Project to research and design strategy to expand working capital available to science-based innovators

From satellites to semiconductors.

In the post-war Eisenhower era, scientists worked on everything from satellites to semiconductors, to the infrastructure for the Internet. During that period, Bill Draper founded Draper, Gaither & Anderson, one of the first venture capital firms in what was to become Silicon Valley. His partners were the founder of the Rand Corporation and a retired Air Force general, drawing on expertise from both the public and private sectors. It was a golden age of scientific discovery and innovation, much of it backed by the US government.

Today’s scientific innovations are undercapitalized.

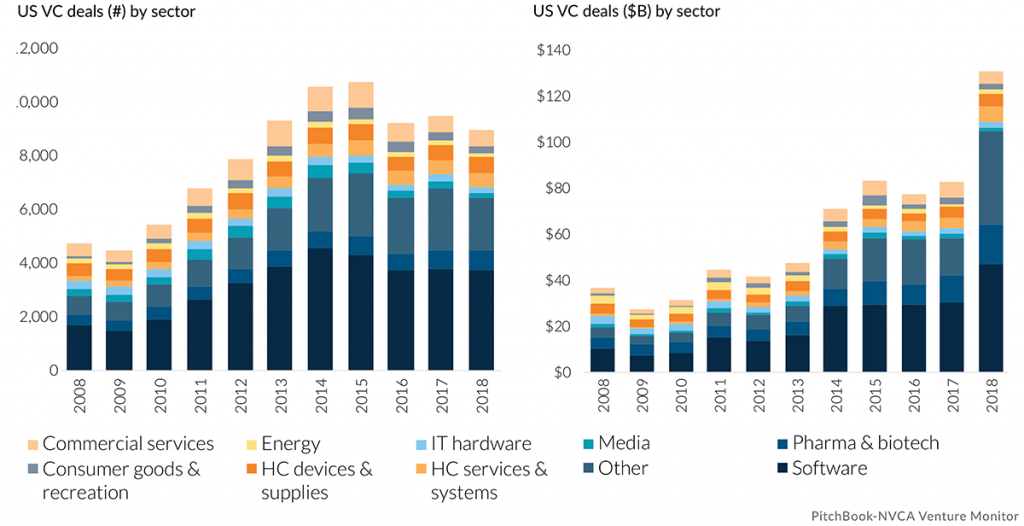

We’re in a period of massive scientific innovation today. Entrepreneurs are using modern science and advanced computing to tackle everything from water scarcity to quantum computing to solving the riddle of dementia and other complex neurological diseases. But today’s scientific entrepreneurs have greater challenges when it comes to working capital. While the venture capital industry has expanded exponentially since the 1950’s, the vast majority of funding goes to consumer and enterprise software products. All too often great discoveries, that have the potential to be transformational (and highly lucrative) businesses, languish on the lab bench or in the garage for lack of working capital.

We’re going to change that.

We believe the future of venture is Different. We’re excited to announce that Schmidt Futures, a philanthropic initiative founded by Eric and Wendy Schmidt, is supporting Different to assess the current state of investing in scientific entrepreneurs, with the goal of quantifying market gaps, and better understanding their challenges and opportunities. Using this information, we can advance solutions designed to catalyze more capital into emerging companies that have the potential both to impact millions of lives and to become successful businesses.

“The U.S. federal government invests more than $140 billion a year in research and development, creating a huge bench of talent and ideas that private markets can help commercialize and scale,” said Kumar Garg. “I’m excited that Different is working with us on unlocking that potential, using their ability to both leverage data, and work nimbly across government, universities and finance.”

It’s time for science arbitrage.

If scientific entrepreneurs are undercapitalized — and undervalued — investors can seize this as an opportunity for arbitrage. Our work will identify promising venture firms who have the expertise and networks to invest in scientific entrepreneurs. We’ll use this information to offer insights to qualified investors who may wish to add a “Frontier Technology” component to their venture portfolios. By analyzing and mapping the landscape, we’ll uncover new opportunities and help better inform investors on their options.

Knowledge is power.

The world faces extraordinary challenges, many of which can only be solved by scientific and technical advances. Government and academia play important roles in the development of these innovations, but it’s up to private investors to help transform these ideas into thriving companies. The goal of the Schmidt Futures support of Different is to equip more investors with the intelligence needed to consider a role for scientific entrepreneurs in their portfolios. If the 21st century is the era of the knowledge economy, we want to help you build your knowledge portfolio.

About Schmidt Futures

Schmidt Futures is a philanthropic initiative, founded by Eric and Wendy Schmidt, that bets early on people who will make our world better — helping people to achieve more for others by applying advanced science and technology thoughtfully and by working together across fields. Learn more at www.schmidtfutures.com.