Anticipating the long-term effects of COVID-19 on venture capital performance: geographically distributed teams might be better positioned to capitalize on trends accelerated by the pandemic.

When it comes to investing in startups with geographically distributed talent, venture capitalists often split into two camps.

The first (more conventional) crowd argues for the creative power of so-called “water cooler” moments, and other office synergies that are lost with remote startup teams — it’s why Steve Jobs placed office bathrooms in the center of the workspace and why Marissa Mayer banned remote work while CEO of Yahoo. The second crowd argues that distributed teams actually help startups scale faster — having a remote team opens up access to broader talent pools, prepares the company for future expansion, and decreases overhead costs (Peter Thiel has been quoted lamenting that the majority of VC dollars go to Silicon Valley “urban slumlords”).

But regardless of what side of the debate a VC firm falls on, the conversation around distributed teams rarely extends to the VCs themselves.

In the new economy, that’s no longer a conversation that can be ignored.

The virus has forced venture capital, like every other industry, into remote work. If a VC wants to close commitments from LPs, vet new startups, or allocate capital, they have to do it all while handcuffed to Zoom. Some are struggling to adapt and would prefer to wait until “normalcy” returns to place new bets and close on fundraising. Unfortunately, that option is becoming less and less viable as the pandemic drags on and a return to “normal” seems more and more like a delusion.

Will all firms be equally affected by this shift? Unlikely. While remote work will certainly be new to some VC firms, for those with partners already in separate locations it’s hardly out of the ordinary.

Snapshot of the Landscape

How common are distributed teams in venture capital? To answer this question, we leveraged unique data we gathered to fuel our DeepTech Investing Report and subsequent work, and looked at the geographic distribution of the approximately 1,100 decision-making partners constituting nearly 400 DeepTech firms. Although this limits the scope of our analysis to a specific subset of VC, it provides a reference point for an otherwise unanswered question, and qualified generalizations can be made. We will look to expand the scope more broadly in the future.

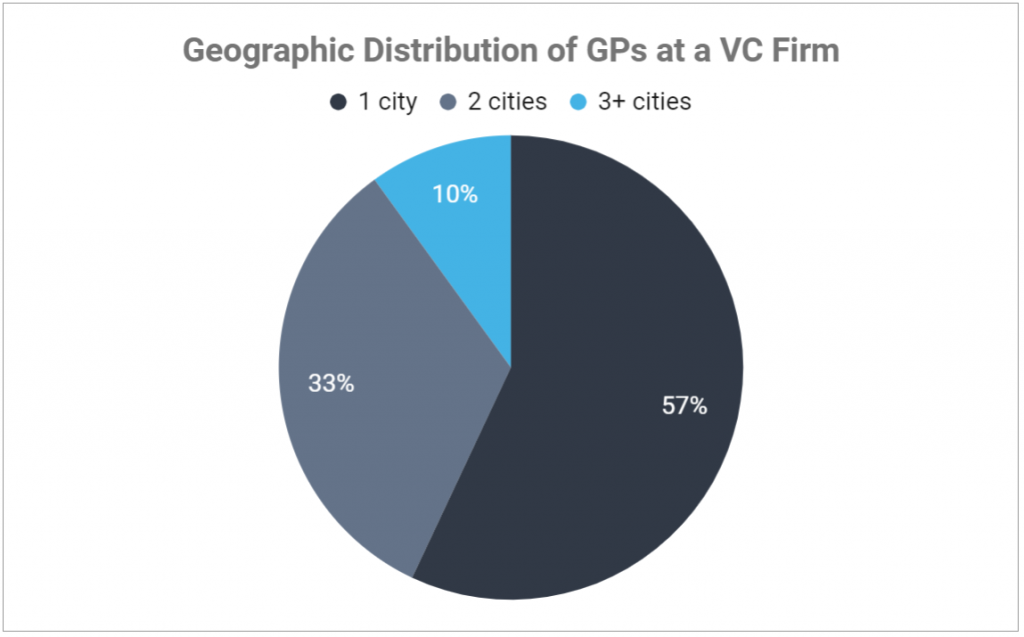

Here’s what the landscape looks like:

After removing the 24% of VC firms that are sole GPs (since they’re neither distributed nor centralized[1]), a majority of venture capital firms (57%) operate with centralized teams, where all GPs reside in the same metro area. A third (33%) of VCs are split (with GPs in 2 unique metro areas), while just 10% are spread (with GPs in at least 3 unique metro areas).

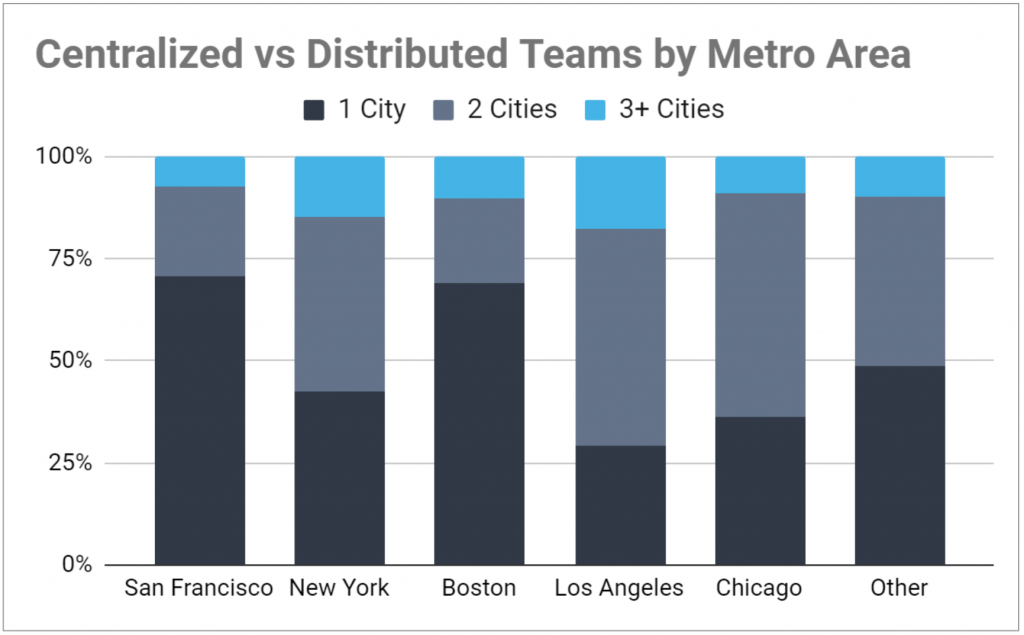

Looking with more granularity, VC firms headquartered in the San Francisco Bay Area are more likely to be centralized than any other metro area. Nearly three-quarters of Bay Area firms (71%) consist of teams where every partner resides in the region, significantly above the 57% overall rate of centralized teams.

There are a couple likely drivers behind this trend:

1) The abundant flow of resources (namely, promising startups and LP dollars) into this venture capital epicenter means the network-tapping benefits of distributed partners are relatively minimal compared to the perceived costs of finding and working with partners outside of the firm’s headquarters.

2) The prevalence of a Silicon Valley-centric mindset further diminishes the perceived value that distributed partners can offer in having direct access to diverse markets.

Interestingly, Boston-based firms are also more likely than average to be centralized (69% of multi-partner teams are concentrated all in Boston vs 57% overall). However, this observation may be unique to DeepTech — Boston is a hub for technological innovation (Harvard and MIT, a strong biotech ecosystem, etc.), creating the same in-flow of resources to the region that likely reduces the prevalence of distributed teams in the Bay Area. A look at the broader VC landscape may show centralized teams to be less common in Boston than this DeepTech sample suggests.

Los Angeles-based firms, on the other hand, are less likely than those in any other major VC ecosystem to be centralized: just 30% of firms headquartered in LA have all GPs residing there. In part, this is due to LA firms having partners just up the coast in Silicon Valley. But LA VCs are also twice as likely to have partners in at least 3 metro areas than on average.

So why does this matter?

Although too early to tell, there’s a strong possibility that the changes ushered in by the pandemic could produce a long-term shift towards remote work. And if remote work does merge into a norm, already distributed teams may prove to have a leg-up in fundraising, accessing and vetting promising startups, and meeting their return targets.

Why? Because distributed teams are likely more practiced when it comes to coordinating conference calls, generating productive brainstorming sessions through Zoom, problem solving remotely, and making significant decisions without convening face-to-face. They are accustomed to navigating this operational friction. And, with some studies suggesting humans are less creative and persuasive when not face-to-face, VCs with remote partners might also be more practiced at these two skills central to bringing in the best deals and scaling their portfolio companies. Meanwhile, centralized teams that are accustomed to in-person work might have to climb a learning curve that distributed teams have already been chipping away at for years.

Perhaps more significantly, distributed teams could emerge as better positioned to capitalize on a fundamental trend being accelerated by the pandemic: a drastic shift towards remote work across sectors that is consequently driving a migration out of major cities, a migration particularly concentrated among younger populations. If (or when) these large talent pools begin distributing out across the country, we could see innovation and entrepreneurship rates follow. As the geographic distribution of top venture opportunities widens, the value of emerging venture ecosystems would likely expand.

Venture capital firms that already have established presences in a number of these new startup ecosystems (through their distributed partners) may have a better chance at capitalizing on that value — their geographically spread partners could already have the networks, local knowledge, and community leadership needed to attract and accelerate the top tier deals offered by these newer ecosystems.

Or, maybe they won’t. There are a host of other factors at play (the types of industries a firm targets, their management style, and their go-to-market expertise, to name a few) that in many cases will outweigh any possible advantages being distributed provides.

But in a post-COVID environment, it’s a factor LPs should be adding to their consideration list when diligencing VC firms. It may just prove more consequential than a first glance suggests.

[1] Yes, some may have worked with distributed analysts or VPs, but this is less relevant for investment and fundraising decisions than working with a distributed partner.