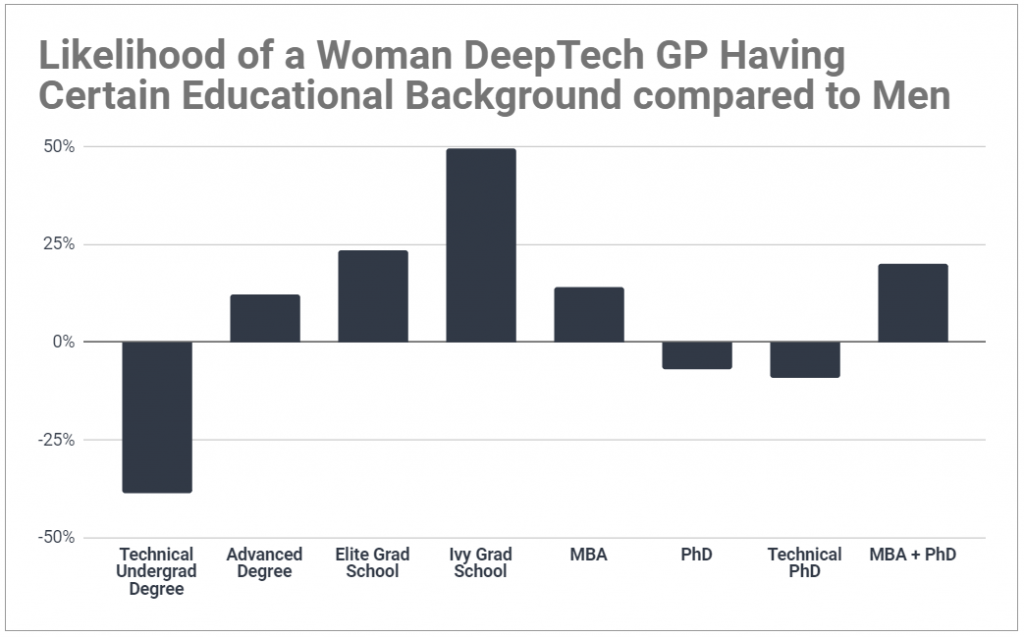

Women in DeepTech are more often sole GPs, and consistently manage less capital than their male counterparts. They are, however, 12% more likely to hold an advanced degree, with over 73% having completed a graduate program. They’re also 14% more likely to have an MBA and 20% more likely to hold both a PhD and an MBA. Women GPs are also 23% more likely to have attended an elite university and 49% more likely to have attended an Ivy League university for their graduate education.[3] Their male counterparts, on the other hand, are more likely to raise (more) capital relying solely on a technical bachelor’s degree. Among men GPs with a technical bachelor’s, just one-fifth continue on to a technical PhD, while nearly a third of women do the same.

There is a persistent perceived bias about women that perpetuates both in STEM and venture capital. The fact that DeepTech women GPs are more likely to have attended an elite or Ivy League university than men could indicate that women entering DeepTech without an elite pedigree face a stronger barrier to entry than men.

A quote from one of the women GPs we interviewed explained: “I haven’t run into issues investing in DeepTech. But I have run into issues being a woman investing in DeepTech. Male LPs will tell me, ‘I just don’t think you’re technical enough to do this.’”

An uneven playing field: constantly having to prove herself

One active way to overcome this bias is to obtain the highest possible technical credentials. While not explicitly stated, to break into the DeepTech VC industry, women need to meet a higher educational standard. This may explain why women with a technical bachelor’s (and not a PhD) are less likely than men (with the same education) to even consider, or have an interest in, investing.

But in February of this year, All Raise reported that women make up just 13% of decision-makers at venture capital firms with over $25M, while data from the National Science Board shows women represent just 28% of the science and engineering workforce (despite representing half of the overall college-educated workforce). So sometimes even having the credentials is not enough to secure a decision-making role.

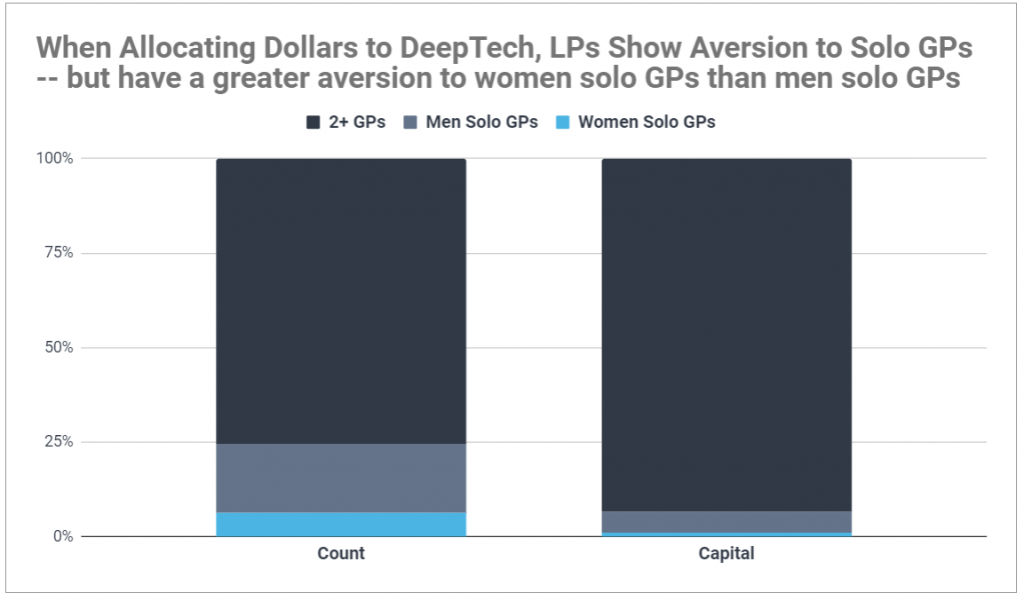

Women in DeepTech VC are doing twice the work for half the reward

Women GPs in DeepTech are twice as likely as men to operate their funds as sole partners. Sole GPs account for nearly 25% of all DeepTech VC firms, yet manage less than 7% of DeepTech capital. This is way below their proportional share and indicates LP aversion to sole GPs. While it’s impossible to confidently say whether this tendency is an active choice or a result of many women being unable to break into male-dominated firms, what’s clear in the data is that going solo generally hinders fundraising.

However, men receive nearly double the proportional share of capital going to sole GPs. So women sole GPs receive less capital than men sole GPs — despite being almost twice as likely to have an advanced technical degree and more than twice as likely to have a PhD.

Network Bias in Full Force

At the end of the day, accreditation and credentials can only take you so far; you could be on the cusp of creating a flying car, but it won’t take off if you don’t have the right investors. LPs invest in what they know, and these decisions are usually based on relationships from their existing networks.

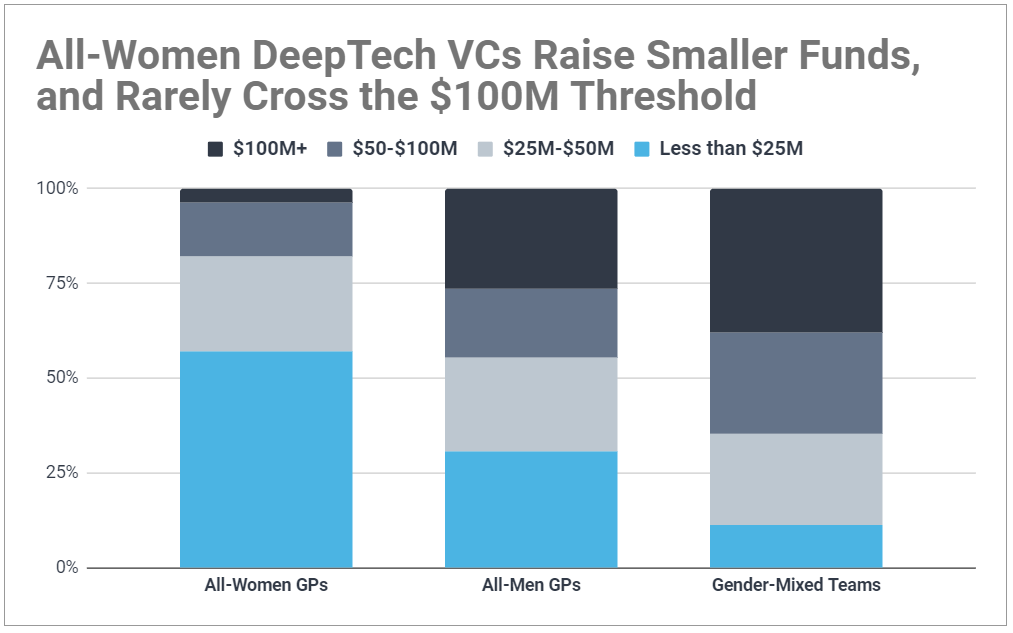

Network bias could explain why women GPs have a harder time raising capital in general. More than 55% of all-women VCs raise funds of less than $25M, compared to just 30% of all-men VCs. And, almost no all-women DeepTech teams raise more than $100M, a threshold many institutional LPs use as a cut-off when sourcing funds. This consequently eliminates nearly every women-led DeepTech fund from even being considered by the investment committees of institutional LPs.

So while network bias routinely keeps female GPs from getting funding, implicit bias keeps them from obtaining senior roles in firms. Our data suggests men are more likely to break into firms via warm college connections, while such a path is not always available to women. Among these GPs, women are about 26% less likely to work at a firm where at least one other partner attended the same undergraduate school.

By now, we should all be aware of the gender pay gap: women make seventy-eight cents on the dollar to men. This statistic is derived from complex structural issues, some of which are illustrated in this post in regards to DeepTech VC. From having to pursue higher levels of education to be considered for the same roles, to not having access to the same networks or levels of fundraising as men, women GPs in DeepTech lack equal opportunity in their field. It is these structural issues that drive lower compensation for women nationally in all professions, and this gap can only be overcome with active efforts on the behalf of LPs and investors.

[1] The research for the report cataloged the education and work backgrounds of more than 1,100 DeepTech GPs, and is updated on an ongoing basis.

[2] This is slightly higher than All Raises’ 13% figure since we include VCs under $25M, where women GPs disproportionately end up.

[3] Defined as the Ivy League Institutions, the top 10 non-Ivy League institutions as ranked by U.S. News & World Report’s 2019 top National Universities, and the top 10 private colleges as ranked by U.S. News & World Report’s 2019 top Private Liberal Arts Colleges.