Media attention undoubtedly influences the perception of the venture capital industry, but how representative is this coverage of the VCs actually making investments? New data explores overrepresentation in venture capital media coverage & the distorted perception it creates.

When it comes to shaping public perception of the venture capital industry (as well as the view from inside), media coverage may very well be the dominating force. Particularly in an all-digital environment devoid of community events and conferences to bring smaller, more diverse corners of the ecosystem together, published articles have an outsized role in defining what VC looks like, who VC looks like, and how VC appears to operate.

This gives media influence over real decisions made throughout the ecosystem — it affects where founders look when they seek funding for their startups, it affects who LPs consider when allocating venture capital investments, and it affects what politicians expect when forming policy on innovation and entrepreneurship.

But this begs an important question: how well is this influential media attention being distributed? Are the types of VC firms that attract (or actively snatch up) the most mindshare also the ones who most accurately represent the industry? Who’s being overrepresented and how’s that contributing to a distorted perception of the reality of VC?

Methodology

In an attempt to quantify mindshare in U.S. venture capital and take a data-driven approach to assessing overrepresentation in media, we supplemented our existing database on over 1,600 U.S.-based VCs, CVCs, and accelerators with the total media mentions of each venture brand. We defined media mentions as the number of search results returned by Google News for each firm’s exact branding (e.g. the number of news results for “.406 Ventures” or “Liberation Capital” or “Shasta Ventures”).

For firms with incredibly vague brands that would obviously return a lot of false negatives (e.g. “Addition”), some steps were taken to narrow the results to “VC” or to the firm’s HQ; however, at scale these false negatives can reasonably be assumed to be distributed evenly across the VC population. For example, there’s no reason to think false negatives will show up more frequently for Bay Area firms than New York firms, allowing for clean comparisons between the media attention of each geography despite the acknowledged presence of false negatives.

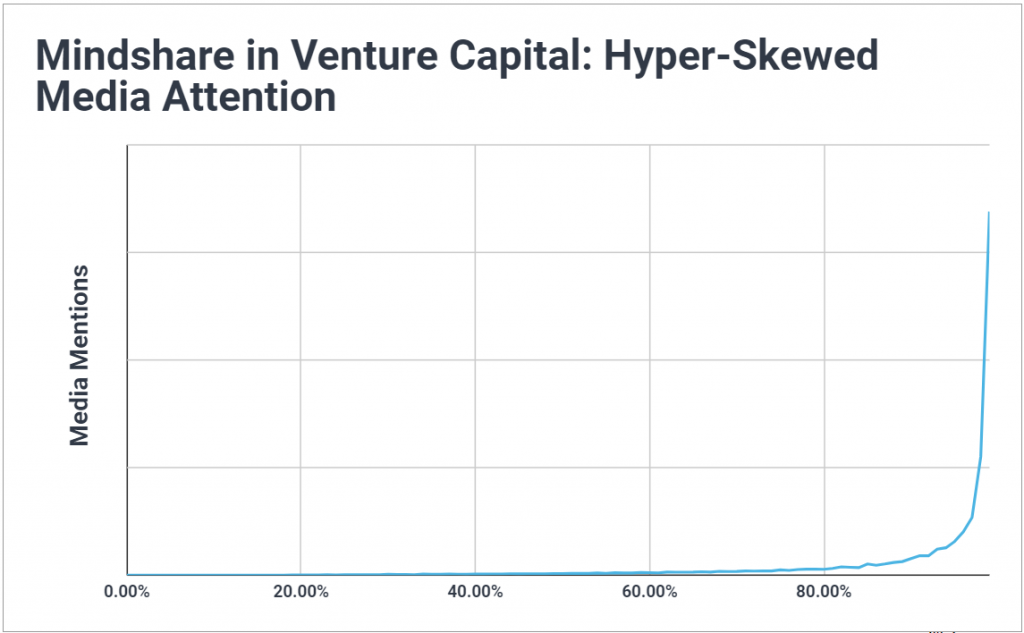

Media Mentions Are Hyper-Skewed

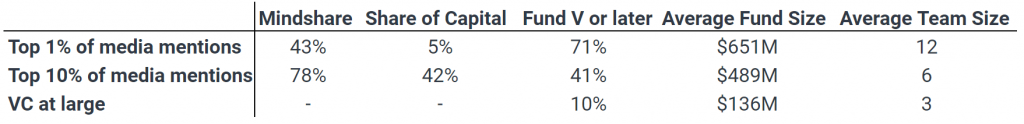

The top 1% of venture capital firms account for 43% of total media mentions — that’s just 16 brands managing to hold nearly half of the media mindshare for the entire industry. For comparison, this 1% segment of the VC world manages just over 5% of total venture capital.

Further, the top 10% of VC firms in terms of mindshare account for 78% of media mentions, leaving 90% of the VC ecosystem with barely more than a fifth of total media attention between them.

Put another way, these high-profile outliers garner so much media attention that a random selection of VC news articles could easily lead a blind reader to conclude that the entire venture ecosystem consists of less than 150 firms — a conclusion that’d be about 10 times off-base from the current 1,600+ firm reality.

And who are these mindshare hoarders? Logically, they’re the exact brands that come to mind first when many think of venture capital: the likes of Sequoia, a16z, Kleiner Perkins, Bessemer Venture Partners, Founders Fund, 500 Startups, Accel, Google Ventures, and Khosla Ventures, to name a few.

By and large, these outliers are established firms (only 4 VCs of the top 1% have raised fewer than 5 funds), often raising mega funds (the average fund size is more than $650M), with significantly more GPs on the team than is typical of venture (the average team size is about 12 GPs for an outlier firm, versus 3 in VC at large). They’re the type of firm with the resources and people-power to have an extensive PR team and strategy, perhaps purposefully sucking up an outsized portion of media attention more so than naturally attracting such a share.

Extending the lens, the top 10% of mindshare VCs better represent the full VC landscape, though are still a far cry from reality. This segment manages 42% of all venture dollars, making their 80% share of media mentions seem a bit more proportional than that of the top 1%. However, they still lean very heavily towards established firms, as more than 40% have raised at least 5 flagship funds despite only 10% of all VCs being on a Fund V or later. With an average fund size just under $500M (compared to an average fund size across VC of $136M), the top 10% is also dominated by very large funds and very large teams (averaging 6 GPs).

The Bay Area is Over-Represented in VC Media, But by How Much?

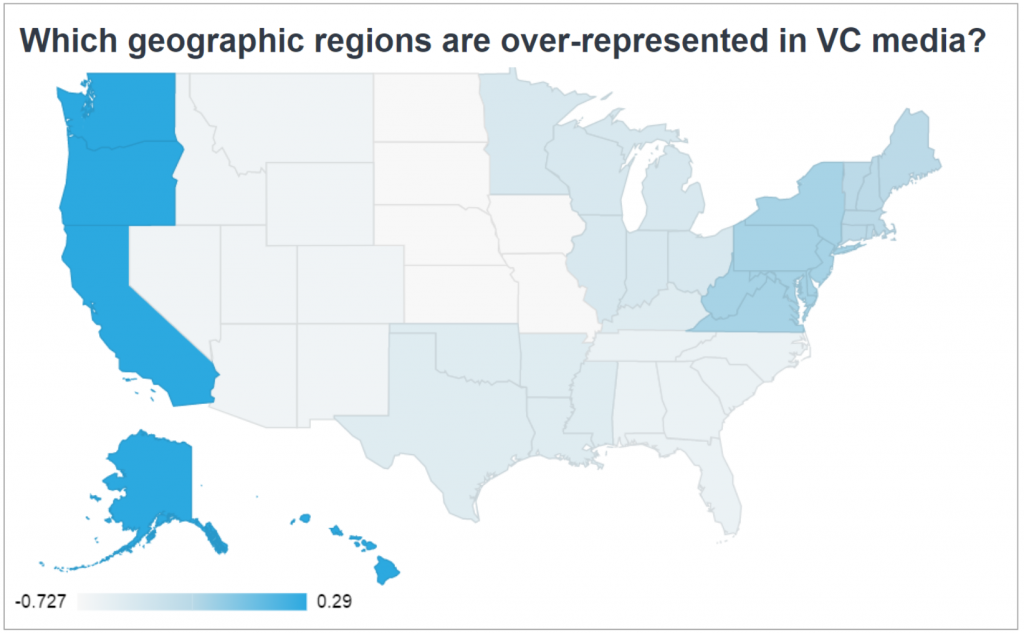

Anyone outside of the San Francisco Bay area would be quick to agree the Bay Area is overrepresented in venture media coverage — for many people, “venture capital” is practically synonymous with “Silicon Valley.” And although the Bay Area is home to more VC firms than any other US metro area (packing over 550 VCs into about 7,000 square miles), two-thirds of U.S. VCs are headquartered elsewhere.

So exactly how overrepresented are Bay Area firms in venture media? We estimate they hold more than 1.4 times their proportional mindshare[1], accounting for nearly 60% of media mentions but just 40% of total funds raised.

Comparatively, VCs outside the big four metro areas (San Francisco, New York, Boston, and Los Angeles) are significantly underrepresented in media, receiving about 65% of their proportional mindshare. And, the Midwest is the least represented region in the US, receiving a quarter of its proportional mindshare.

Emerging Managers, Small Funds, and Diverse-Led Funds are Underrepresented

Unsurprisingly, established VCs are overrepresented in venture media, with firms on a Fund V or later receiving 1.7 times their proportional mindshare. This is even controlling for the fact that they’re older firms and naturally receive more media attention for having raised more funds — removing that correction would mean they garner over 5 times their proportional number of media mentions.

Interestingly, debut firms (Fund Is) are actually closer to receiving their proportional mindshare than are Fund II-IVs, though still only receive 70% of the media attention they should. In part, this reflects media’s ability to find and highlight new venture funds, though also points to a barbell effect that benefits firms on either end of the emerging vs established spectrum.

Firms raising more capital generally receive more media attention. And while this is directionally a logical allocation of mindshare, the extent to which larger funds control more media attention is out of proportion. Mega funds (firms that raise a fund with at least $500M) account for nearly 30% of media mentions while only making up 4% of firms and 10% of funds raised. This implies they appear in media 2.5 to 7 times as frequently as they appear in the actual population of VCs. In contrast, firms that raise funds with less than $100M in AUM (historically the majority of VCs) receive just a third of their proportional mindshare.

And lastly, women-led and Black-led firms are underrepresented in venture media, receiving 60% and 70% of their proportional mindshare, respectively.

Implications for Evaluating VCs

What does it mean, exactly, for a VC to have garnered a lot of media mentions?

First and foremost, media mindshare doesn’t necessarily correspond to returns, let alone outperformance. (In fact, documented outperformance of first time funds may suggest otherwise.) Similarly, media mentions don’t necessarily correspond with highly valued expertise. While both may be true in some cases, LPs should consider the recursive nature of journalists referencing other journalists’ work, and past interviews leading to more interviews.

Further, a high share of media mentions does not necessarily mean a firm has an advantage in deal competitiveness. While being a prominent brand might give a VC a leg up in attracting first-time founders with limited venture experience, it becomes less relevant for seasoned entrepreneurs. Experienced founders are better equipped to navigate venture and will opt for their preferred investors — or those they’ve discovered have better founder reputations — regardless of media positioning.

To the extent there is a deal competitiveness advantage, it likely matters more for generalist VCs (who receive 1.4 times their proportional mindshare). VCs that specialize in a certain sector, technology, or geography don’t need (and may not want) to be a “popular” firm. It’s much more efficient and valuable for these specialists to be reputational leaders in their niche corner of the media — well-known and respected within their industry or geography while simultaneously being a blip on the scale of global media attention.

The takeaway for LPs is to consider a VC firm’s media strategy, evaluating how and whether it aligns with their investment strategy, target sectors and founders, value-add approach, and available resources. A firm with top tier media mindshare could make perfect sense for their strategy; or it could be a negative signal for poor use of time and resources.

Implications for the Venture Ecosystem

From a broader view, does it matter that a purely media-driven perception of the VC landscape paints an ecosystem that’s much older, more established, whiter, more male, more concentrated in the Bay Area, and managing more capital than in reality?

If you’re anything other than a rich white man reading from your seven-figure Bay Area home (i.e. almost everyone), then absolutely.

Why? Because any new entrant to the venture world, whether an aspiring founder or a first-time fund manager, is going to initially view the venture ecosystem through the lens of the media. And if that lens paints a very narrow view of a world with a specific mold (a mold that’s rich white, and male in Silicon Valley), it can act as a deterrent that only perpetuates the homogeneity and pattern-matching that currently plagues both the founder and manager sides of the VC ecosystem.

[1] When quantifying exact overrepresentation in VC mindshare, we chose to use a fund-weighted lens, which works under the assumption that a perfectly proportional distribution would allocate media mentions in direct proportion to the total number of funds raised. This method roughly controls for the age of a firm, since firms that have raised more funds should naturally occur in the media more frequently. Alternatively, we considered using a straight-forward firm-weighted lens, which would assume media mentions should be distributed in direct proportion to the count of firms, as well as a capital-weighted lens, which would assume mentions should be distributed in direct proportion to total capital managed. However, the limits of each outweighed the merits compared to a fund-weighted lens.