A data-driven profile of VCs headquartered in Los Angeles, from fund sizes and investment cadences to target sectors and stages.

Venture capital, perhaps more than any other sector of the economy, is notorious for its geographic concentration.

Since its genesis, the venture industry has revolved around Silicon Valley and the greater San Francisco Bay area. The region secures as much as 40% of yearly startup capital and never fails to top the rankings for venture-backed deals and dollars.

But with the unique challenges of last year’s pandemic forcing many VCs to become more comfortable with remote investing (and the record-breaking level of investment confirming their comfort), there are signs of change for the historical Bay Area monopoly.

A number of states not traditionally known for VC investing saw impressive growth, with an unprecedented 14 states witnessing at least $1.5B invested. What’s more, the Bay Area’s dominance in deal count continued its recent fade.

Recognizing the evolving landscape of venture capital, we’re launching a series to profile several emerging VC markets across the US. Each edition will be a data-driven deep dive into the state of VC for the select geography, drawing from Different’s database on 1,500+ US VC firms.

We’re kicking-off the series by narrowing in on Los Angeles.

The Largest of the Burgeoning Ecosystems

Compared to other emerging US ecosystems, Los Angeles is hardly nascent. By count of VC firms, it’s the third largest market behind the Bay Area and greater New York City.

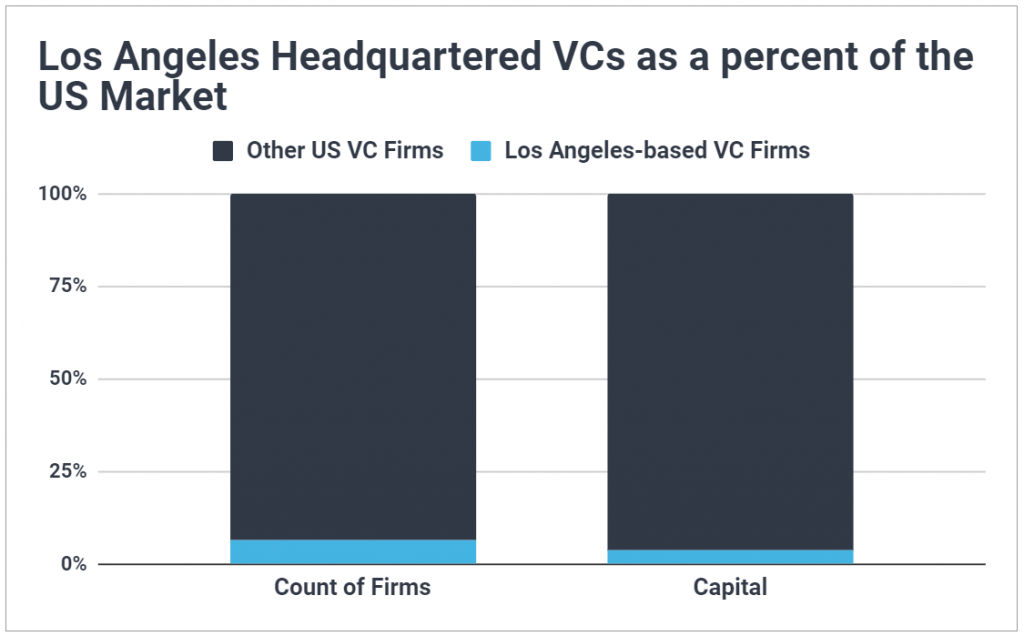

However, this says more about the dominance of the top geos than the maturity of LA’s venture market. We estimate there are about 120 VC firms headquartered in LA, managing a combined $9.1B out of their most recent flagship vehicles. That pegs their firm count at 6.6% and their capital sum at only 4% of the US market.

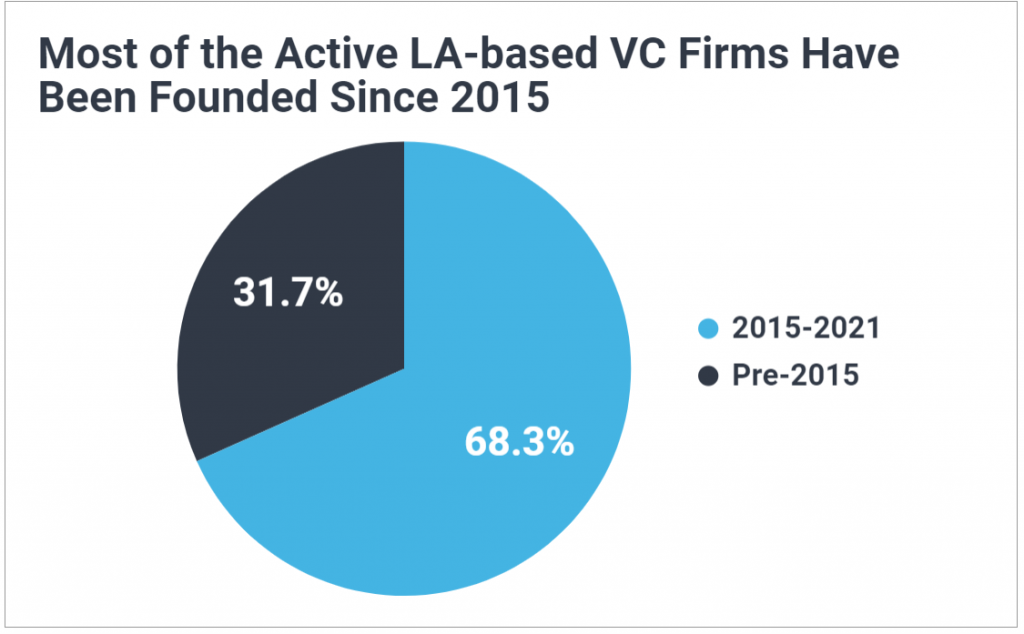

Of note, we found 68% of active LA-based VC firms have been founded since 2015, meaning the vast majority of LA’s market has less than half a fund life under its belt (and presumably very few exits to show LPs when fundraising). Indeed, 90% of LA VCs are emerging managers (Funds I-III).

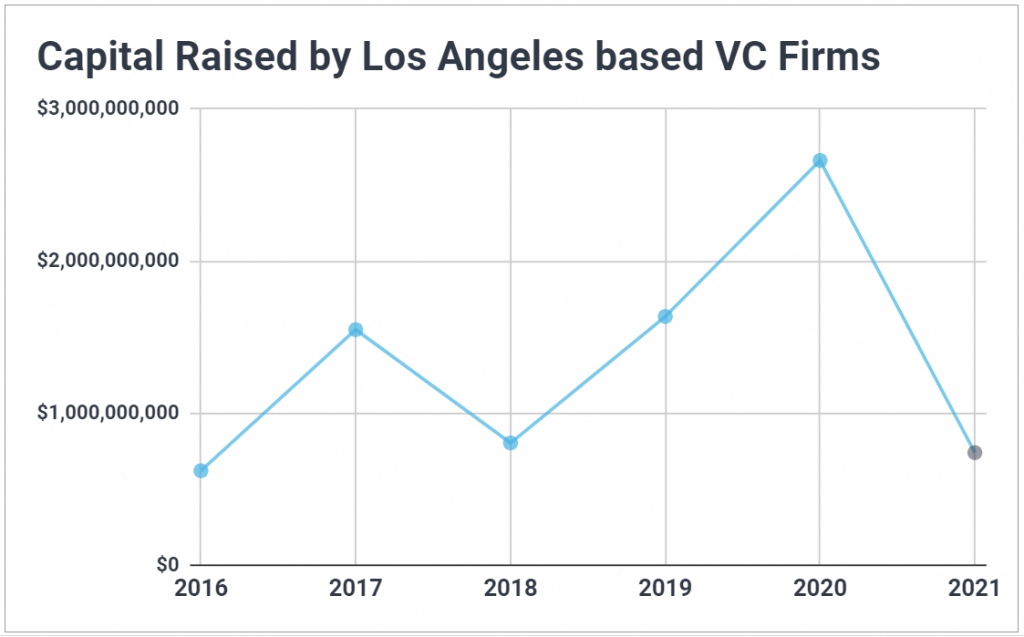

But promisingly for the area, the amount of capital closed each year has been steadily growing since 2016, including in 2020 (when many emerging, and particularly debut, funds struggled).

The median fund size in LA ($50M) is also on-par with the rest of the US, although the average fund size still lags, sitting at $93M in Los Angeles versus $164M for the rest of the US. This points to a lack of larger, later stage vehicles in the LA area, a crucial piece of a mature VC ecosystem capable of scaling startups with local capital. That said, LA has frequently benefited from (and sometimes struggled with) its close proximity to the Bay Area — a proximity that makes it more likely than other emerging ecosystems to see activity from the established late-stage Bay Area investors.

Fund Strategies, Stages, and Cadences

Los Angeles thesis strategies largely mirror the rest of the US from a broad lens: 33% leverage a generalist approach, 38% take a specialist approach, 22% position themselves as thematic, and 7% have a geographically-centered thesis.

However, the exact sectors targeted by LA VCs do differ in a few significant areas.

For one, LA firms are much more likely to target consumer startups over enterprise ones. We found 26% of Los Angeles headquartered VCs list “consumer” as a target sector, compared to our estimate of 14% for non-LA firms.

Fitting with the economy of the LA market, VCs in this region are also more likely to target startups in health (24%), media (19%), sports (11%), ecommerce (11%), gaming (8%), and wellness (8%), among others.

LA VCs appear to be very focused on building and investing in their own ecosystem: although only 7% leverage a geographically-centered thesis, a full 36.8% include a specific focus on investing in startups in Southern California or Los Angeles.

Unsurprisingly given fund sizes, they’re also more focused on the early stages. More than 68% of LA-based firms target seed (or pre-seed) startups, compared to 57% of non-LA firms. The studio model, too, is more prevalent in Los Angeles, with 5% of LA-based firms having a studio component versus 2% elsewhere.

In terms of investment cadences, the average LA VC invests in 7.7 new portfolio companies per year, on-par with the 7.72 average across the US. Their average fundraising cadence, however, is slightly more extended, at one flagship fund every 3.42 years compared to one every 3.12 years for other VCs.

What’s Unique About the LA Ecosystem?

In sum, the Los Angeles VC market is dominated by relatively new firms (post-2015 founding dates) of moderate size ($50M), focused on consumer and entertainment sectors and preferring to invest in SoCal startups. With few funds at the upper end of the AUM spectrum, the market focuses on the very early stages, with each firm averaging about 8 new portfolio companies per year and a new fund every 3.5 years.

But there’s one last aspect of the LA VC market not captured in the preceding data but that’s nonetheless noteworthy: the presence of celebrity VC funds. From Snoop Dog’s cannabis-focused Casa Verde Capital to the Chainsmokers’ Mantis VC, the relatively small size of LA’s venture capital ecosystem means these celebrity funds could play an outsized role in dictating the future of startups from the area. Whether that’ll give the region a leg-up in building the next ubiquitous consumer company or will prove to be a drag on the market’s maturation remains to be seen.