A data-driven profile of VCs headquartered in Miami, from fund sizes and investment cadences to target sectors and stages.

Miami has exploded in VC buzz since a half-joking tweet in December sparked an aggressive social media campaign by the mayor to capitalize on the idea of “Silicon Beach.”

Touting low taxes, warm weather, and a pro-business government, Mayor Suarez is hardly shy about pitching disgruntled Silicon Valley investors and entrepreneurs on the perks of Miami living (while quietly ignoring the swampish summers, wrecking ball hurricanes, and nihilistic driving).

But a few name-brand VCs have shown they’re taking the idea seriously. The list of firms to open a Miami office has grown to include Founders Fund, Atomic, Palm Drive Capital, and SoftBank.

Given all the hype, we decided to focus on Miami for the second edition of our latest series that takes data-driven deep dives into the state of VC for select markets. (Browse all market profiles here, or read the first edition on the Los Angeles VC ecosystem here.)

Miami Headquartered VCs Still Represent Less than 2% of Total US Firm Count and Less than 1% of Capital

We estimate fewer than 30 VC firms are headquartered in the greater Miami area, pinning the market at 1.4% of the total US firm count and placing it just outside the top 10 most common US metro areas. Combined, these firms managed $1.3B out of their most recent flagship vehicles, representing about 0.6% of the US total.

Although this ignores the slew of firms to list Miami as a secondary (or septenary) office, throughout this post we’ll focus exclusively on Miami-headquartered VCs, given the difficulties of identifying every office of every firm, as well as the difficulty in discerning the legitimacy of each additional office (i.e. whether it’s actually used as a hub for activity versus one GP of seven lives there while focusing on activity elsewhere).

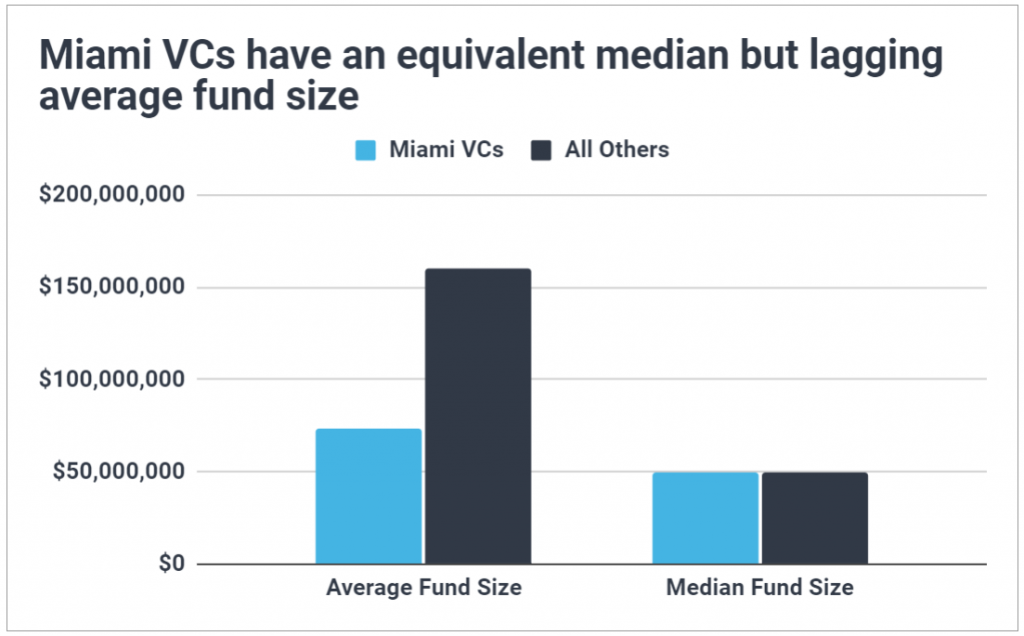

Among Miami-headquartered VCs, the median fund size is on-par with the rest of the US at $50M, with the average fund size lagging significantly ($73.8M vs $161M). Crucially, we find 50% of Miami-based VC firms manage a flagship fund smaller than $100M (a critical cut-off for institutional investors) and less than 1% manage a fund exceeding $200M.

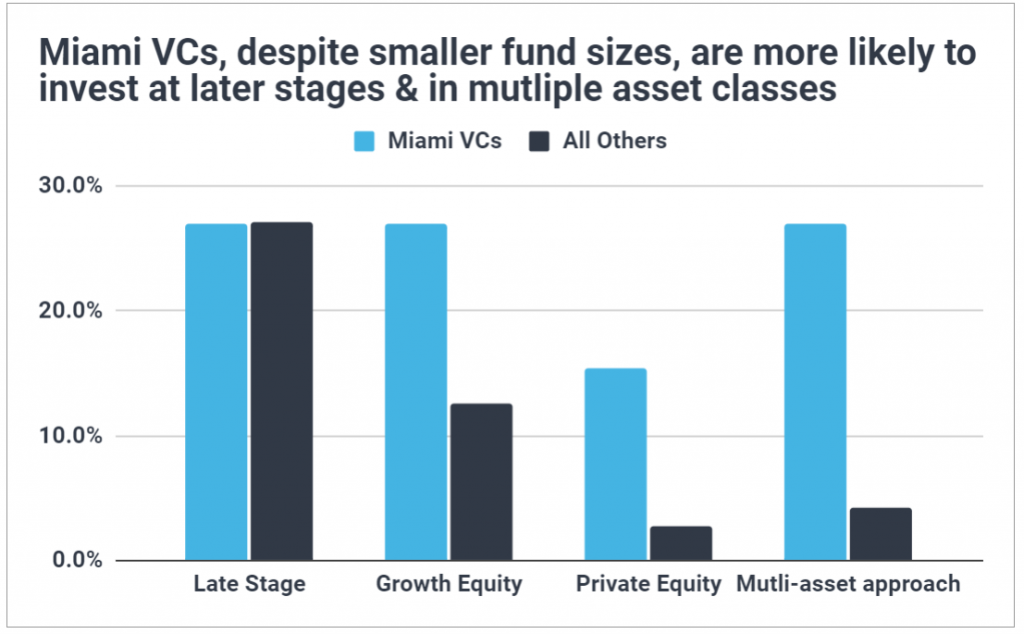

Yet counterintuitively given fund sizes, Miami VCs are very prone to target later stage, and even growth or private equity stage, companies. Whereas 12.4% of VCs in other geos target companies at the growth equity stage, 26.9% of Miami VCs do; and while just 2.7% of VCs elsewhere additionally invest at the mature private equity stage, 15.4% of Miami VCs do.

Relatedly, Miami VCs frequently take a more Wall Street approach of investing in multiple asset classes beyond venture capital (e.g. hedge, debt, real estate, private equity, etc.). Across the US, we estimate just 4.3% of VCs leverage this multi-asset investing approach, yet in Miami that figure jumps to 27%.

It’s not surprising, then, that the most popular second office for Miami-headquartered VCs is New York rather than the Bay Area.

Slower Investment and Fundraising Cadences

Compared to the rest of the VC market, Miami VCs have slower investment and fundraising cadences.

Whereas the average US VC firm invests in 7.9 new portfolio companies per year, the average Miami firm invests in just 4.5 per year. And, whereas the average US VC firm raises a new flagship fund every 3.1 years, the average Miami firm does so every 4.46 years.

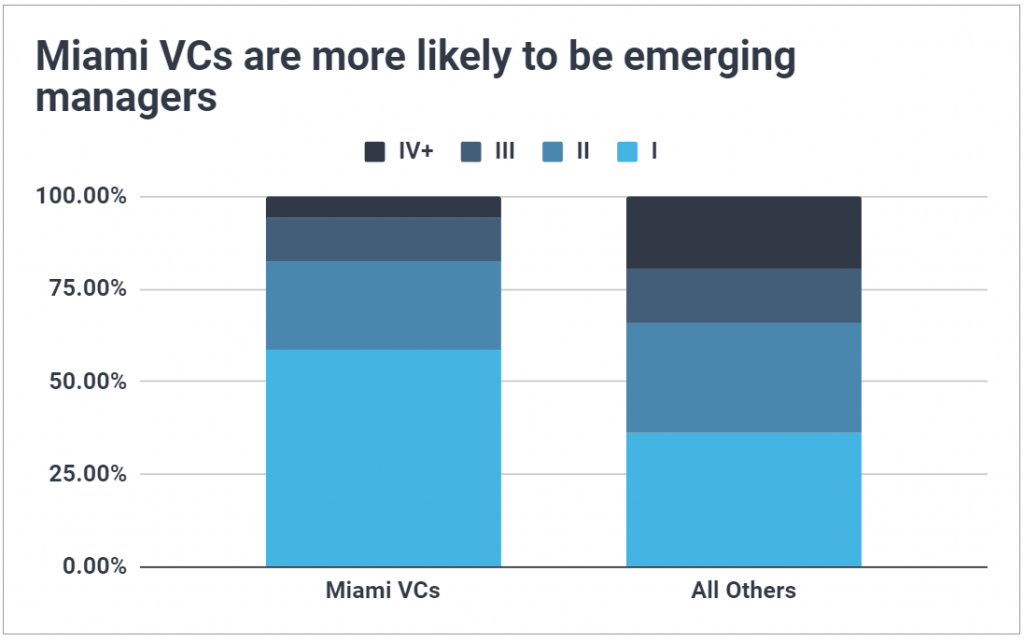

These slower activity cadences help explain why nearly 60% of Miami VCs are on Fund I despite over 42% having been founded pre-2015.

Target Sectors & Geos

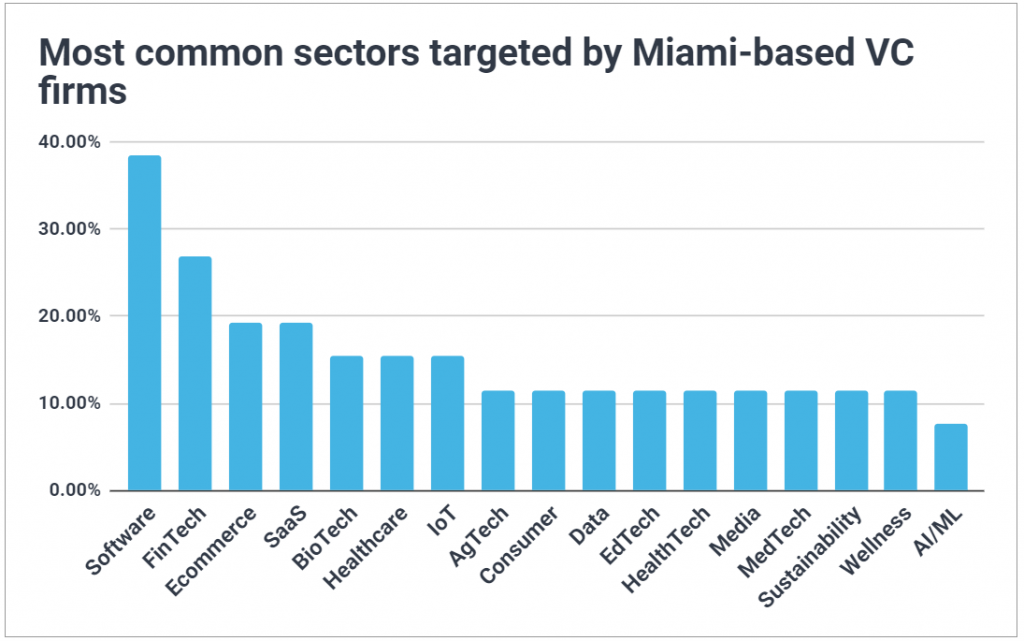

Although Miami is a relatively small VC market, the range of target sectors is quite diverse, with 80 unique investment focuses among VCs headquartered there.

The most common targeted sectors include software (38%), FinTech (27%), Ecommerce (19%), SaaS (19%), and BioTech (15%). Of note, Miami VCs are more likely than VCs elsewhere to focus on wellness and mental health startups, exemplified by the psychedelic-centered thesis of 2020-founded Iter Investments.

In terms of geographic focuses, it’s actually more common for Miami-headquartered VCs to target startups in Latin America or South America (25% do so) than to target startups in Florida (15% do so). Miami, then, seems to more frequently be a jumping-off point for investing in LatAm startups than Miami ones.

The Future of Miami?

Although Miami has gained headlines in recent months for its predicted future as a tech hub, convincing a few big-name VCs to set up a Miami office won’t alone build a strong, local entrepreneurial ecosystem.

After all, the pandemic didn’t just teach VCs that they could live anywhere. It also made clear they could invest anywhere — meaning the Silicon Valley investor can get all the perks of living in Miami while continuing to comfortably pattern-match-invest in familiar Bay Area startups.

And so far that appears to be exactly what’s happening. Despite Mayor Suarez’s claims that “all the financial companies” in New York and “all the venture-capital companies” in Silicon Valley are moving to Miami, through Q1 2021 VC investments in South Florida are on-par with the last five years.

Of course, there are always lags in venture capital and the rest of the year could witness a surge in Miami investing; but for now, it’s important to remember the “homegrown” VC ecosystem in Miami is still quite nascent.