DeepTech startups struggle to progress through meaningful funding milestones and don’t experience the same growth in round size as the broader ecosystem.

In our last post, we applied the framework of CB Insights’ Venture Capital Funnel to DeepTech and found advanced science & tech startups are more likely to secure follow-on funding than the broader startup market (though often wait as many as 5 years for their first VC investment).

For this post, we propose another framework for understanding the DeepTech deal funnel that attempts to track startups through meaningful funding milestones rather than simply counting funding events.

Using this framework, DeepTech startups appear to struggle when progressing through the funding pipeline, often raising multiple rounds of capital at the same stage (e.g. 2-3 rounds of seed funding). We also look at round sizes and find that the size of DeepTech funding events doesn’t experience the same growth that’s seen in the startup ecosystem at large.

Progressing Through the Pipeline

As startup companies raise progressive rounds of capital, they typically announce their fundraising success and will often classify rounds according to traditional “stages” in a press release or other medium. This takes some form of, “We successfully closed a $3.4M Series A,” or “We raised a $500k seed round.”

When interpreting the venture funnel, it’s generally assumed that moving from a first to a second to a third round is mostly a clean, consistent progression upwards in these (albeit arbitrary) stages, from Seed to Series A to Series B, etc. While there’s no exact definition for the scope of each stage, startups nonetheless often report new funding rounds in this language.

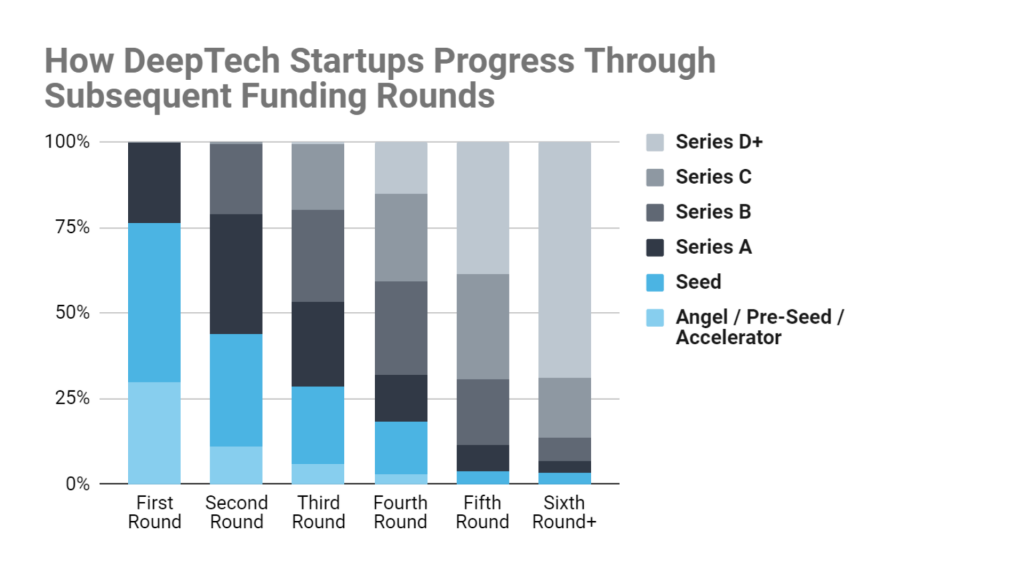

We found that DeepTech companies frequently fall off the typical “Seed → Series A → Series B → …” milestone trail. Their funding histories are often messier and less consistent than is expected in VC, making it difficult to fit them into existing diligence and investment models.

For instance, about a quarter of the DeepTech startups we sampled never even raised a seed round. Instead, they jumped straight to Series A for their first equity funding event. This offers some signal that DeepTech companies need to be more mature before VCs are willing to dole out cash, and thus have to skip seed rounds altogether. This possibility is backed up anecdotally by the interviews behind our DeepTech Investing Report, in which DeepTech experts frequently stressed how advanced science & tech startups don’t align with VC norms for KPIs. This misalignment makes DeepTech difficult to fund before there is an established revenue source and clear business model — two traits rarely observed in the seed rounds of any tech companies.

We also observed that DeepTech startups often report raising two, sometimes three, rounds of “seed” capital before reporting a “Series A” round. As the above chart shows, more than a quarter of DeepTech startups report their third funding event to be a seed or pre-seed round. This is a clear indication that many advanced tech startups aren’t really experiencing growth in the scale of their funding, even while experiencing more and more funding events. There are even a handful of DeepTech companies reporting their sixth funding event to be a seed round — that can hardly be considered progressing through the funnel.

A New Funnel Framework

Based on these findings, we believe a more representative deal funnel would look at the progression of startups through funding stages rather than funding events. In many ways, this adjustment provides clearer insight into whether DeepTech companies are meeting meaningful funding milestones and whether they are gaining investment from new and progressively later stage investors — rather than whether they’re raising a third $1M seed round just to cover costs for a year.

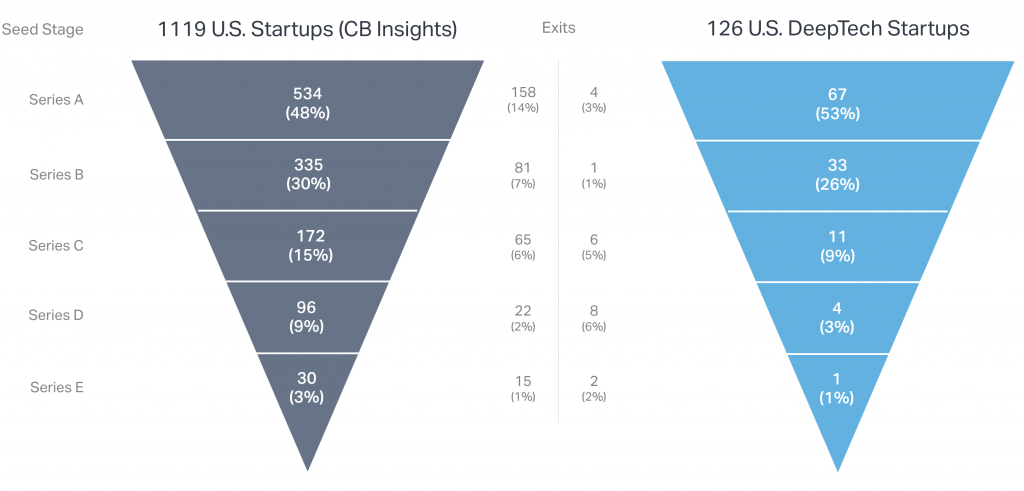

The following revised funnel tracks the stage progression of the 126 DeepTech startups in our sample that received seed funding:

Under this lens, the DeepTech Funnel shows advanced technology startups failing to raise a subsequent round at similar, if not higher, rates to overall startups. Almost half (47%) of DeepTech startups that received seed funding fail to even make it to a Series A round. And just 1% make it to Series E.

Compared to the funnel framework of our first post, this revised funnel paints a much less optimistic picture of the DeepTech funding landscape, with many startups stumbling (rather than speeding) through the pipeline.

Late-Stage Funding Gap

Regardless of the exact funnel framework used, what’s glaringly clear is the funding gap for late-stage DeepTech companies. This is especially true when compared to the funding available in the broader late-stage startup market.

Advanced science & technology startups have an increasingly difficult time securing funding at later and later stages. The following table looks at the marginal success rate at each round (the percent of startups from the previous round of funding moving to the new round) rather than the overall success rate (the percent of the entire sample moving to that round). This view shows that the percent of DeepTech startups being weeded out at each round increases at later stages — that is, fewer companies who secure a fourth funding event go on to secure a fifth funding event than the proportion who secure a first funding event go on to secure a second.

These declining marginal success rates imply there’s less and less capital available at later and later stages for DeepTech. This sits in stark contrast to the same figures reported by CB Insights, which led them to conclude that at later stages “investors are a lot more eager to invest.”

| Overall Startups | DeepTech Startups | |

|---|---|---|

| First Round | – | – |

| Second Round | 48% | 83% |

| Third Round | 63% | 70% |

| Fourth Round | 51% | 53% |

| Fifth Round | 56% | 55% |

| Sixth Round | 31% | 45% |

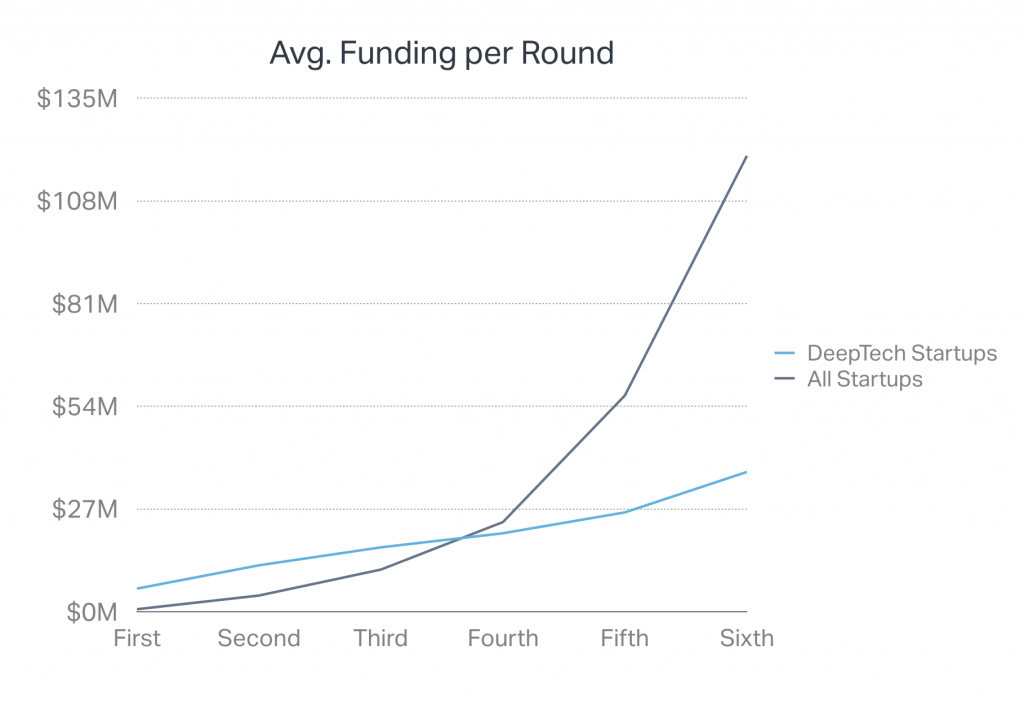

Lastly, DeepTech startups show a very clear drop-off in round size at the later stages, falling significantly behind the growth in late stage rounds for the rest of the startup ecosystem. This signals a clear lack of substantial growth funding for DeepTech startups.

While DeepTech rounds are larger on average for the first 3 funding events (likely due to their high up-front capital expenses), from the fourth round on, they fall significantly behind the growth in size for the broader ecosystem. As the average funding round for DeepTech startups continues to follow a linear trajectory, the overall startup market trajectory turns exponential, so that the average size of a pure-software or ‘tech-enabled’ startup’s sixth venture round is over 3 times greater than that of a DeepTech startup.

While part of this increasing divide stems from software and other capital-light startups ‘blitzscaling’ (thereby skewing the average round size up), the median round size shows similar trends, thus emphasizing the capital gap for late stage DeepTech startups.

Conclusion — DeepTech startups lag entering the venture capital funnel, struggle to meet notable financing milestones while in it, and fall further behind at later financing stages.

When compared to the overall startup deal funnel created by CB Insights, DeepTech startups have a rather different fundraising experience:

- DeepTech doesn’t conform to traditional VC expectations in any realm, including in funding lifecycles.

- One of the biggest hurdles for DeepTech startups is making the jump from grant funding to venture funding — they’re frequently left waiting years before VCs come into play.

- DeepTech startups often have to stumble their way through the early funding stages, needing multiple rounds of early stage capital just to keep developing.

- There’s a big gap in funding for late and growth stage capital in DeepTech.