As venture capital’s ultimate source of capital, LPs are driving the industry’s lack of diversity — and they’re missing out on returns because of it.

Over the past weeks and days, protests against the systemic racism embedded in the United States criminal justice system have escalated in cities across America. As the Black Lives Matter movement has sought to teach Americans for years, institutionalized racism has depressed upwards mobility and opportunity for Black Americans for centuries. Venture capital is no exception. The question is what can we in the industry do about it, to enact real change, and move forward.

Fewer Black VCs, Few Black-led Firms

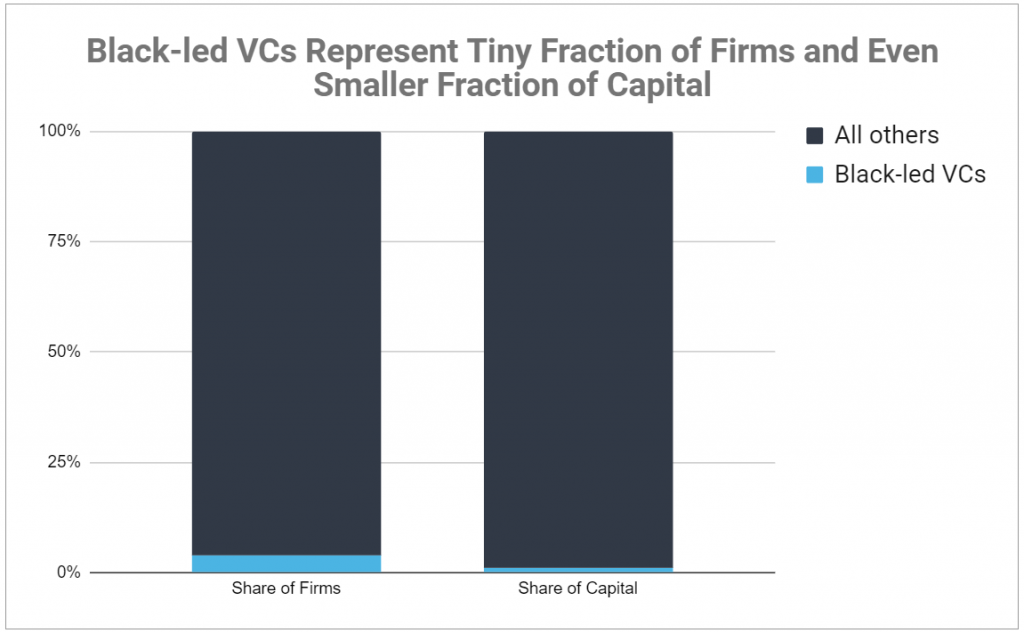

The lack of diversity in venture capital is no secret. In line with other research, our data estimates that of the 4,255 decision-making partners at 1,500 US venture capital firms, less than 3% are Black, and diverse management teams make up only 18% of VC firms.1 Over 93% of venture firms have no Black representation at the partner level.2 And Black-led firms account for just 4% of all VC firms.

Smaller Funds, Less Capital

As if that wasn’t a wide enough gap, Black-led firms receive a disproportionately low share of funding, with just over 1% of total venture capital. The median fund size for Black-led firms is $45.3M, compared to $50M for the overall VC ecosystem, but the average fund size of $56.6M is less than half the overall average of $120.4M. This points to a clear shortage of Black-led funds at the upper extreme of the fund size spectrum, meaning few have enough capital to invest meaningfully at the growth stage. This just perpetuates the funding problem for Black entrepreneurs.

Structural LP Bias Against Emerging Managers

Furthermore, the data shows that the vast majority of Black-led firms (>90%) are emerging managers (Fund I-III). Yet there’s an industry bias against emerging managers due to their limited track records.3 This, despite the fact that many large institutional investors are aware of this structural issue and that emerging managers are more likely to outperform incumbents.

Paradoxically, diversity in venture capital would actually be more prevalent if investors truly were focused solely on returns, like so many claim. Diverse management teams solve for inherent network bias and have been shown to outperform homogenous teams. But instead, Limited Partners are somehow too averse to changing their investing habits or sourcing anything outside the ordinary to capture those higher returns.

Diverse Investors Yield Diverse Portfolios

The point of VC is to be contrarian to the rest of your portfolio, to seek out innovation and untapped markets. Investing in the exact same people with the exact same backgrounds and ‘pedigrees’ increases the likelihood that they don’t invest in the markets you’re actually looking for, and that those untapped markets won’t be part of your portfolio.

Our message is therefore to the LPs, the investors and allocators of capital: you are the reason managers of color don’t get funded, the reason founders of color don’t get funded, and, as an effect, the reason diversity in venture capital is strangled and stagnant.

Here is what you can do:

- Don’t just invest in the usual suspects; evaluate emerging managers, seek out managers of color, take the time to understand the opportunities they’re investing in.

- Give those responsible for underrepresented minorities’ mandates real teeth … if they don’t have the power to actually make the investments and select diverse managers, there’s a strong likelihood they’ll be ineffective.

- Make sure your selection criteria isn’t designed to perpetuate bias and racism. Recognize that managers of color won’t be able to check certain boxes you set for traditional investments precisely because they’ve been kept out of venture for so long (e.g. requiring diverse managers to be raising their third $100M fund after working at Sequoia for a decade excludes pretty much every diverse manager …)

- Be wary of OCIOs and Fund of Funds that claim to select diverse managers, but have track records of investing in the usual suspects. In practice, some institutions have bought into this sales pitch of mandate fulfillment and locked in to a commitment, only to be told by the OCIO or FoF a year later “well, we looked and we didn’t find any quality diverse VCs…so we’re sticking to what we’ve always done.”

We can help.

Different advises institutions and family offices how to discover, analyze, diligence, and select venture capital funds. We track 1,500+ US venture firms in nearly 100+ different metro areas, across dozens of sectors and investment strategies, and follow managers of different genders, ethnicities, perspectives and backgrounds. We can help you source, research and review diverse managers as part of your overall venture strategy or mandate.

To be clear: investing in diversity isn’t a sacrifice. It’s not charity or a ‘special initiative’ or good politics. It’s smart business.

“The moment in history to create intentional racial equity in venture capital is now. There should be fear of missing out (FOMO) amongst LP’s to invest in funds and founders where the data indicates a 35-50% return on investment. We’re raising and know at least ten other vetted Black VC’s that are raising as well. We are not asking for help. This is not charity. Begin your anti-racist journey by investing in us and learning simultaneously as we work to provide returns while building new multi-generational wealth with no reliance on pre-existing multi-generational wealth.”, Rodney Sampson, GP, 100 Black Angels & Allies Fund I; Nonresident Senior Fellow, Brookings Institution.

[1] Asian and S. Asian GPs represent the majority of managers of color within diverse management teams. To more accurately understand diversity within VC firms, for our analysis “diverse” and “people of color” excludes Asian and S. Asian GPs.

[2] Black-led means at least 50% of a firm’s partners are Black.

[3] Funds IV+ are more frequently diverse, but partners of color are almost always a small ratio (i.e. 1 partner of color with 5+ white partners).