A data-driven profile of VCs headquartered in Austin, from fund sizes and investment cadences to target sectors and stages.

Austin has long been hyped as the next Silicon Valley.

Every few years, the city experiences its semi-regular spurt of relocations by high-profile tech companies, and the slew of announcements inevitably inspire visions of mass migration, drumming up predictions of a reworking of the Bay Area dominance.

And unsurprisingly, last year’s hotly-discussed shift to remote-work continued the trend.

Stories of Y-Combinator alumni flocking to “Silicon Hills,” supplemented with early LinkedIn reports that Austin was experiencing the greatest pandemic-induced inflow of any city, caused many to rekindle the narrative of huge startup growth in Austin. Big tech players (Palantir, Oracle, SpaceX) began announcing relocations, and were even accompanied by some name-brand VC firms (8VC).

Although the validity of this past year’s narrative is beginning to come into question (early Census data finds minimal evidence of a significant spike in population growth for Austin, and postal data suggests San Francisco residents by-and-large just moved to other Bay Area suburbs), Austin is nonetheless continuing its years-long steady growth as a startup hub.

StartupBlink recently ranked Austin as the 18th best city for startups in the world, and for years Austin has legitimately been one of the fastest (and in some cases the fastest) growing major metro in the US, proving particularly attractive for millennials.

With this in mind, we’re continuing our market profile series with a data-driven deep dive into the Austin VC ecosystem.

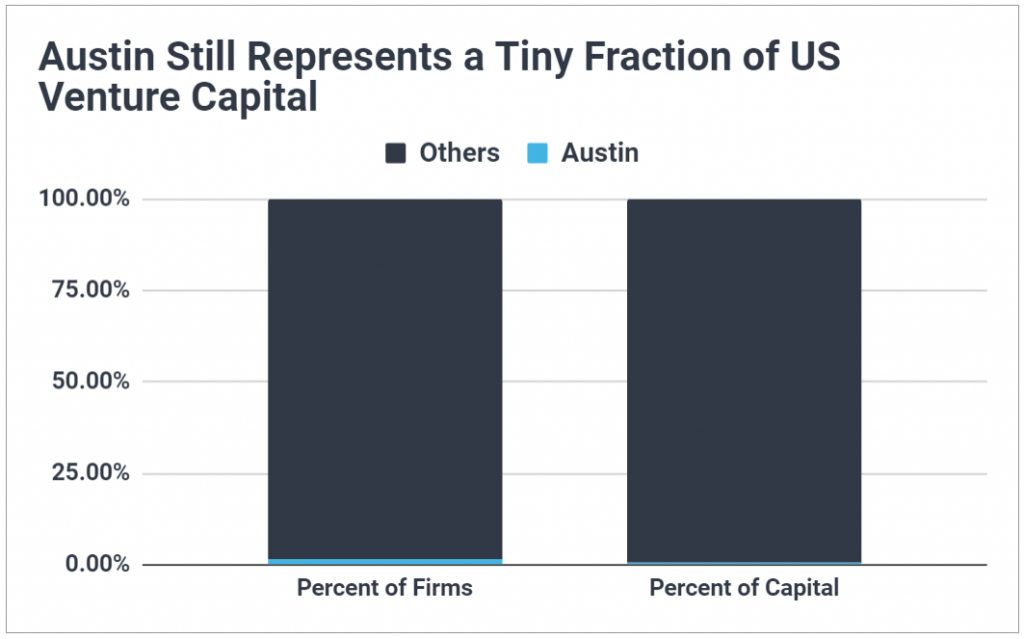

Despite Long-Standing Narratives, Austin Still Represents a Tiny Fraction of US VC

Although thought-leaders have long predicted the rise of Austin’s VC ecosystem to national stature, to-date we have yet to see the city mature into such a role. Austin VCs currently represent just 1.6% of all US firms and manage less than 0.9% of total capital. This places the region in 10th across the US for VC firm count.

But there are positive signs for growth: over 60% of active Austin-based VCs have been founded since 2015, and the region’s capital sum for its flagship vehicles has grown to nearly $2B.

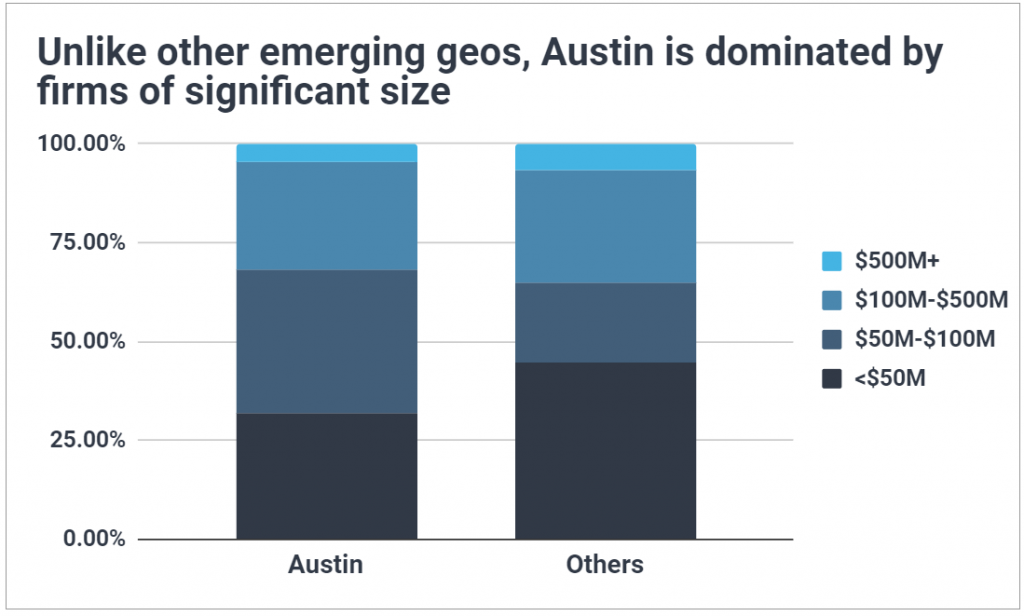

In yet another promising sign, Austin VCs are raising funds of a fairly significant size.

Unlike other emerging geos, the median flagship fund is actually greater than that across the US ($72.5M in Austin vs $50M nationwide). Further, the proportion of Austin VCs managing an institutional-sized fund ($100M+) is nearly equivalent to that seen across the US (32% for Austin vs 35% nationwide).

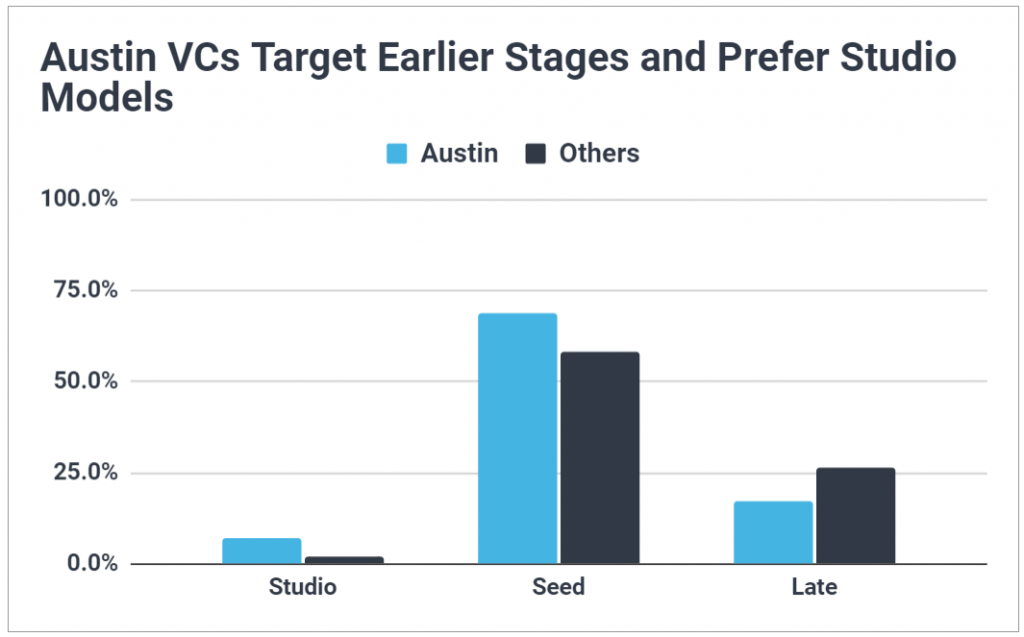

Austin VCs Lean Early and Prefer Studio Models

Despite the robust size of funds raised by Austin-based firms, VCs in the region are more likely to target startups at earlier stages than VCs elsewhere.

Whereas 58% of US VCs aim to make first checks at the seed or pre-seed stage, in Austin that figure rises to 69%. Additionally, the percentage of VCs aiming to make first checks at the late stage (Series C+) drops from the nationwide figure of 27% to 17% in Austin.

This early-stage preference could be partly explained by Austin’s trailing average fund size: in other geos, the ‘average firm’ manages a $170M fund, but in Austin the average firm manages just an $88M fund. Coupled with the previous findings of a higher median fund size in Austin, the low average suggests Austin VCs cluster around similar fund sizes and are missing from the far extremes ($1B+) featured in the broader US VC ecosystem.

Interestingly, Austin VCs also prefer studio models compared to other geos: across the US, just 2.2% of firms invest via a studio model, but in Austin nearly 7% do.

Coupled with the fact that VCs in the region have a fairly strong propensity to explicitly focus on startups based in Texas (55% do so), it’s reasonable to conclude Austin features a VC ecosystem well-centered on taking a hands-on approach to building startups founded in the area — a promising sign for the future of its startup ecosystem.

Fundraising and Investment Cadences Mirror the US Ecosystem

While some emerging geos differ significantly from US norms when it comes to fundraising and investment cadences (typically by fundraising and investing more slowly), Austin VCs evidently mirror the broader US ecosystem.

The average US VC raises a new flagship fund every 3.46 years and invests in 8.1 new portfolio companies per year. The average Austin VC, in comparison, raises a new fund every 3.75 years and invests in 8.7 new portfolio companies per year.

It’s interesting to note Austin VCs have a slightly faster investment cadence, particularly since “the rest of the US” in effect means Bay Area VCs (given their vastly disproportionate influence on US averages). So, not only does it appear Austin VCs are keeping up with Silicon Valley norms, but are even exceeding them.

Whether a quicker investment pace alongside slightly slower fundraising cadences implies Austin VCs are being stretched too thin or simply prefer diversification strategies is debatable, but worth considering.

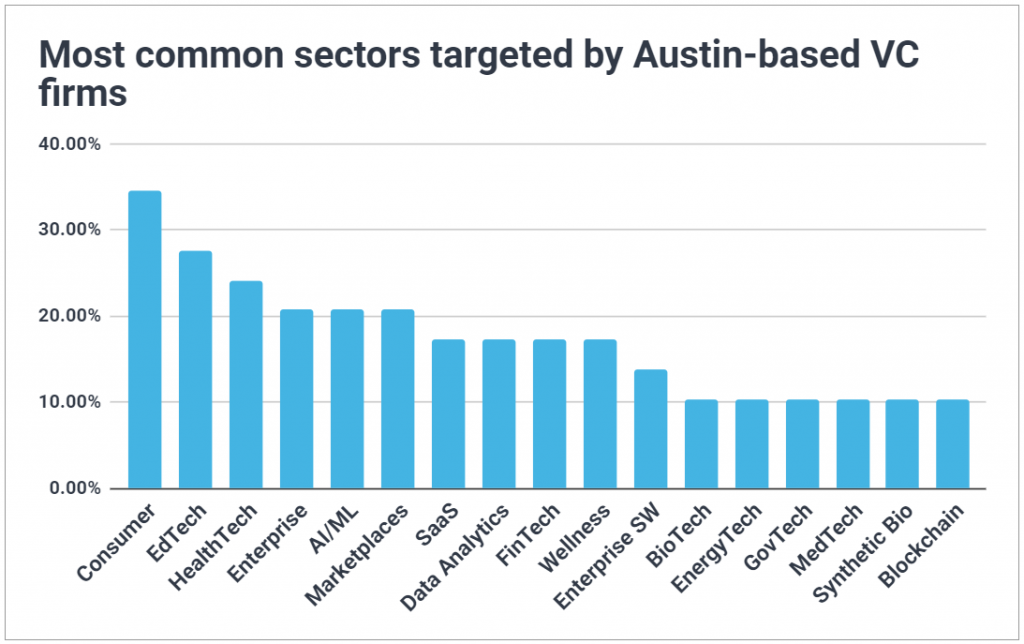

Sector Preferences for Austin VCs

The most common sectors targeted by Austin-based VC firms include Consumer (34%), EdTech (28%), HealthTech (24%), Enterprise (21%), and AI/ML (21%).

While none of these are necessarily unique to the ecosystem (they all also fall within the top 10 most common sectors for Silicon Valley VCs), a few notable sectors also surface for Austin’s VC market: namely, Wellness (17%), Synthetic Biology (10%), GovTech (10%), and Blockchain (10%).

The Future of “Silicon Hills”

Although we prefaced this post noting how worn the “Silicon Hills” narrative has become for Austin, based on the above market profile, is it reasonable to expect the narrative to actually be fulfilled?

Austin is certainly a long way off for now. But, given the market’s robust fund sizes, its preference for investing in its own ecosystem, and its tendency to mirror Silicon Valley’s investment cadence and preferred sectors, it’s not out of the question for “Silicon Hills” to eventually manifest.

There’s also another less data-driven factor in favor of Austin morphing into Silicon Valley: the growing presence of the PayPal mafia. Joe Lonsdale’s 8VC is now headquartered in the area, Elon Musk has moved a number of business operations there, and Luke Nosek’s Gigafund calls Austin home. If they continue this trend, the group could prove to have an out-weighted impact on the future of Austin’s startup and VC ecosystem (whether or not it’s to the benefit of the city).

And, beyond the more tangible evidence of a growing market, the power of narrative in itself could certainly prove enough to self-prophesize Silicon Hills. As Miami and its VC scene are now trying to imitate, the Bay Area has built a powerful global narrative that’s helped attract and retain both talent and capital for years. By continuing to promote and grow its own narrative, Austin just might gain the edge it needs to catapult itself to the forefront of the US startup and tech ecosystem.