With climate and social justice concerns growing across the country, many investors have flocked to ESG & impact investing as a source of both social and financial returns — how have the venture capital markets responded?

Article written by Ellen Brooks Shehata and Jacob Tasto

2020 has made it difficult to ignore the need for more responsible investing. As unprecedented wildfires fueled by record heat waves and droughts rage across the West Coast, and an out-of-control hurricane season driven by warming waters pounds the East Coast, the effect of climate change on natural disasters has been reinforced across the US. Simultaneously, months of peaceful protest against racial inequity and injustice have brought to the forefront a myriad of social and economic issues that have sat unaddressed for decades, if not centuries.

Of course, neither climate change nor racial justice are “new,” and are hardly “uniquely 2020” (not to mention inextricably linked; marginalized communities disproportionately bear the brunt of climate change’s effect). These are long-term issues requiring a systemic response. Activists and international organizations have been sounding the alarm and taking action for years. The world of finance, however, has been slow to acknowledge these issues, often relegating ESG investing, sustainability, and CSR to the margins. We set out to look specifically at how the role of ESG and impact investing has evolved for venture capital — the segment of finance responsible for funding and scaling companies with novel products or business models that could potentially shape solutions to the massive problems facing society.

Implicit vs Explicit ESG Strategies

We estimate that 11% of VC firms in the US invest through an ESG lens.

Within this segment, some firms take an explicit ESG approach (when their thesis centers specifically on impact investing, ESG investing, or SDG investing), while others take what we call an implicit ESG approach (when their thesis does not explicitly specify impact investing but nonetheless centers on sustainability, the environment, or underrepresented founders).

In the US, the vast majority of ESG VCs utilize an implicit strategy (75.3%). In a country that lags behind Europe and China for regulatory and legislative climate action, this is not that surprising. It’s also sometimes viewed as a practical necessity for any VC hoping to have an impact on global issues — many LPs still remember the CleanTech burn of the mid-2000s and are hesitant to back impact funds with the (mis)perception that they’ll have to sacrifice financial returns.

However, our data does not suggest ESG firms marketing as explicit raise any less capital than their implicit counterparts. Explicit ESG firms manage 24.4% of capital being deployed by ESG VCs — nearly equivalent to their 24.7% share of ESG firms — and both strategies average a fund size of $65M.

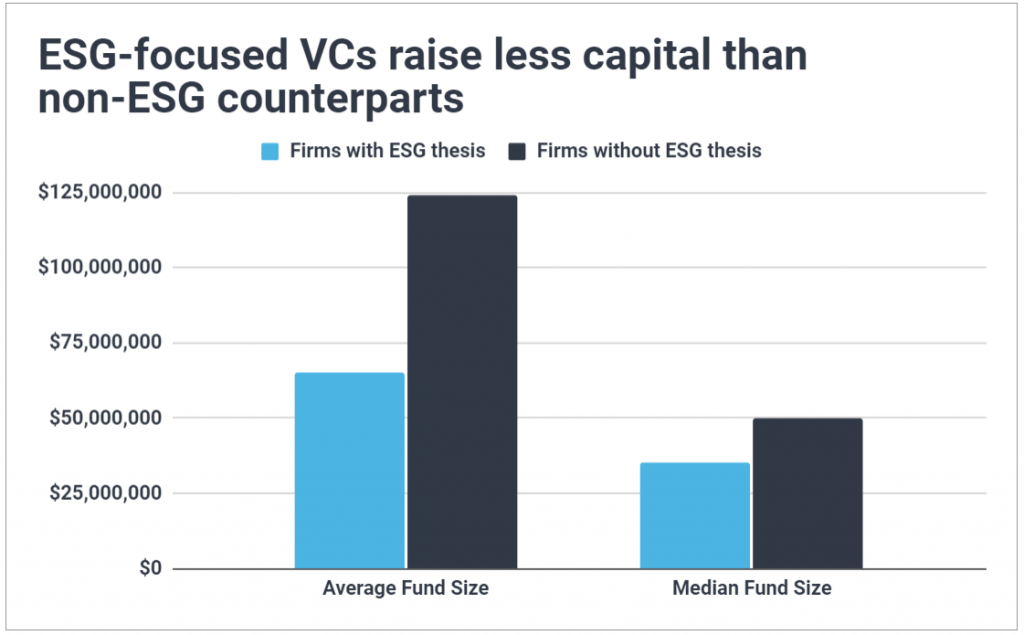

In contrast, we do find evidence that ESG firms (whether explicit or implicit) raise less capital than non-ESG VCs. The average fund size of a non-ESG firm sits at $123.9M, nearly double the $65M figure of ESG firms. While part of this discrepancy is due to the non-ESG figure being skewed upwards by the outlier megafunds in VC (none of whom leverage an ESG lens), the median fund size of ESG firms (at $35M) also falls well below the $50M median of the broader venture capital market. Further, ESG firms only manage 5.6% of venture capital despite accounting for 11% of all firms.

ESG Funds are on the Rise

Despite ESG firms managing less capital on average than the broader VC market, we are nonetheless seeing a consistent rise in the number of vehicles being raised by ESG VCs, as well as the total amount of capital raised by the ESG segment.

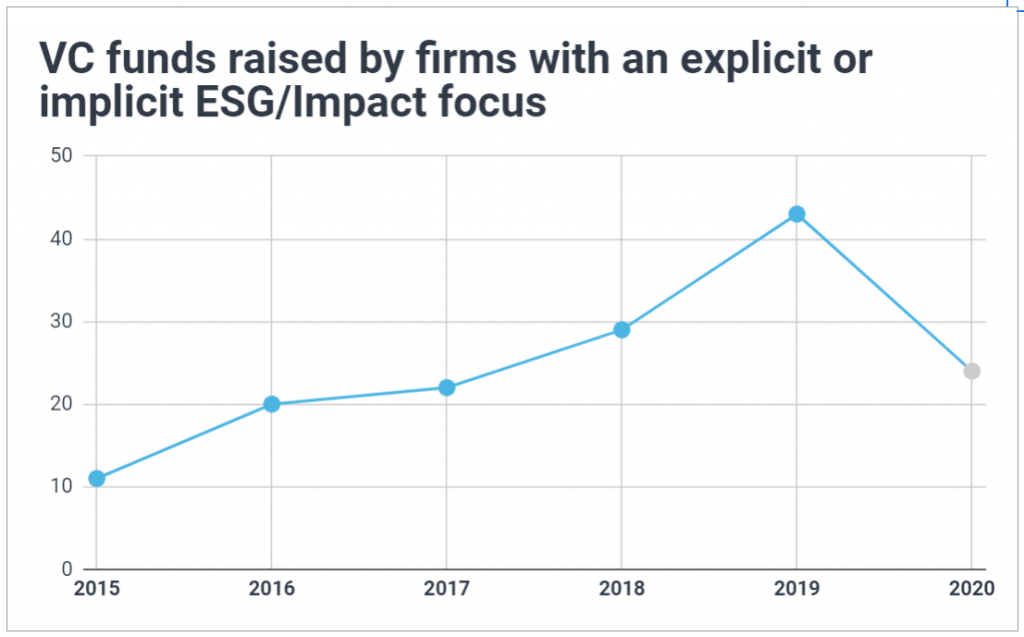

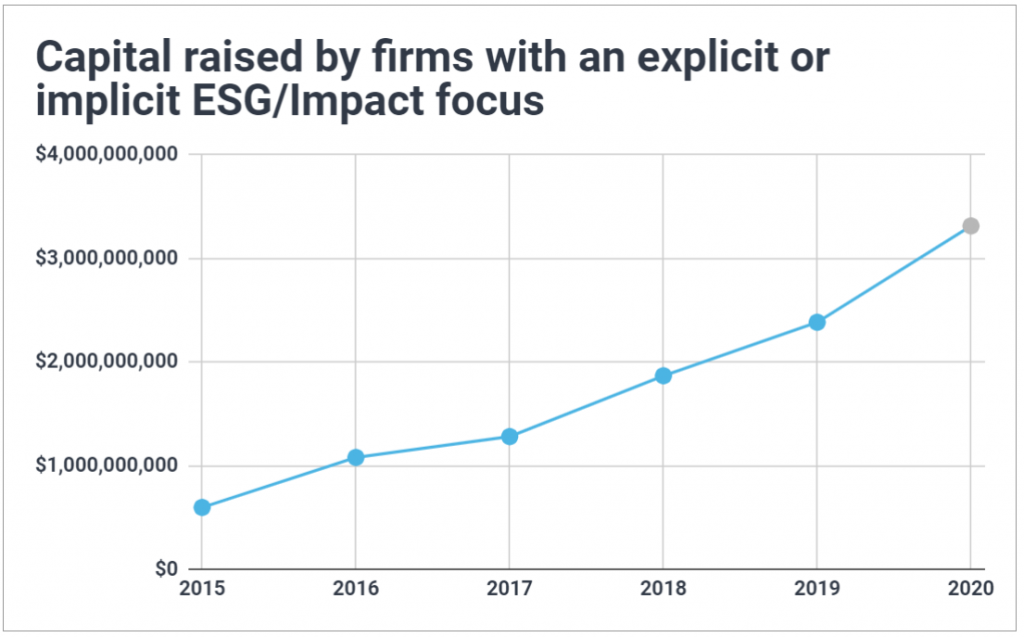

Since 2015, the number of VC funds raised each year by ESG firms quadrupled, up to more than 40 in 2019. The amount of venture capital raised each year by ESG firms has similarly quadrupled since 2015, up to $2.4B in 2019.

Although 2020 data is still preliminary, it’s worth noting that this year is tracking behind 2019 for count of funds, but has already set a new fundraising high of $3.3B. The downturn in the number of fund vehicles raised in 2020 with a simultaneous record high in actual capital closed suggests the pandemic may have consolidated ESG dollars into a handful of “mega ESG funds” — just as the pandemic consolidated venture capital across the broader market. Also important to note, the new high for ESG venture capital comes alongside heightened recognition of the importance of ESG in general: the pandemic and protests of 2020 have spurred many companies to rethink how being more sustainable can help withstand financial shocks. Increased awareness is a critical step in continuing to increase investor appetite for funds (public or private) that utilize an ESG lens.

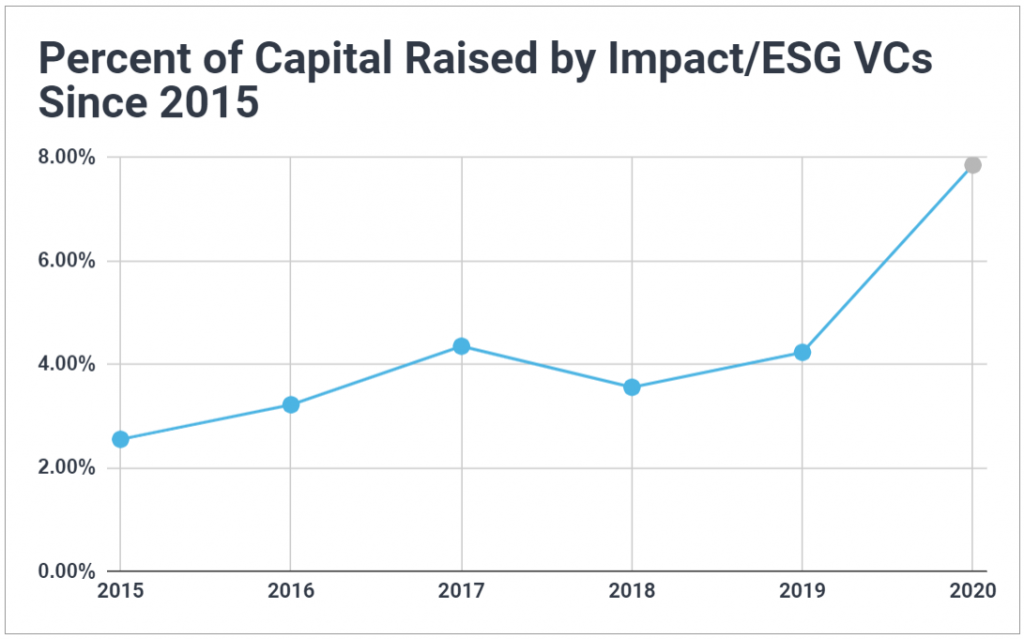

While such strong growth in both fund count and capital raised are positive signs for ESG VCs, it’s also important to compare their growth to that of venture capital more broadly. After all, while raking in $2.4B sounds impressive, it’s dwarfed next to the more than $46B raised across all 2019 funds — are ESG firms growing at the same pace as the broader market?

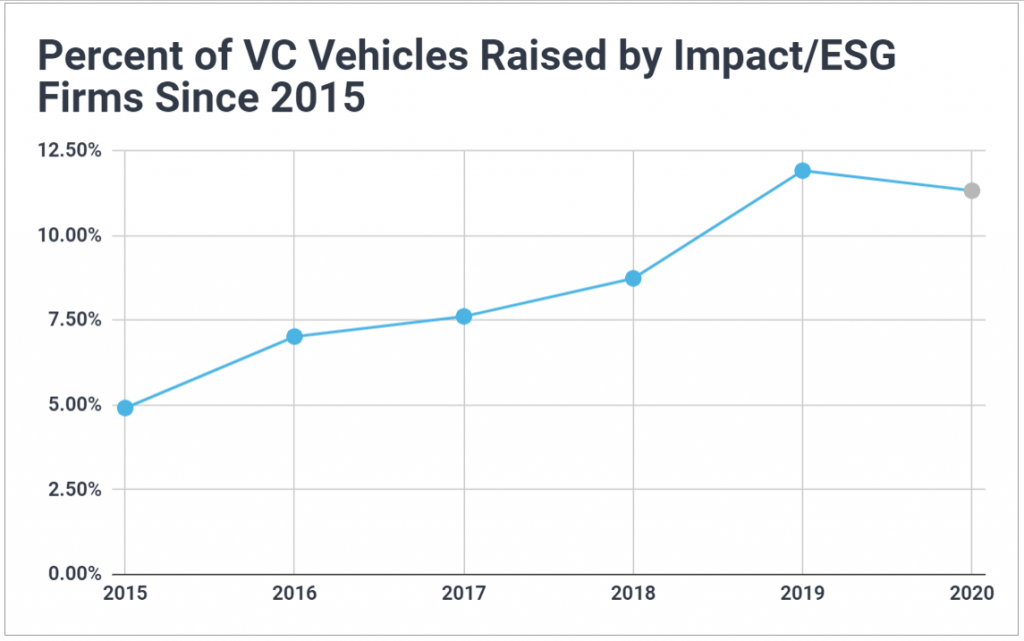

Yes and then some. As a percent of the VC market, ESG funds have been steadily rising in prevalence and have been attracting an increasing share of capital allocated.

Whereas 2015 saw just 5% of venture capital vehicles being raised by firms with an ESG thesis, by 2019 that figure rose to 12%, with 2020 tracking to a similar level. And, the percent of all venture capital being raised by ESG firms grew from just over 2% in 2015 to more than 4% in 2019 — with 2020 climbing all the way to 7.9%.

Without a doubt, ESG-lens investing is on the rise in US venture capital.

Looking Ahead: Continuing to Invest with Impact as ESG Becomes More Common

For investors seeking both social and financial returns, the growing segment of venture capital dedicated to ESG offers a compelling mechanism to achieve positive impact within a portfolio.

ESG VCs are particularly compelling as an alternative to many of the so-called ESG funds in the public markets. The explosive inflow to ESG ETFs has produced a host of buzzword-chasers, claiming an ESG lens to attract investors without actually backing companies actively seeking a positive impact on people and the planet (the only thing ESG about Big Tech is that they aren’t a coal power plant). By comparison, the small but growing group of ESG VC firms consists largely of genuine managers. Enabled by the illiquid nature of their investment vehicles, these VCs are able to truly make long-term, impact-minded bets, all while generating significant alpha.

Over time, ESG investment strategies may lead the way forward with capital seeking multiple forms of return (people + planet + profit). That said, as this niche segment grows (and even in its current state), LPs should be wary of what metrics matter: the hazards of green-washing may always be present. After all, the private markets aren’t completely immune to the challenges facing public market ESG. But with careful due diligence and clearly laid out expectations regarding impact metrics, investors may realize that venture capital presents a much more effective (and authentic) means of not just avoiding “bad” companies, but funding impactful ones.