Compared to the broader ecosystem, DeepTech startups more frequently secure follow-on VC funding — but they sometimes wait as many as 5 years just to get their first round.

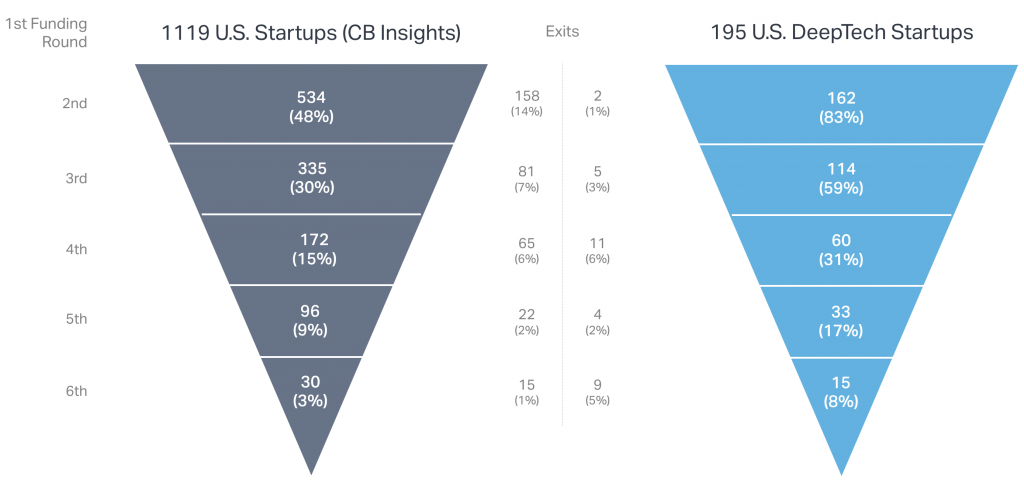

Since its release, CB Insights’ Venture Capital Funnel has been considered a premier source for understanding the funding lifecycles of venture-backed startups — not only because the visualization of the funnel itself intuitively resonates with VC investors and entrepreneurs alike, but because the robust sample size offers a certain legitimacy to their conclusions. With more than 1,100 seed-funded tech companies behind it, the funnel is often viewed as a representative snapshot of the startup ecosystem.

But with the 200+ conversations fueling our DeepTech Investing Report still fresh on our minds, we couldn’t help but wonder: Is this really what the funding lifecycle looks like for all startups? What about the largely undercapitalized subset of advanced science and technology entrepreneurs — that class of companies transforming the physical world but which receive just a quarter of all venture capital (and just 9% after removing Life Sciences and AI).

The broad consensus among the DeepTech investors, founders, and experts we interviewed stressed how differently the funding stages look for advanced technology companies. Could the CB Insights’ Deal Funnel really be representative of the DeepTech Deal Funnel?

To find out, we randomly sampled 195 DeepTech startups founded in or before 2015 that have received at least one VC-backed equity funding round. We collected exhaustive data on the funding histories of each of these startups, cross-referencing a variety of sources to sort through the tangled mess that defines public funding data. A full explanation of our methodology can be found at the end of this post.

The resulting analysis will be discussed in two separate articles and will cover several key areas:

- Direct Comparison: exactly matching CB Insights’ funnel framework suggests DeepTech startups raise follow-on capital with relative ease (This Article).

- Pre-Venture Financing: inclusion of grants in DeepTech uncovers a significant gap as startups try to make the leap to their first round of VC funding (This Article).

- Progressing Through the Pipeline: a new funnel framework shows DeepTech startups struggle to progress through traditional funding milestones (Second Article).

- Late-Stage Funding Gap: in contrast to the overall startup market, DeepTech startups have a harder time securing funding at later stages and don’t experience comparable levels of growth in round size (Second Article).

Ultimately (across both articles), we find that DeepTech startups lag entering the venture capital funnel, struggle to meet notable financing milestones while in it, and fall further behind at later financing stages.

Direct Comparison

Using CB Insights’ framework, the DeepTech Funnel appears to show that advanced tech startups have a significantly easier time securing follow-on funding.

Compared to the broader set of startups, DeepTech companies who receive a first round of venture funding are about twice as likely to raise a second, third, fourth, fifth, and sixth round.

Of course, it’s not necessarily accurate to conflate lots of funding rounds with lots of success — a highly “successful” startup, in the eyes of an investor, may only require a handful of rounds before scaling rapidly and exiting for handsome returns. Consequently, the high percentage of DeepTech companies moving onto round after round might instead be seen as a symptom of:

- An immature early stage exit market — per CB Insights data, exit rates for the overall startup market are relatively high even after just one equity round; by contrast, DeepTech startups rarely exit that early, perhaps because there are few potential acquirers willing to make acquisitions of DeepTech companies in the early stages, or because a portion of DeepTech companies are profitable and growing while exiting on a slower timeline.

- The capital intensity of commercializing advanced science — DeepTech companies may actually require significantly more rounds of funding because, unlike software startups, they can’t be “built in a basement over a weekend”; these hardware intensive companies on the edge of scientific research may need more funding rounds to perfect the science, mature, and lock down a revenue-producing business model.

- Existing investors keeping the company afloat — rather than gaining participation from new investors, follow-on rounds for DeepTech startups might simply be additional cash infusions by existing investors, designed just to fund another year of operation until the startup is in a position to attract new, larger players.

Nonetheless, ignoring this qualification, taken at face-value the DeepTech Funnel appears less steep with better follow-on rates than those experienced by the overall startup community.

However, as we’ll show, this is far from the full story.

Pre-Venture Financing

CB Insights’ framework begins the funding lifecycle when a company receives its first round of seed funding. For traditional software and tech-enabled companies, this more or less marks the beginning of a startup’s funding history (other than angel / convertible note rounds that are notoriously hard to track). But in DeepTech, many startups have to scrape by on grant and prize money for years before venture funding comes into play.

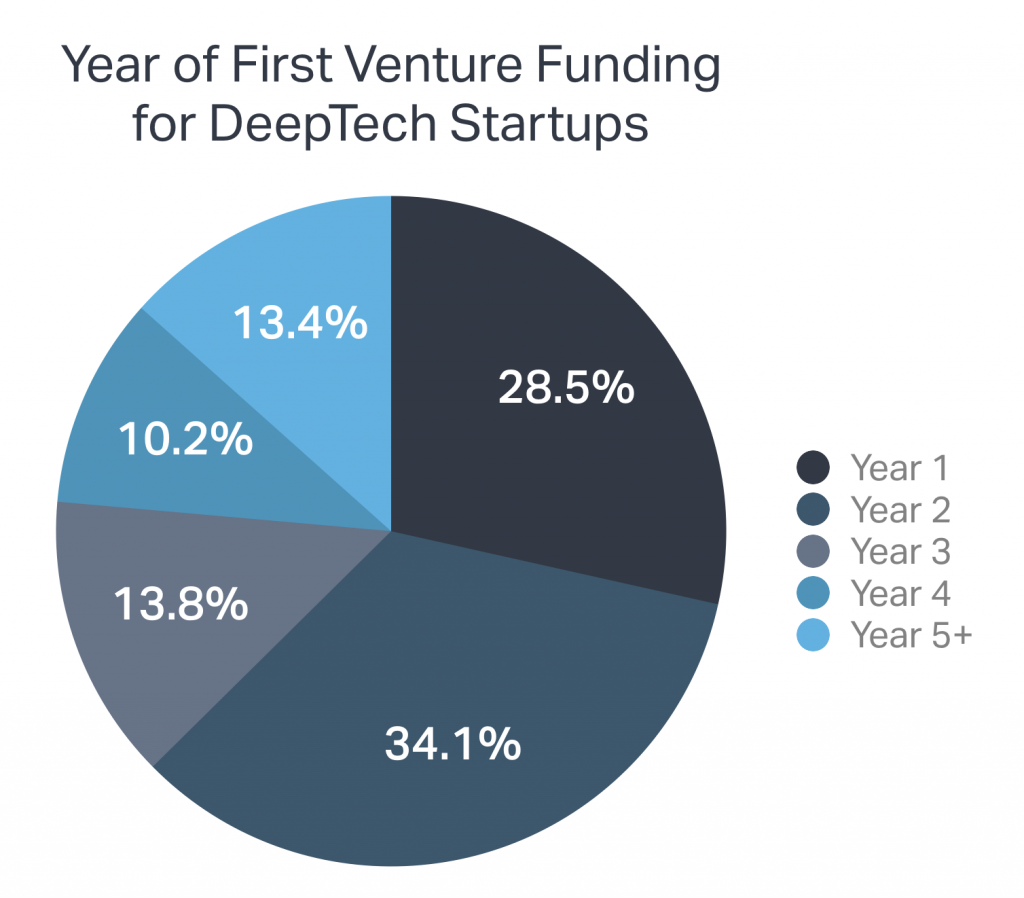

According to our data, nearly a quarter of DeepTech startups received no VC investments until at least their 4th year of operation. This isn’t even taking into account the years of behind-the-scenes research at universities or labs that’s sometimes required to fuel the technology behind an eventual spinout. In order to make it that long without venture financing, a DeepTech startup has to be pretty buckled-down, cost-efficient, and well-managed. Consequently, when these companies finally make it to a first round they are, by necessity, top of their class and thereby more likely to receive follow-on investment (at least initially).

So how do these companies scrape by without VC financing in their first years? We found that over a fifth of venture-backed DeepTech startups received non-VC funding (grants and other non-equity awards) before their first venture investment. Further, nearly half of these grant-funded companies (48%) received multiple injections of grants before managing to secure a VC investment.

It’s also important to note that non-VC funding is necessarily limited to known grants and awards, which are less publicized and more difficult to track for really early stage research. In reality, a larger percentage of DeepTech startups receive this form of funding than is reported. And again, this only considers venture-backed DeepTech startups — based on anecdotal evidence collected during interviews for our DeepTech Report, a major failure point for DeepTech companies is transitioning from grant funding to venture funding. This means an even larger portion of DeepTech startups secure grant funding but then fail to make it to their first venture investment. DeepTech startups that actually secure a first VC round are then, from the outset, the most readily commercializable of their cohort.

Taken together, this means that the first venture round of a DeepTech startup is frequently its second (or fifth) round of capital (from grants or investment). One of the highest drop-out points for DeepTech is just managing to get into the VC deal funnel.

First Glance Conclusions

At an initial pass, the DeepTech Deal Funnel looks pretty strong. A significant percentage of venture-backed advanced technology startups successfully secure at least 1 round of follow-on funding. And once they make it in, fewer startups drop out of the funnel at subsequent rounds when compared to the overall startup funnel from CB Insights.

But to overlook that key distinction — “once they make it in” — would be to miss half the story.

For DeepTech startups, the hurdles required to secure the first equity round are some of the highest in the funnel. Surviving three, four, or five years before a VC even comes into play makes a couple rounds of follow-on seem relatively easy. Plus, that kind of resiliency may offer potential investors peace of mind that the company can survive difficult times and tight budgets, boosting their confidence in the team’s ability to succeed.

As our next post will show, the gaps don’t stop there. DeepTech startups, while often holding many funding events, frequently stagnate in their progression through meaningful funding milestones, raising multiple rounds of capital at the same stage. And importantly, we don’t see the kind of growth in round size that characterizes the broader VC funnel — leaving DeepTech companies without substantial growth funding to scale and exit.

Methodology

To fuel this analysis, we randomly sampled 305 startups from our database logging the portfolio companies of more than 400 US-based DeepTech VCs. Collectively, these portfolios gave us a combined population of more than 3,250 DeepTech companies from which to sample. We then collected data on the 1,090 VC and grant funding rounds of the 305 venture-backed startups we sampled, cross-referencing between Pitchbook, Crunchbase, SEC filings, SBIR databases, published articles, and news releases to ensure accuracy.

When constructing the funnel, we only included startups founded in or before 2015 so that the entire sample had ample time to secure funding. Consequently, the sample size for the DeepTech Funnel decreased to 195.

| DeepTech VCs | 400+ |

| Total DeepTech Portfolio Companies Across all VCs | 3,250+ |

| Sampled DeepTech Startups | 305 |

| Total Equity and Grant Funding Rounds of Sampled Startups | 1,090 |

| Sampled DeepTech Startups Founded in or before 2015 | 195 |