How the coronavirus pandemic is affecting venture capital fundraising and LP allocations: analysis finds that emerging managers, women-led firms, and micro VC funds likely to bear the burden.

As the US rolls into month three of shuttered storefronts, mass layoffs, and forced teleconferencing, nearly every conversation around venture capital has (understandably) been steered by the not-so-subtle hum of coronavirus-driven uncertainty. Media coverage and market notes are awash with predictions for poor fundraising performance in the latter half of 2020, a rise in the prevalence of down-rounds, and nervous LPs backing out of soft commitments.

Both Pitchbook and Crunchbase have noted the impending drop in VC activity for the remainder of 2020, as lagging venture markets start to feel the pinch following strong levels of VC investment through Q1. And Samir Kaji, a respected voice in the venture community, has repeatedly called for VC managers to adjust their fundraising expectations to reflect smaller (or negative) step-ups for Fund IIs and IIIs, longer time-to-close horizons for funds that have yet to close a significant portion of their target, and greater stringency and hesitancy from LPs assessing new funds and managers.

Characteristics of the 2020 venture capital climate

While these published perspectives are certainly valuable, at Different we decided to leverage our unique data to further unpack the impact of the novel coronavirus.

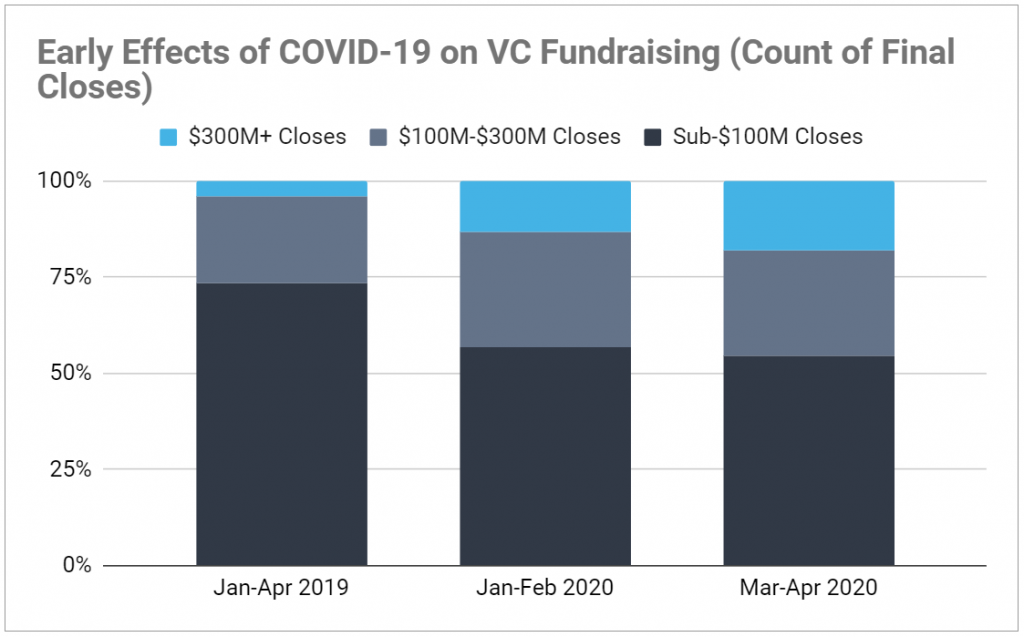

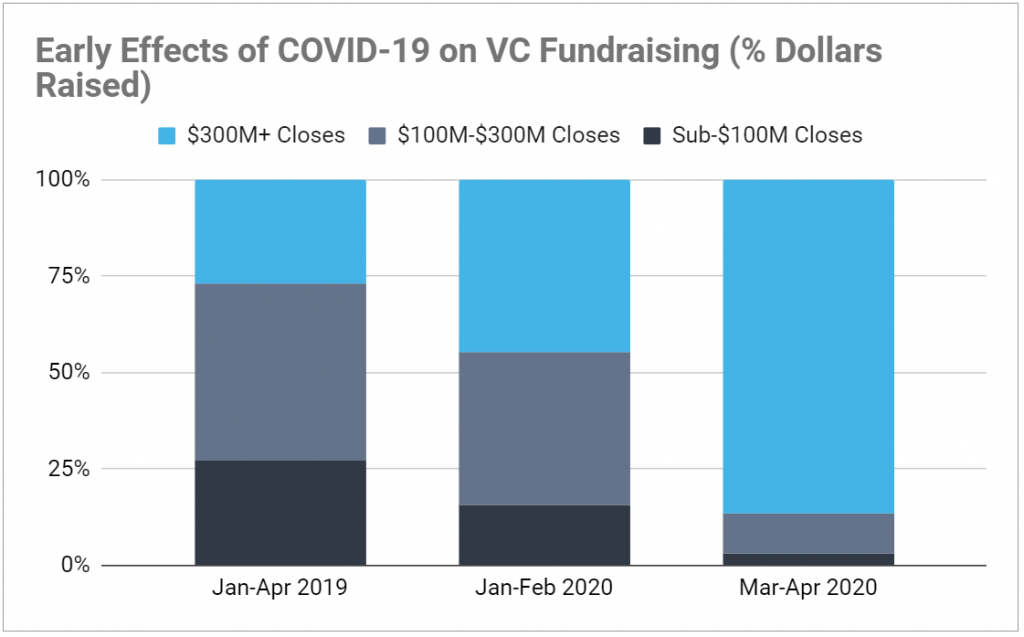

Although 2020 began fairly typically, as we watched new fundraises come in towards the end of March and into April, it became immediately clear that the funding landscape was being increasingly dominated by mega-funds, with a near disappearance of micro and modestly sized funds. Nearly 50% of funds that held final closes in March or April of this year successfully raised at least $100M — in March/April 2019, just 26% of funds fell in this size class. And, funds over $300M accounted for a whopping 25% of final closes in March/April 2020, compared to just 9% during the first four months of 2019. This finding is mirrored by the recent Pitchbook assessment that announced mega-funds of $1B or more claimed nearly half of all capital raised by US VCs in the first quarter, compared to less than a third in normal years. Clearly, this class of VC firm is having no trouble fundraising in the current climate — the weight of the coronavirus burden falling on VCs with more modest targets.

Even more telling, VC firms driven by a generalist thesis have accounted for a similarly disproportionate share of final closes in recent months, with specialist VCs (those investing exclusively in one set of specific technologies or sectors) dropping off significantly. While specialist VCs held 47% of Q1 2019 closes, since the beginning of March they’ve accounted for just 30% (and that’s despite the year starting with an on-par rate of specialist closes). Meanwhile, the concentration of generalists among VC fund closes has jumped from 30% in Q1 2019 to 50% since the pandemic took hold of the US economy (again, despite 2020 beginning with on-par rates). Anecdotally and in contrast, family offices report preferences for specialist VCs with deep sector expertise, and VC firms that are uniquely differentiated. Given we’re quite early in the COVID-driven economy, it’s possible we may see this reported specialist-preference emerge in fundraises later in the year.

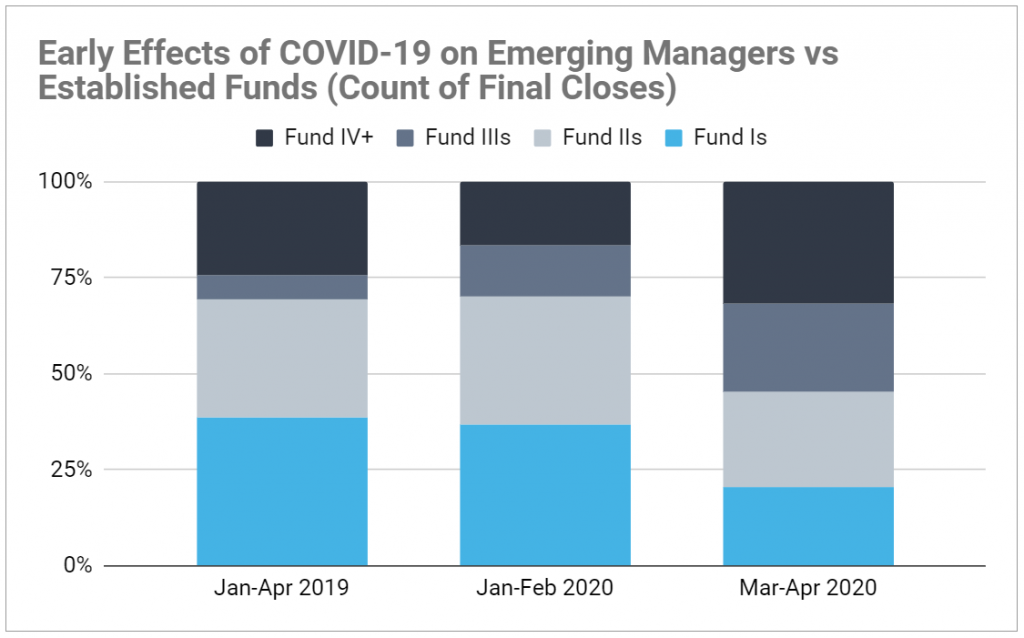

Perhaps not surprisingly, established VCs also appear to be weathering the pandemic with more ease than emerging managers. In Q1 2019, 70% of successful closes were either a debut fund or a Fund II — since the beginning of March, their relative prevalence among final closes has fallen to 45%, with the relative frequency of Fund I closes being cut fully in half. Of note, the decline in emerging managers is a trend that precedes the coronavirus outbreak, and is by no means a reaction purely to COVID. However, when comparing the first two months of 2020 to the most recent two, the drop in prevalence of Fund Is and IIs is precipitous. This is strong evidence that the pandemic has, at a minimum, accelerated this longer-term trend.

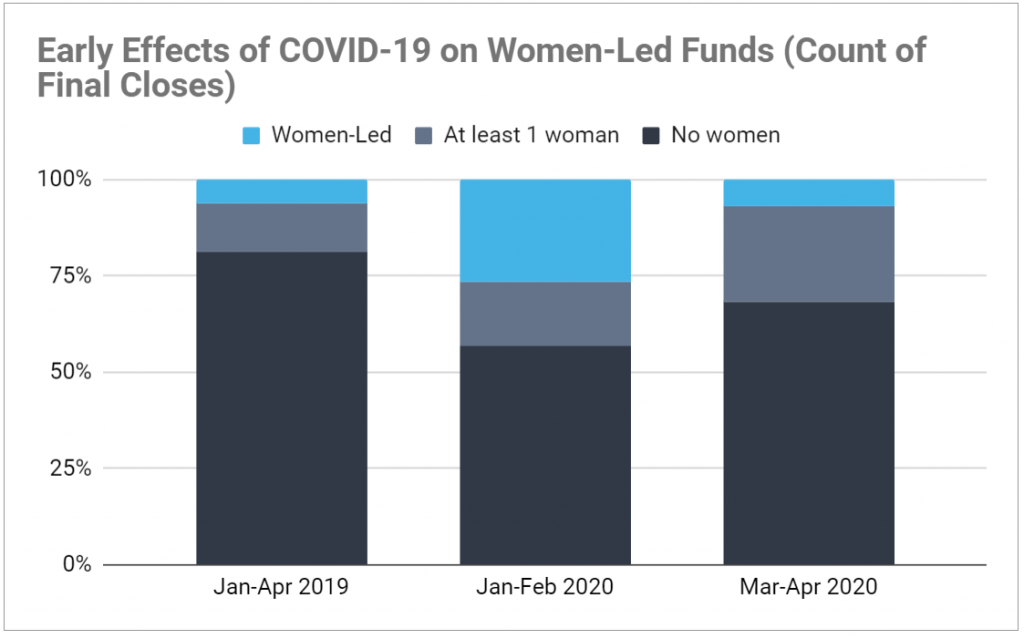

Women-led VC firms (those with either a majority of women GPs or all women GPs) have seen a dramatic fall in relative closes since the economic shut-down began, despite beginning 2020 by accounting for an incredibly strong share. Women-led firms held just 6% of closes in the first four months of 2019 but climbed to almost 30% of January/February 2020 closes, only to experience significant pullback in recent months and fall back to 7% of March/April closes. While this could just be a reversion to the mean, it’s likely a signal that the pandemic could erase much of the recent progress made in LPs’ increasing portfolio allocations to women and diverse managers. We’ll continue to monitor this trend as the impacts of COVID evolve.

The bottom line

Taken together, what does all of this say? Even before the pandemic introduced wild economic and societal shocks, venture markets had been growing increasingly concentrated for years, with LPs flocking to the same established funds chasing huge target raises. Now, the early signs suggest this market concentration will only be exacerbated by the uncertainty COVID introduced. What we’ve seen so far points towards at least a short-term future where LP capital flows increasingly towards known managers perceived to be stable — that is, large generalist funds often managed by male-dominated teams that have been established for years, some of whom successfully weathered the last downturn. In a time of unprecedented market volatility, reflexing back to standard pattern matching and finding anything that’s “other” to just be an additional layer of risk is an instinct that can make intuitive sense — but not necessarily financial sense.

There’s also some early evidence that the recent fundraising dominance of mega-funds has been partially driven by these large firms accelerating their fundraising cycles and loading up on as much dry powder as possible — perhaps to weather risks of an extended economic downturn. The median mega-fund (>$300M) announced or closed during the first four months of 2019 came 3.2 years after the firm’s previous fund; the median mega-fund announced or closed in March/April 2020 came just 2.35 years later. That’s a 25% reduction in the median time-between-funds, a signal of contracted fundraising cycles for mega-funds. Taken in tandem with the additional 25% drop in the median time-to-close for 2020 vs 2019 mega-funds, the contracted fundraising cycles appear to be rushed closes of funds scheduled to close later in 2020.

Within these trends there’s a silver lining for bold investors: the pandemic has created an incredibly wide and diverse class of undercapitalized yet potentially over-performing VC opportunities. Venture performance varies by vintage. In recent years, some of the best venture vintages were during the Global Financial Crisis, a crisis which also gave rise to some of today’s brand-name firms. Today’s crisis is creating similar opportunities. As a growing chunk of LPs flee to “safe bets” with established managers, they leave behind potential alpha for those investors willing to stick to, or expand, their venture strategies.

Investors daring enough to look past short-term disruptions to invest in modestly-sized funds, specialized funds, and new emerging managers — all classes of VC that have shown superior returns — could see this as an exceptionally rare opportunity for exceptionally rare investment performance.

COVID-19 is not only a fast-moving disease, but it’s causing rapid changes to economies and asset classes…venture capital included. We will continue to monitor and discuss how venture capital is impacted over the coming months. Please reach out if you have particular questions or strategies you’d like to discuss.