A data-driven look at the role of women in US venture capital, including fund sizes, targeted sectors, and more.

In the US, recessions have always exhibited gendered differences.

But historically, that difference has resulted in a greater drop in employment for men than women, in part because women’s employment is more concentrated in less cyclical industries (e.g. services) and because women become more attached to the labor force during downturns as a form of household insurance.

However, the recession brought about by the COVID-19 pandemic has been markedly different. The combination of a sharp decline in the demand for high-touch service jobs along with school and childcare closures meant unemployment spikes and labor force dropout fell disproportionately on women. In the last year, more than 3 million American women left the labor force.

The disproportionate impact on women extended to the startup world, too. In October, PitchBook reported venture funding for female founders fell to its lowest quarterly total in 3 years. And despite 2020 turning into a record year for venture funding, the percent flowing to women-founded startups dropped to 14.4%.

Given that a generation of gender equality progress has been erased by the past year, we thought it important to revisit the work from our Women Leading Venture report and provide an update on the state of women in venture post-COVID.

VC Fundraising Dropped for Women-led Funds

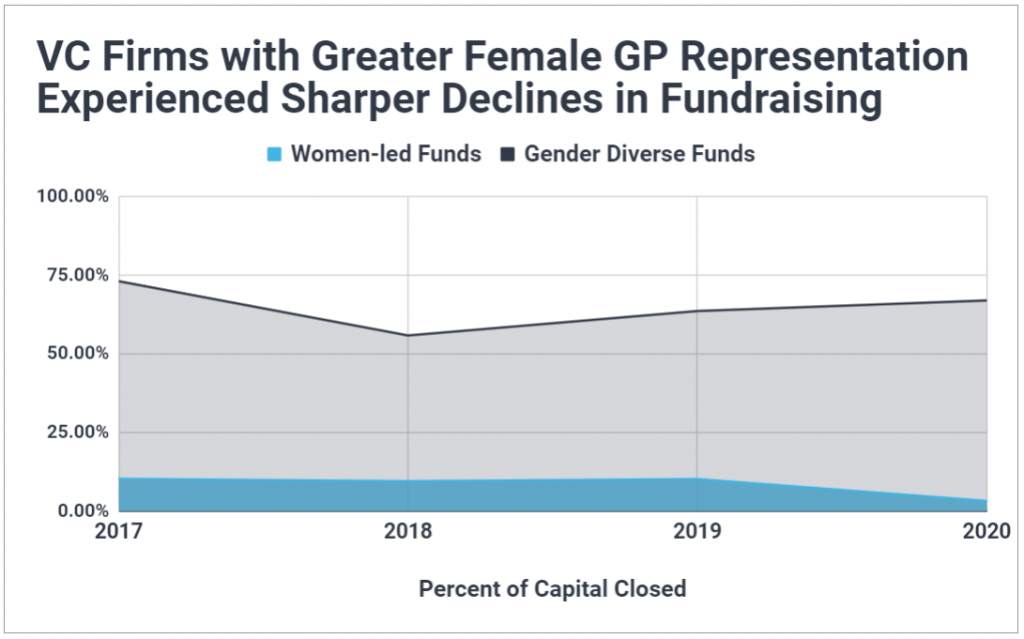

Looking first at time-series trends in venture capital fundraising, 2020 represented a stark decline in the proportion of capital going to women-led firms (here defined as having at least 33% women GPs).

Whereas around 10% of capital closed went to women-led funds between 2017 and 2019, in 2020 women-led funds accounted for just 3.3% of the record-breaking inflow of capital. A subset of women-led funds, solo women GPs accounted for less than a quarter of one percent of 2020’s capital haul.

On a slightly positive note, the percent of capital closed going to gender diverse firms (those with at least one woman GP, but less than 33%) saw a moderate increase in 2020, up to two-thirds of all capital closed in 2020. However, this should be asterisked with the caveat that gender diverse VCs consist mostly of large, established name-brand firms whose deal rooms and portfolios are dominated by men (with many having only recently brought on their first female partner — a move partially driven by a high-profile discrimination case and that’s had little impact on venture capital flowing to female founders).

The State of Women in Venture

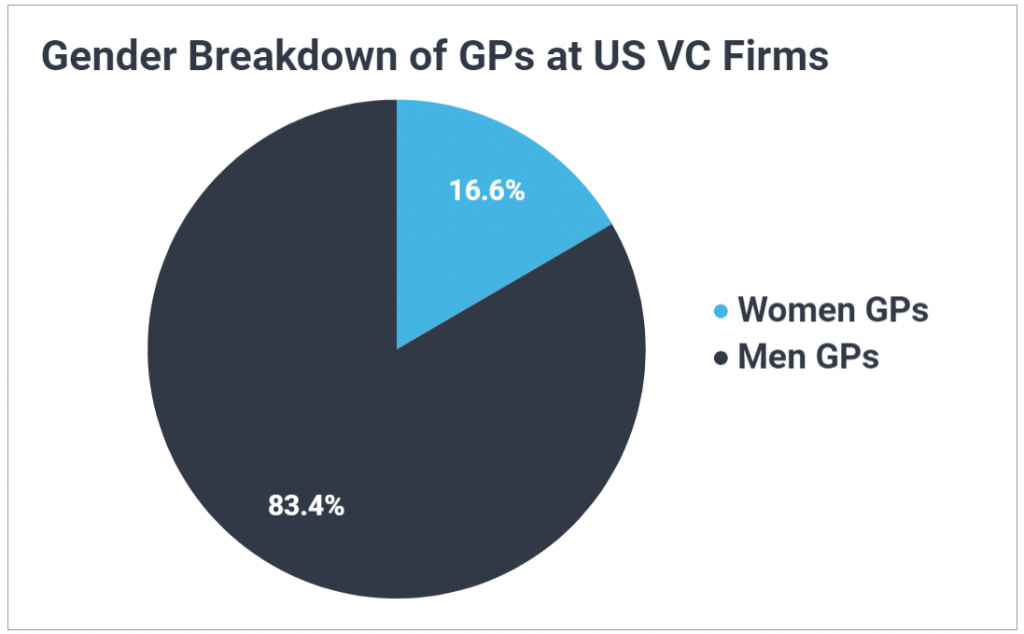

Turning now to a cross-sectional look at the current state of women in post-COVID venture capital, we estimate16.7% of GPs at US VC firms are women. As All Raise recently noted, there was minimal movement in this proportion over 2019 figures.

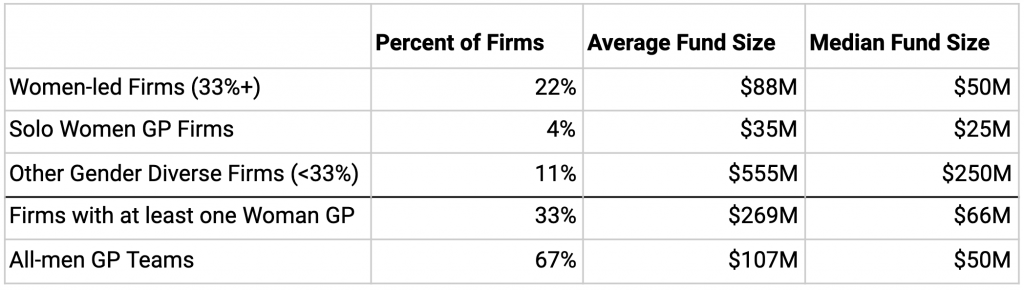

We also find that two-thirds of VC firms in the US have no woman representation at the GP level, with just 22% of firms being women-led and 4% being solo women GPs. (In comparison, about 59% of European VCs have no women GPs, with 23.5% being women-led and only 2% being solo women — dive deeper into the European VC ecosystem in our latest post.)

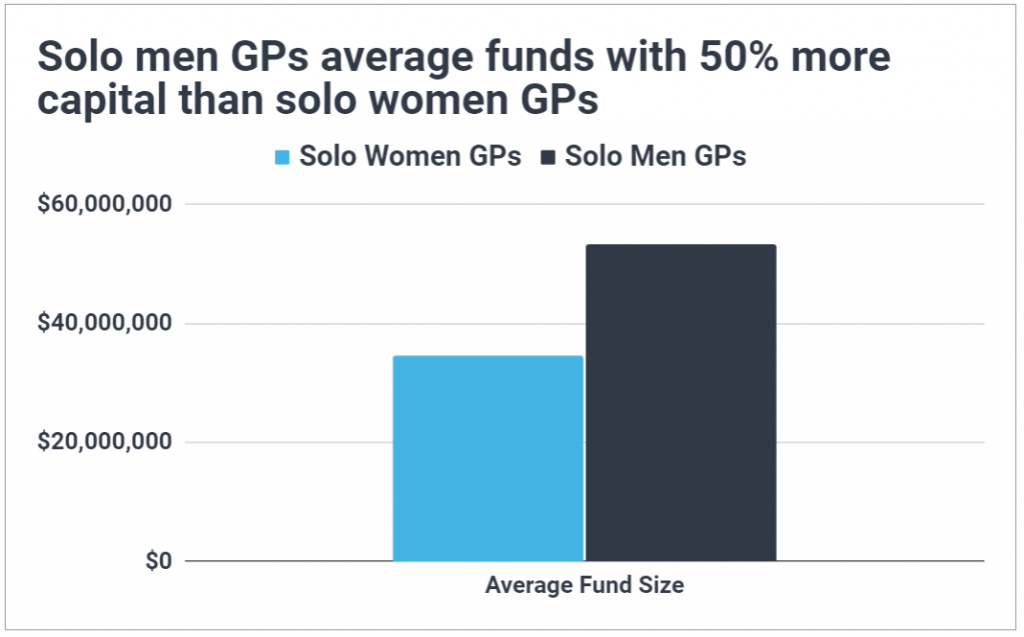

This last category (solo women) is by far the most undercapitalized, with a median fund size of $25M and an average of only $35M. While these small fund sizes are partly a function of LPs being hesitant to back solo GPs of any kind, there’s clearly an added layer of hesitancy brought about by the solo GP being female: solo men GPs average a $53.3M fund, or 50% more.

Women-led firms, although on-par with all-men teams for median fund size (at $50M), lag behind when looking at the average ($87.5M compared to $106.7M). This combination of an equivalent median and a lagging average suggests women-led firms are missing from the upper end of the fund size spectrum, being significantly less likely to manage funds in excess of $100M. In turn, this implies a potential capital gap for female founders looking to secure larger, later stage investment.

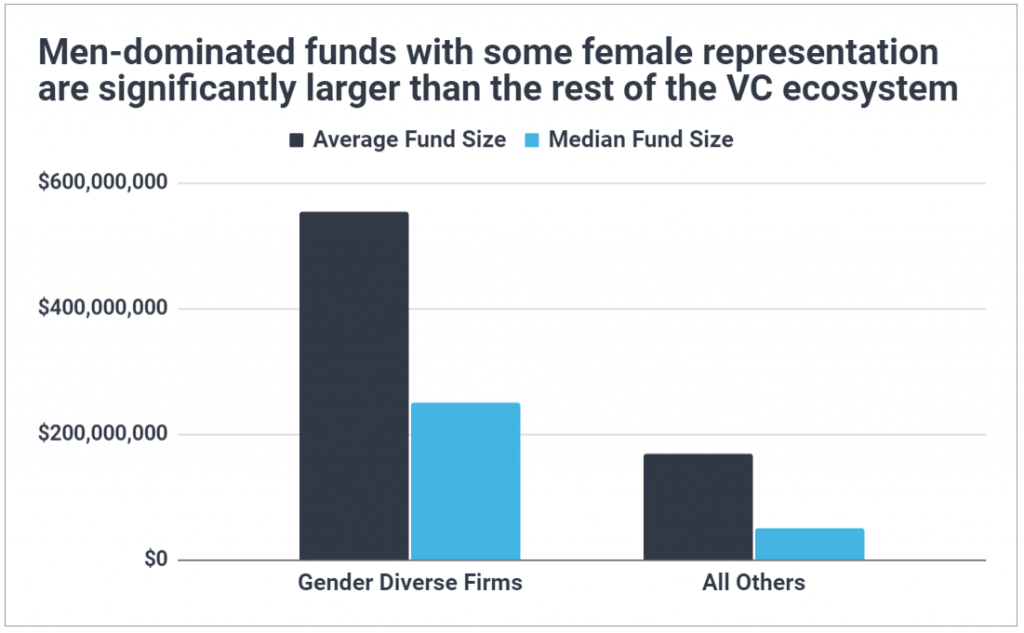

It’s particularly striking to visualize the typical fund size of gender diverse firms compared to the rest of the venture ecosystem: this cohort (accounting for just 11% of VC firms) has a median fund size of $250M and an average of $554M. But again, these VCs are by-and-large male-founded name-brand firms that have only recently become gender diverse. It’s nonetheless promising to see these large VCs at least move marginally towards gender parity.

What Sectors Do Women Invest in?

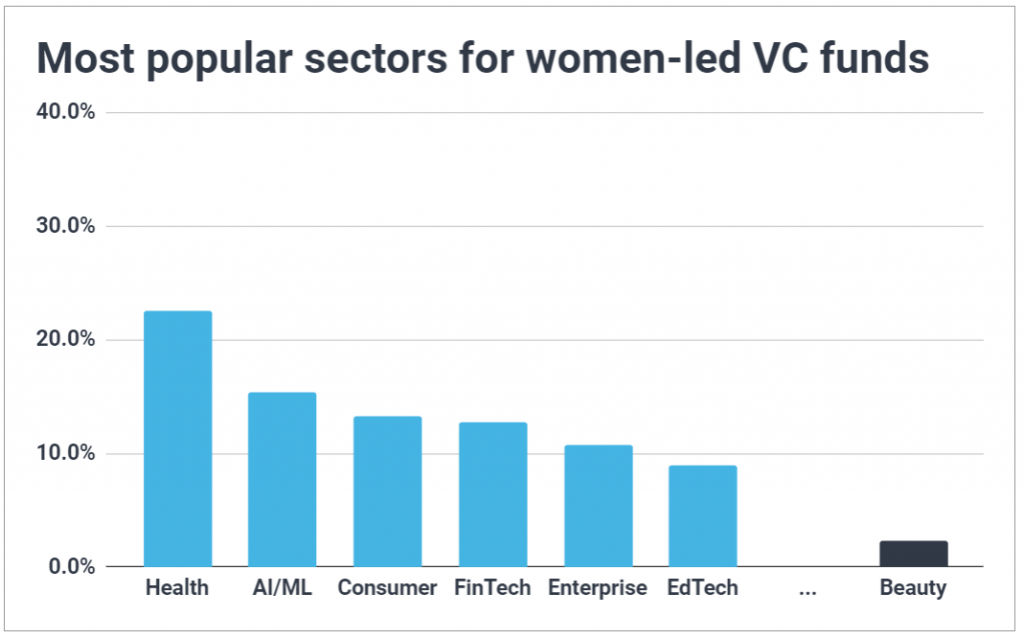

There’s a common perception by LPs that women VCs only invest in beauty and other supposedly ‘femtech’ sectors.

But, unsurprisingly, we find only 2.3% of women-led firms target beauty as a sector — surely a significantly larger proportion than the 0.17% of all-male teams targeting beauty, but hardly a common strategy.

Instead, we find the most popular sectors for women-led firms include health (with 23% targeting the sector), AI/ML (15%), Consumer (13%), FinTech (13%), and Enterprise (11%).

And importantly for gender equity in startup funding, women-led VCs are exceptionally more likely to explicitly focus on investing in women: whereas less than 1% of all-male teams include a focus on women founders in their thesis, a full 12% of women-led firms do. It’s also noteworthy that gender diverse VCs (those with less than 33% women GPs) are even less likely than all-male teams to have an explicit focus on female founders — just 0.5%.

Other areas where women-led firms are more likely to center their thesis: Future of Work, EdTech, marketplaces, sustainability, wellness, beauty, diverse and underrepresented founders, and impact investing.

Lastly, women-led firms are less likely to invest in generalist software, internet, mobile, and autonomous vehicles.

Moving the Needle on Gender Equity Requires Backing Women-led VCs

After a year of setbacks for gender equity in startup funding, it’s critically important to recognize the role of LPs in reducing or maintaining unequal capital access: as the ultimate source of capital, they dictate which VCs get funded which in turn has a major impact on which founders get funded.

So while it’s great that large established VCs are increasing their gender representation at the GP level, the number that really matters (funding for female-owned businesses) isn’t shifting unless more capital flows to women-led VCs (who are the true drivers of conscious investment priorities for female founders).

Given women-led firms suffered a setback of their own in 2020’s fundraising numbers, it’s not unreasonable to expect funding for female founders to continue lagging in the near term.

“While it seems like much in the VC world has changed over recent times, one thing remains constant: women continue to be undervalued, both as fund managers and as founders. When it comes to founders, we know that women founders exit earlier at higher valuations. We also know that women VCs are more likely to invest in women entrepreneurs. The continued outperformance of female founders points to the missed opportunity by investors who do not have diverse teams — and diverse managers — in their portfolio. At Beyond the Billion, we’re confident that alpha will accrue to those who recognize the future in women.”

— Shelly Porges, Managing Partner at Beyond the Billion