Society is facing a critical juncture due to decades of underinvestment in advanced technologies and DeepTech startups. This article presents 16 potential solutions that could jumpstart innovation, create millions of jobs, and help mitigate future crises.

Written by Mack Kolarich and Leslie Jump

A World Unprepared for a Once-in-a-Century Crisis

As years go, 2020 will go down in the history books for revealing extensive shortcomings and existential challenges across societies, industries, governments, and economies. The most notable forcing function has been COVID-19. In a short few months, the pandemic exposed humanity’s massive underinvestment in critical, science-based technologies. When our team at Different was researching the state of DeepTech investment during the fall of 2019, one of several recurring concerns raised by seasoned DeepTech investors was the lack of funding in diagnostics (see report pp. 49). As noted by one investor,

“All the forces around computation, visualization, and simplifying hardware can be leveraged in diagnostics. But it’s deeply unsexy…nobody wants to be a diagnostics funder.”

— Lindy Fishburne, Breakout Ventures

And look at where that underinvestment brought us in 2020.

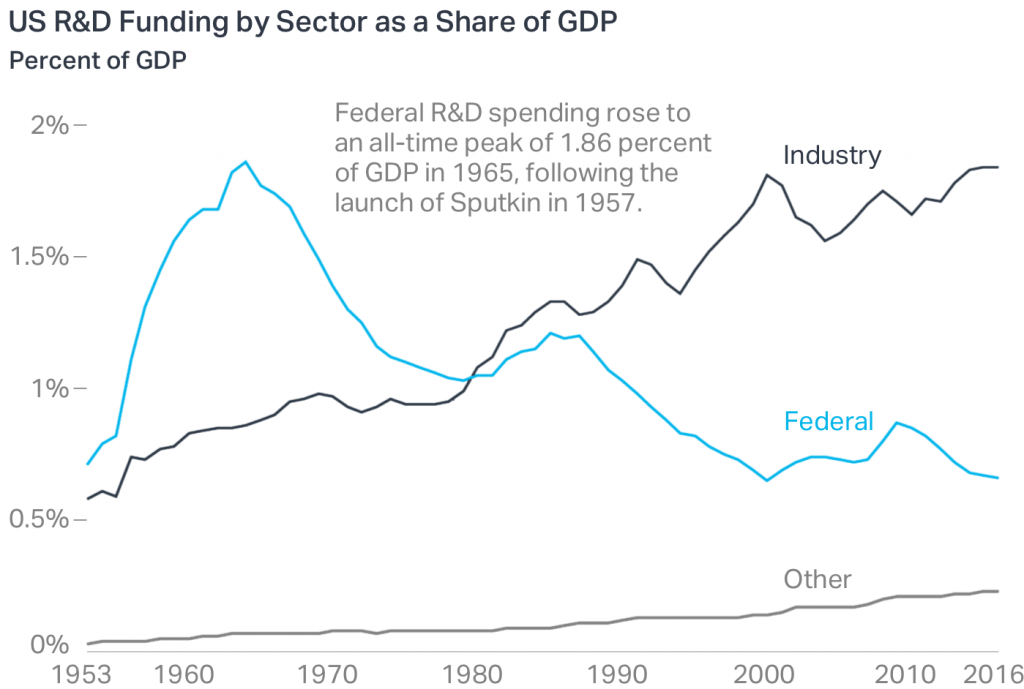

For better or worse. Capital available for some diagnostic innovation has since increased. But diagnostics are just the tip of a looming iceberg of scientific underinvestment. With few exceptions (ex: China, Google), most governments and corporations have reduced their budgets and support for critical R&D over the last several decades.

These capital gaps span many fields, ranging from microelectronics to photonics to novel BioTech approaches to materials science to quantum and beyond. These technologies influence nearly every industry and sector including energy, construction, food & agriculture, travel, entertainment, medicine, and more.

America and the world need to innovate forward. In fact, innovation may also be our most compelling opportunity to address the pandemic-driven global recession. Massive capital injections into the development and application of advanced technologies will not only usher in new economic paradigms and innovation platforms, but also lead to the creation of millions of high-quality jobs across the US. (ex: oil & gas retrofits, new plant constructions, management of vertical warehouse farms, etc, can each employ thousands.)

Where we are today: starting from a solid foundation

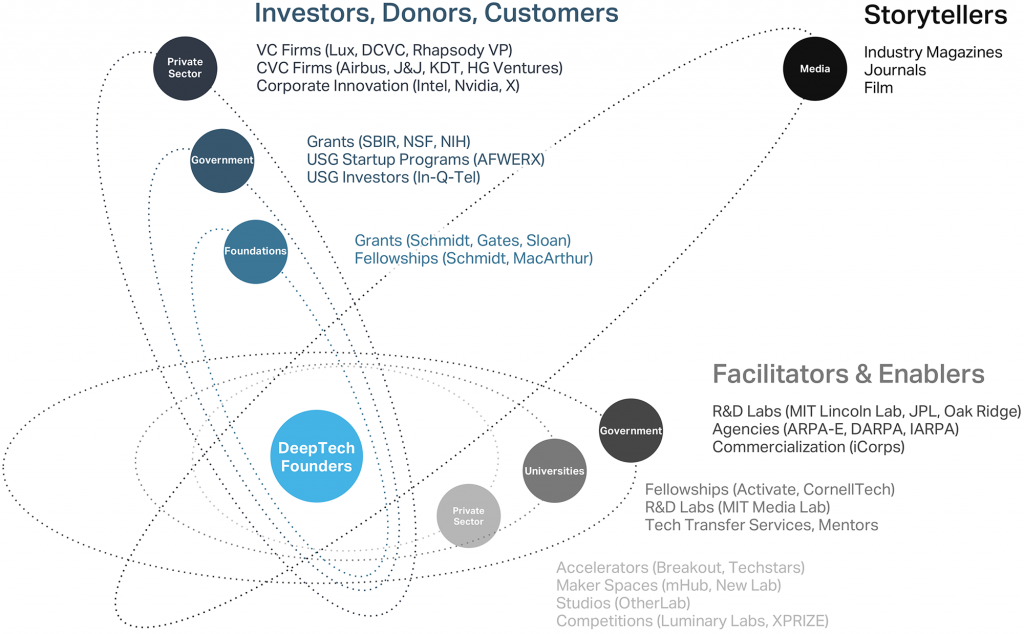

Despite these challenges, we’re not starting from scratch. There is a dynamic DeepTech ecosystem encompassing hundreds of existing organizations and initiatives from which to build. These include organizations that facilitate and enable scientific entrepreneurs, firms and foundations who fund them in the early days, and the journalists who tell their stories and inspire new founders.

As a starting point for those new to DeepTech, we highly recommend you read our DeepTech Investing Report. But we’ll also highlight a few existing resources here:

- Organizations like Activate.org and CornellTech are helping PhDs and other technical researchers build DeepTech businesses and bring technologies to market;

- Researchers such as those at Oregon State University are working to revamp tech transfer processes, and make it easier for intellectual property (IP) to be put to use;

- Maker spaces such as mHub (Chicago) and New Lab (New York) are providing DeepTech founders access to critical prototyping tools typically only found in universities and government labs (they also provide much needed community and investment);

- Groups like the Day One Project are creating policy briefs and frameworks to guide U.S. government agencies in their science and technology agendas;

- Media coverage from the likes of Benjamin Joffe’s DeepTech Podcast and the MIT Tech Review are helping share the stories of the DeepTech community to wider audiences;

- Government programs such as the United States’ Small Business Innovation Research (SBIR) program or Canada’s Industrial Research Assistance Program (IRAP) help scientific founders with early-stage non-dilutive funding;

- Public entities like the European Investment Bank Group (EIB) are prioritizing capital access to issue-specific technologies, with the EIB committing $1T of investments to climate action and environmental sustainability;

- And a growing array of investors interested in DeepTech and innovation-driven alpha — from family offices to corporations to the occasional institution — are helping finance DeepTech funds and companies directly.

We’re also seeing promising new legislation. The recently introduced Endless Frontier Act — a bipartisan bill — proposes investing $100B into advanced technologies over the next 5 years. The bill is certainly an imperfect implementation (it’s never ideal to put more money into a broken system simply because it’s the easiest option) … but it’s well intentioned, would be an important step forward, and is a hallmark of the support for DeepTech commercialization that this country and the world desperately needs.

In China, the CCP has placed ever increasing emphasis on advanced technologies and technological ‘self-reliance’ in its 5 year plans. The U.S. government could and should follow suit in order to not fall behind: the proposed Biden-Harris Clean Energy Revolution Plan offers an opportunity to catapult the U.S. forward with respect to renewable energy, upgraded grids, and clean technologies. If passed, various infrastructure bills could supercharge components of the DeepTech industry as Congress debates how to address America’s crumbling infrastructure.

A roadmap for future investment

Through the course of our extensive DeepTech investing research and work since the report’s publication, we cataloged over 150 ideas for ways to improve the DeepTech innovation ecosystem. Some of these ideas are ours, but most came from conversations with experts we interviewed. Some recommended very similar ideas to each other (suggesting a common problem / need). And many ideas were often presented by experts as “I’m working on the XYZ focus area, but what would really fix this problem I see is ____. We need someone to pick up the mantle to build this solution, or better yet fund it.”

In the hope of shaping the future — whether it be better policy, expanded scientific philanthropy, or increased capital allocations — we are publishing a subset of these ideas. There are many different approaches to the issues encountered in DeepTech innovation, but they tend to group into a couple natural ‘categories.’ Here’s what’s needed:

I. Not enough investable products

One of the consistent challenges we heard from investors is that there aren’t enough “Investable” products, meaning DeepTech startups who meet the criteria needed to attract commercial investment. There are many reasons for this, but overall it speaks to the need to better prepare scientists and inventors to become entrepreneurs, and create more incentives / less friction to go from lab to pilot customer.

- Launch an alternative ‘Scientific Research Fellowship’ that allows graduate students to work on commercialization. The point of such a fellowship is to create a safe space with sufficient funding for more scientists to become entrepreneurs. There are many ways such a fellowship might be implemented. One promising example that could be expanded is Activate.org — whose founder Ilan Gur recently cowrote a policy proposal on this exact topic (worth the read). Another option could be a program like AmeriCorps for STEM graduate students, that offers student debt forgiveness and salary stipends in return for multi-year commitments to work on commercializing technologies of particular importance to governments or corporations.

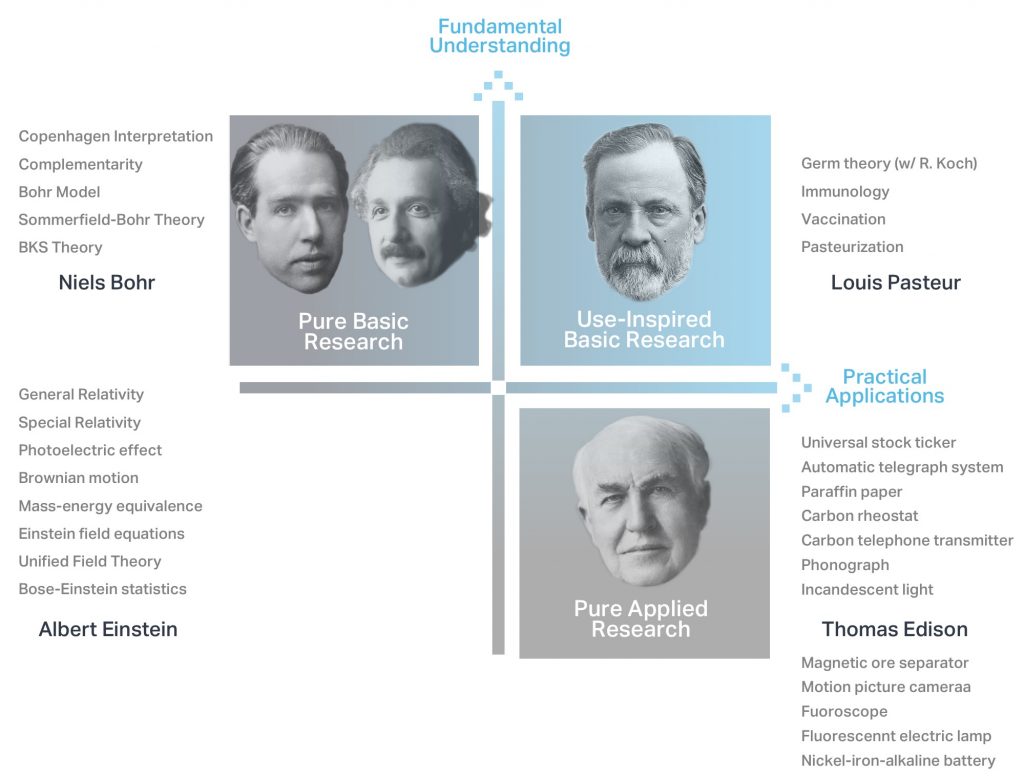

- Create policy mechanisms (either programs or funding) to expand use-based research. Existing U.S. legislation and funding programs are particularly geared towards fueling pure basic research, or ‘science for science’s sake’. Make no mistake, such research is incredibly important, and can lead to new scientific breakthroughs and paradigms. But frequently, basic research struggles to translate into actual products and businesses that impact society. To address this, government agencies should create more funding and support for ‘use-inspired research,’ also known as “Pasteur’s Quadrant.” Effective legislation could both increase the volume of technology commercialization, and shorten the time-to-market for DeepTech … leading to more businesses, more jobs, and more private sector investment.

- Foster ‘exchange programs’ between MBA programs and science departments within universities. Many universities are incredible sources of intellectual property as well as business and scientific talent. DeepTech companies need both business and science expertise to succeed. Yet these students often don’t mingle with each other, with MBA students frequently unaware of the unique scientific breakthroughs happening at the university and the science students often unaware of a powerful commercial opportunity for their science. Universities could easily fix this, which could lead to the creation of many more DeepTech companies. One way to fix this is to run a “DeepTech Business Competition,” where MBAs and graduate STEM students collaborate to form an advanced technology business, and the top ideas receive meaningful funding to bring that business to market.

- Fix Tech Transfer. University Technology Transfer offices frequently hinder licensing of R&D in founder and investor-friendly formats. Many Tech Transfer offices have optimized for Life Sciences, and are staffed by administrators incentivized to keep the process complex in order to preserve their jobs. Our experts consistently reiterated that this Life Sciences licensing approach does not work for the rest of DeepTech and dissuades investors from getting involved (see pp. 18 of the report for more details). Moreover, recent reports have noted how little revenues have actually been generated from university IP … which suggests that tech transfer offices are squandering this potential. This affects both IP licensing to startups … but also to large corporations, which have seen declining rates in university-IP licensing. Universities should get serious about fixing this and creating founder-friendly IP licensing agreements. Groups within CornellTech and OSU can help advise on this front, as can firms like Rhapsody Venture Partners and FreeFlow Ventures.

- Fund the creation and expansion of non-academic laboratory resources. Contrary to popular belief, a significant number of DeepTech founders come from outside the ‘typical’ institutions (one report found that only 30% of DeepTech companies were university spin-outs). Yet many advanced technologies need access to specialized equipment, labs and testing facilities most commonly found in universities and government labs. These ‘non-tracked’ founders struggle to access the equipment and resources they need. Some maker spaces like mHub (Chicago) or New Lab (New York) provide these facilities outside of a university framework — but their spaces are few and far between. Governments, corporations, and philanthropic capital should fund more of these DeepTech maker spaces around the country, which would help level the playing field for DeepTech founders who innovate outside of academia.

II. Not enough expert investors

A second significant challenge is the scarcity of investors experienced in backing DeepTech companies and venture firms. Investing in venture capital and startups is a specialized skill set. Investors fluent in the complexity of diligencing and backing advanced technologies are even more rare. Additional resources are needed to enable more investors to enter this market.

- Create a centralized DeepTech Due Diligence and IP Valuation resource. Many investors struggle to due diligence and assess valuations for DeepTech innovations, largely because they lack the technical know-how in house. As a result, when presented with a potential DeepTech investment, they often default to just saying ‘no’ because the technology is too complex for them to assess or the business model isn’t obvious. Mainstream venture investors need a trusted organization or network to support their due diligence. The Different DeepTech concentration score is a step in this direction, and is informed by our expertise in venture fund sourcing and diligence. A third-party option could be along the lines of Charity Navigator for DeepTech investments.

- Change the structure of CFA and FINRA exams to better prepare those working in financial services to consider and diligence VC and startup investments. As is, the CFA and most commonly taken FINRA exams (such as the Series 7) barely cover private equity, let alone venture capital. These exams are supposed to help prepare these professionals to assess many forms of prospective investments and also to advise wealth management clients on their investment allocations. Yet when it comes to venture capital or startups, most financial advisors have little to no experience with venture capital at all, and default to ignoring the asset class. Incorporating more venture capital content as part of the licensing exams could change this over time.

- Create a ‘Science Corps’ program that embeds PhD scientists inside VC firms. Such a program could help business-inclined scientists work and learn alongside venture capital investors to understand the nuances of growing and capitalizing businesses. Simultaneously, VC firms could benefit from an in-house expert who may be better equipped to diligence advanced technologies (while a few VC firms have PhDs in-house or as partners, most don’t — see Page 43 of our report). The program would need philanthropic or government funding to support the salaries of the scientists-in-residence, and to help coordinate the program between VC firms and academic institutions.

III. Not enough capital

Finally, there’s simply not enough capital focused on investment in DeepTech. Early stage investors often pass on DeepTech deals in favor of software products that meet typical “Sand Hill Road KPIs”. Limited Partners (the investors backing VC firms) and Family Offices rarely prioritize DeepTech investments. And risk-averse Corporates (CVCs) likewise often miss the relevance of DeepTech to corporate strategies. Public and philanthropic resources are needed to reduce barriers, buy-down risk, and draw more private capital into the market.

- Create a Science Investment Rating Product (or a ‘Science Portfolio Rating’). Think of an ESG rating score for a publicly traded company, but make it DeepTech or R&D-investment-oriented. The intention of this rating product would be to 1) make it easier for investors to choose what companies they invest in while 2) helping capital allocators (like pensions or endowments) benchmark themselves on where they invest. The Different DeepTech Concentration Score is a prototype for a possible rating system.

- Fix the SBIC (Small Business Investment Company) program. The SBIC program has been out of date and poorly utilized for decades. As described by one expert, the SBIC is a “rickety model that doesn’t work for VC anymore, let alone DeepTech.” Restructuring SBIC to be relevant for the 21st century and better geared for DeepTech funds could drive existing capital sources into this field.

- Fix the SBIR (Small Business Innovation Research) program to avoid capture specialists. SBIR is an incredibly important resource for American DeepTech. And make no mistake, some great startup companies effectively leverage SBIR grants every year. But a hefty chunk of SBIR’s budget is captured by ‘SBIR mills,’ also known as ‘capture specialists.’ (Basically, what they’re best at is figuring out how to win repeat SBIR grants while never scaling or commercializing the technology for which they received each grant.) Some of this capture stems from agencies using SBIR as a flexible ‘hammer’ to try to get some form of bespoke tech or research the agency direly needs, but does not have a better budgetary mechanism to acquire it. But most of America would not consider a 12-year-old company with 100 employees to be a startup. One possible fix would be to have stronger startup litmus tests, or special budgetary carve-outs to go to small teams that demonstrate they haven’t won 3+ SBIR grants in a row.

- Expand the SBIR program to help ease early stage capital gaps. Frequently, startups exhaust the limited yet critical monies they receive through SBIR before they get to commercial pilots. Many of these companies still have tremendous promise, but the nature of their technology requires a bit more time and resources. Yet, one of the challenges we found in our DeepTech research is that few VCs are willing to invest before a company has an active commercial pilot (or at least, within immediate sight). As a result startups that are still ‘too early’ either whither away or begin to pursue other SBIR and similar grants (and sometimes, this causes them to devolve into capture specialists as discussed in the previous point). This disconnect fuels one of the major capital gaps we identified in our report. One potential solution is for the government to authorize and fund a “Phase III” component of SBIR that would offer increased capital grants to startups. (Note: Our team is scoping an alternative approach that could solve this issue, which we’ll publish in the next few weeks.)

- Form a public-private development finance institution for DeepTech. Think the DFC (U.S. International Development Finance Corporation, f.k.a. OPIC), but specifically designed for DeepTech. There are multiple capital gaps faced by DeepTech startups throughout their lifecycle, and these capital gaps frequently stem from limited capital available to DeepTech VCs. A well designed public-private investment entity could help bridge these capital gaps by anchoring emerging DeepTech VC funds, providing first-project finance, offering relevant training and advice for DeepTech investors, and supporting the underlying companies with additional capital when needed. Additionally it could bridge the need for debt alternatives and first plant financing rarely available to DeepTech startups.

- Build an operating company that acts like an evergreen fund and backs DeepTech businesses. Think of this as a long term operating and financing umbrella, that can provide both patient capital and centralized resources to the underlying advanced technology companies. This could look like a Berkshire Hathaway or a BridgeBio. This operating company would likely excel by picking a specific sector or specialization (ex: materials science or agtech), and offering extensive centralized expertise and resources to its underlying holdings that can offer uncorrelated potential alpha in that sector. There are a variety of ways this could be funded, but one option is for shareholders to be endowments and other NGOs exempt from U.S. taxes.

- Remind corporations that R&D expenditures can be a tax benefit. Many corporations have drastically reduced their R&D budgets over the last several decades — sunsetting internal laboratories and R&D teams. Instead, corporations increasingly favor M&A to find innovative breakthroughs…but this doesn’t always work, and can actually stunt applied science progress as startups often lack the resources or tools that a large corporation may have historically offered. R&D expenditures shouldn’t be viewed as ‘cost centers’ that reduce profits (and thus corporate taxes), but as long term investments that are tax advantaged.

- Reinforce the concept of ‘legacy through technology’ with family offices. Family offices around the world control trillions in wealth. These families can direct those assets to countless priorities — funding technological breakthroughs is just one. But DeepTech breakthroughs can generate massive positive returns for society, resulting in cleaner environments, less waste, more efficient computing, space travel, more food and water, and a thousand other solutions to critical problems facing humanity. Families that invest in DeepTech can cement their legacy for generations. Consider how Andrew Carnegie built 1700 libraries and brought access to knowledge to millions. What if more of today’s billionaire families did something similar with DeepTech?

Our role in the DeepTech Investment Ecosystem

We believe the future of venture is different. We’ve spent years immersed in the landscape of investment and advising key players from venture firms to institutional investors and family offices to government. We published a landmark report on the state of DeepTech investment (supported by Schmidt Futures). We’ve analyzed nearly 500 DeepTech VC firms and ~9,000 portfolio companies. We aim to share our expertise with LPs (Institutions, Family Offices), Foundations and other grantmakers, U.S. government agency administrators as well as the incoming Biden-Harris administration. Here’s how we can help.

- Navigate the Landscape. We can act as “human routers” and connect you to organizations, venture firms and other DeepTech experts. Whether that’s introductions to other investors backing “dual use” technologies or maker spaces for scientific founders.

- Inform your Strategies. Our data covers 1,500+ U.S. venture firms, including 100+ variables on the firms, their funds and general partners. It goes beyond the “usual suspects” in Silicon Valley, with firms in nearly 100 U.S. markets, and tremendous manager diversity (530 firms with women GPs, over 700 firms with BIPOC GPs). We can leverage our data to help you refine your strategies and mandates.

- Advance the Capital Ecosystem. We’re building a tool to make some of our data freely accessible. We’re also collaborating with other DeepTech leaders to build a framework for catalytic capital to back more DeepTech founders and funders. Look for news later this year, or reach out to us directly for information.

Tip of the Iceberg — We must act today.

These are just a few of the 150+ ideas we cataloged in the course of our research. They span all components of the DeepTech ecosystem, presenting ways to create more strong entrepreneurs, bridge capital gaps, activate investors, inspire corporations, fix government programs, unlock non-financial resources, and improve universities.

But a common thread for every idea is it needs funding: without adequate funding, none of these programs, initiatives, or investment vehicles will get off the ground, let alone succeed.

As we race into the winter months of 2020 and witness the next terrifying surge of COVID-19, many are in search of hope in the form of a vaccine. The development of these vaccines, and the diagnostics that allow us to detect COVID in the first place, are made possible entirely by advanced technologies. The paramount importance of DeepTech investment should be as clear as ever. But bear in mind that COVID-19 is just the current crisis. There are other crises coming down the pipe: can we mitigate, or perhaps even prevent them, by investing more in advanced technologies? The answer is certainly yes. The real question is … will we?