Different CIO Harold Hughes explains the newly released Opportunity Zone regulations. This is written to allow the reader to understand whether opportunity zone investing may be of interest or, at the very least, provide the ability to confidently engage in cocktail party conversation about OZs.

The new opportunity zone regulations were recently released. I read and reread the new regs with one question in mind: after all the talk and expectations, is this a truly remarkable thing that exceeds prior incentives? The answer is yes, on a number of points. This makes it worthwhile to explore how any benefits can apply to investments, including operating businesses. If you understand the type of investment incentives provided under the law, you can determine your level of interest and begin to assess the risks. Note that many state and local governments have added additional incentives for opportunity zone businesses.

First, Opportunity Zones (OZs) are a capital formation and investment incentive. Adhering to certain rules, investors have been granted tax incentives to move capital in the form of gains from existing investments, into investments that qualify as opportunity zone investments. The regulatory intention is to spur investment and long-term growth in under-invested census tracts (‘opportunity zones’) throughout the United States.

There are four parts to assess value to investors and potential success of OZs:

- Size of the eligible capital pool – One of the largest and most broadly held ever

- Target investments – Real estate improvements and operating businesses

- Value of the incentive to investors – gain deferral and future tax-free gains

- Compliance/rules – Reasonably clear and flexible with a self-certified process

Let’s unpack the above four points. Note that each of the following is intentionally short. Understand that the regs further define what are relatively small exceptions and additions.

Size of the eligible capital pool

Are there enough potential assets to create and sustain success? Additionally, is there so much potential capital that OZ asset prices will be artificially high?

Substantially all realized capital gains qualify for opportunity zone investment tax incentives. This is perhaps the largest and most widely held pool of private investment capital eligible for a single incentive program ever. This includes capital gains on stocks or any other asset, in addition to real estate. Prior incentive programs have limited the sources of eligible investment capital to specific asset classes and have included a tightly regulated transfer of both basis and gain, 1031 exchanges (investment real estate) for example. Additionally, Opportunity Zone Funds (OZFs) can be used to pool multiple investors’ capital — making OZ investing accessible to smaller investors.

Regarding the question of too much capital inflating prices, the size of the OZ investible opportunity is similarly large. There are over 8,700 zones that were selected within a common set of economic metrics by all 50 governors.

Target investments

What is a qualifying investment and is it easy to invest in?

Under the OZ regs, target investments stem from the regulatory intent — which is to produce long-term economic improvement in these geographic zones. Accordingly, the target investment category is fairly broad. The new regs recognize that, beyond real estate renovation and construction, it is necessary to attract businesses and jobs for any sustained change.

The regs allow for investment in businesses and, while generous to real estate, the regs are not as generous as originally assumed. In fact, if a building is already in use and does not require substantial renovations, there is little or no opportunity zone investment incentive. That being said, the capital improvements to other (adjacent) properties could benefit values for current owners.

However, the capital to renovate or build a new building AND to invest in operating businesses can qualify for opportunity zone benefits. This is where it gets interesting. Think angel and venture capital investments (more on this in the near future). Two important distinctions from the regs are that 1) qualifying businesses do not need to be located exclusively within the zones and 2) products and services can be sold and used outside of the zones. Two applicable examples written into the regs are a software company and a landscaping company — both of which may have customers and employees located outside of a zone. Net net, this introduces flexibility and can enable OZ funds to invest in a broad array of businesses.

Value of the incentive to investors

What’s the value of the tax incentives? What exogenous factors could affect the value of the tax incentives?

The incentive begins with deferral of tax on realized capital gains until 2026. Additionally, the amount of the gain on which tax is calculated is reduced by 15%. It also includes the protection against owing tax in 2026 if the investment loses some or all of its value. This is a floor that is extremely valuable when deferring tax on risk capital.

The biggest value to the investor is that all gains over their original opportunity zone investment (basis) are tax free after a 10 year hold. This is a tax free investment funded by a tax deferred gain. From a strategic and planning outlook, consider taxpayers who move to a state with zero state income tax in anticipation of a 2026 gain. Additionally, consider that Congress has changed the capital gains tax rate a number of times over the last 10 years. No one knows what the rate will be in 2026.

Compliance/rules

How manageable is compliance for OZ Funds? What red tape might discourage investors, investments, or the OZ funds themselves?

Let’s look separately at the OZ Fund (OZF) and the OZF investor. The OZF is an entity formed to invest in qualifying OZ investments. One or more investors can invest in an OZF. The OZF is responsible for compliance…but the tax consequences of noncompliance are borne by the investor. As an investor you need to trust your OZF. I would say “trust but verify”. The biggest value provided by an OZF after investment selection is long-term OZ compliance.

The good news is that compliance is straightforward, beginning with the self-certification of OZFs. The rules are clear on both real estate and business investment, and include three safe harbor calculations for operating businesses. This is very good news for venture investing. There are allowances for working capital in the calculations, as well as for delays caused by permitting or other approvals.

For operating businesses, the difficult part of OZ compliance is remaining a qualified opportunity zone business for more than 10 years in a global economy. This requires a commitment by the company to its investors to avoid disqualifying activities (in addition to real-time compliance monitoring). That being said, the regs recognize the need for companies to compete and sell globally and have tried to include provisions to allow for this. The regs also include remedies for potential capital “churn” when businesses are sold or recapitalized. Reporting will include a revised IRS FORM 8996 for initial self-certification and annual compliance.

Not All Zones Are Equal

OZ investments are long-term illiquid investments in some of the weakest local economies. These are substantial risk factors — suggesting that OZ investing is generally risky. However, the OZs vary as widely as the landscape and demographics of this country. This dispersion among the zones is opportunity for alpha through OZF skill, in addition to providing diversification for multi-zone investing. Put simply, some of these zones will be very successful and others will fail.

As this is very important to investment decisions, let’s look at a few interesting examples. Certain zones seem primed and ready to go.

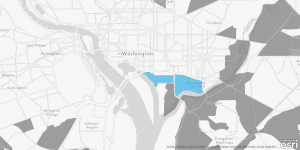

Let’s first look at a national opportunity zone map and zoom in on Washington, DC (image below). In that city, you will see a waterfront zone that is adjacent to already renovated areas on the waterfront of DC (renovated areas in blue, opportunity zones are dark grey). This zone has already been cleared, has a new soccer stadium, and is across South Capitol Street from the Nationals Baseball Stadium. For visual context, photos of the redeveloped blue areas can be seen here, here, and here.

Let’s next look at Baltimore, MD (image below). The main blocks of the Inner Harbor office district (in magenta) in Baltimore are also in an OZ. For those unaware, this area was developed as Baltimore’s primary class A office space over the past 40 years and is home to a number of very successful companies, law firms, and accounting firms. While substantial new class A office space has been built east of this OZ along the harbor, this OZ designation could incentivize renovation and — if combined with any State incentives — attract businesses. In Maryland, for example, Senate Bill 581 would make qualifying businesses in OZs eligible for six state tax credit incentives. Directly south (in purple) is the core Baltimore waterfront area (Harbor 2.0).

As another contrast, south of Orange County, CA is a zone with beautiful ocean views and a walk to the beach (image below, zone is highlighted in green). For additional context, examine this satellite shot of the area or this google streetview of the nearby beach.

Most OZs are not as lucky and are among the thousands of areas that have been left behind over whole or even multiple economic cycles. While most of the 8700+ zones will not have ocean views or be sandwiched next to a stadium and new hotels, they may have other unique and strategic value adds. For the right businesses, the right investors, and the right opportunity zone investments…they may do well and generate lasting positive change. There is also controversy over gentrification and the selection of some census tracts at the expense of others.

The opportunity zone set of incentives have the potential to bring capital to underdeveloped areas across the country…and the regs have defined eligible capital as practically any investment gain. But beyond capital, each zone will also need ongoing leadership and individual successes to create lasting change and a return on investment. What we do know is that the regs have been written with the flexibility needed to meet the goals of economic improvement: under OZ regs, a broad base of capital is eligible; target investments have been defined to allow for a wide range of job-producing companies, including software; compliance seems to be manageable and the long-term tax incentives are compelling.

We hope this article was helpful in offering a structure in which one might consider the benefits and risks of opportunity zone investing. Our next article on this topic will take a specific look at how to think about OZ and OZF tax incentives.