After a year dominated by mega funds (capping off a long-term decline in first-time managers), will 2021 see the resurgance of debut VC funds?

Earlier this year, in a post outlining 7 evolving trends in VC, we highlighted the recent decline in debut funds: between 2017 and 2019, first-time managers, as both a proportion of funds entering the market and those closing capital, dropped in half. 2020 did nothing to slow the trend.

Pitchbook later confirmed that their data, too, saw a drastic decline in absolute numbers for first-time VC fundraising activity, with 2018 representing a major turning point that reversed a nearly decade-long trend of continuous growth.

Set against 2020’s backdrop of record-breaking levels of VC activity (across deal-making, exits, and every other measure), this was a troubling sign for the future of the emerging VC market. Particularly as mega funds began accounting for nearly all venture capital raised, it appeared 2020 may have set in motion an irreversible shift in the nature of the VC market: towards increased monopolization, increased uniformity, and increased pattern-matching.

But with H1 2021 now at an end, early data hints at an impending return of first-time managers.

In this post, we’ll take a look at the surge of debut funds beginning to enter the market, exploring who these managers are and the strategies they’re adopting.

Debut Funds Are Starting to Return — Albeit, Slowly

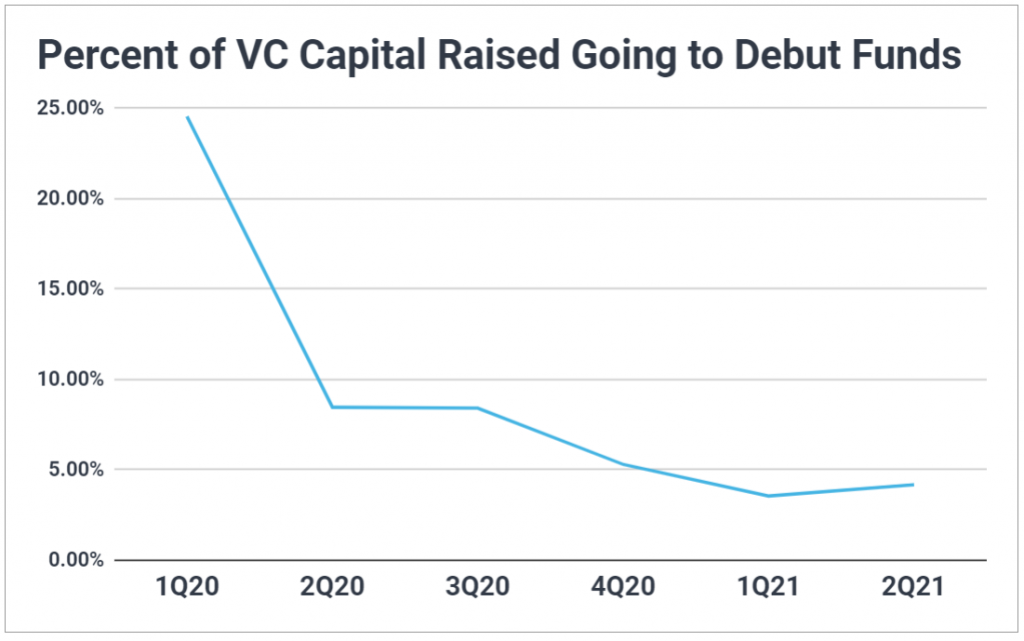

Following a year in which debut funds raised less than 15% of the total capital pool for US venture firms, 2021 threatened to continue a rapid crowding out of new managers by large established players.

But in a promising sign for the industry, there’s some signal debut funds are pushing back.

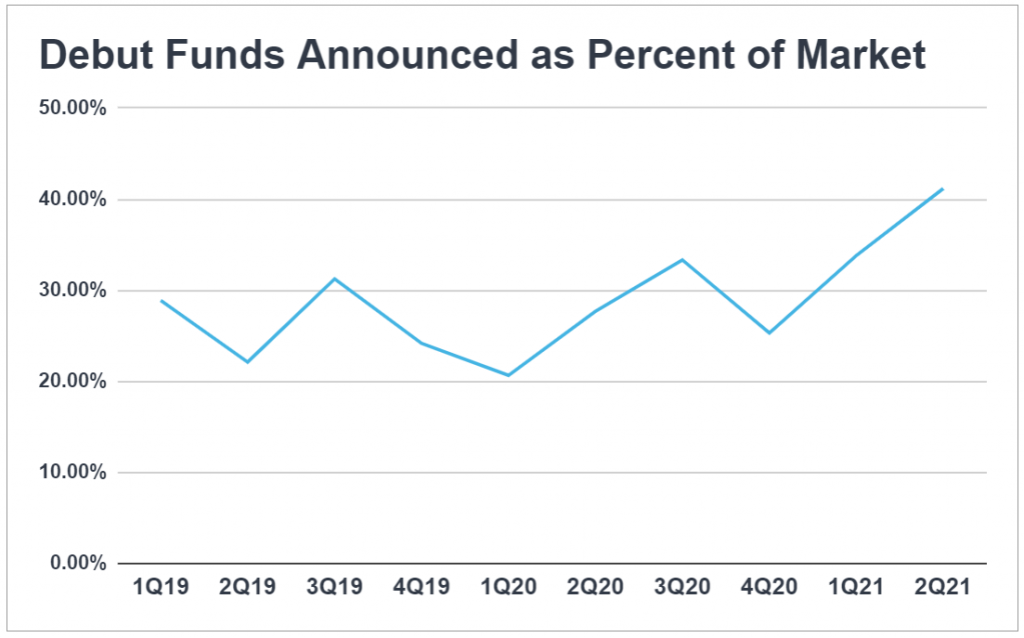

Through the first half of 2021, new fund announcements have been increasingly coming from first-time funds. Whereas each quarter of the last 2 years saw debut funds account for just 20% to 30% of fund announcements, Q2 2021 has witnessed debut funds climb to over 40%.

Now, to be clear, this doesn’t mean debut funds are actually gaining any significant ground (and in reality, the opposite is largely true). Although 2021’s debut funds are targeting a combined $4.3B (with the median fund targeting $50M and the average $108M), there’s a huge chasm between funds simply announcing they’re in the fundraising market, actively seeking LP investment, and then successfully closing any capital.

To illustrate this point, despite first-time managers accounting for their highest share of fundraising announcements in years, their share of US venture capital raised is at a staggering low. So far in 2021, less than 5% of capital closed went to debut funds, even less than the 15% figure for 2020.

And while it’s a hopeful sign that first-time funds are at least setting fundraising targets, it’s unlikely the return of debut funds will actually show up in final numbers for 2021.

With typical fundraising trails extending 12-18 months (or even longer for new managers), debut funds won’t regain a significant share of US venture capital until at least early 2022, when they begin holding final closes on the raises begun this year. Plus, that assumes they even reach a final close — not all funds that announce a raise successfully close any capital, and many funds that do still fall short of initial targets.

Typical Strategies of 2021’s First-Time Managers

For debut funds entering the market in 2021, what are the preferred strategies?

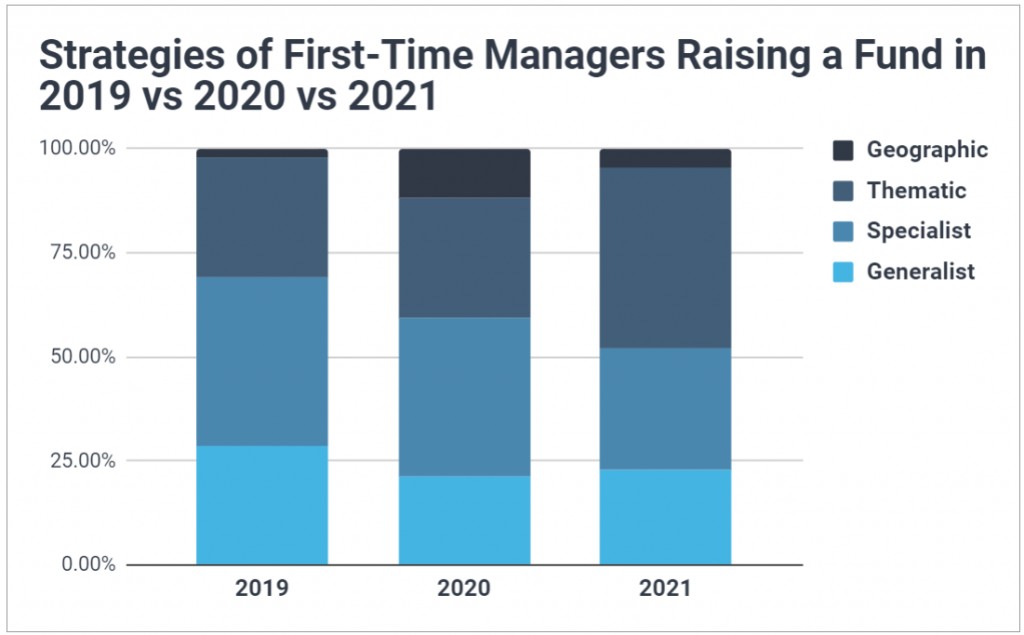

At a broad level, we’re seeing a heavy focus on thematic approaches, with a shift away from specialist strategies. Among 2021 debut funds, 43% are leveraging a thematic thesis, 30% a specialist thesis, 23% a generalist thesis, and 5% a geographic thesis. (Click here for definitions of thesis styles.)

It’s interesting to note the steady rate of generalists over the last 3 years, considering such an approach places debut funds in direct competition with most mega funds for deal flow.

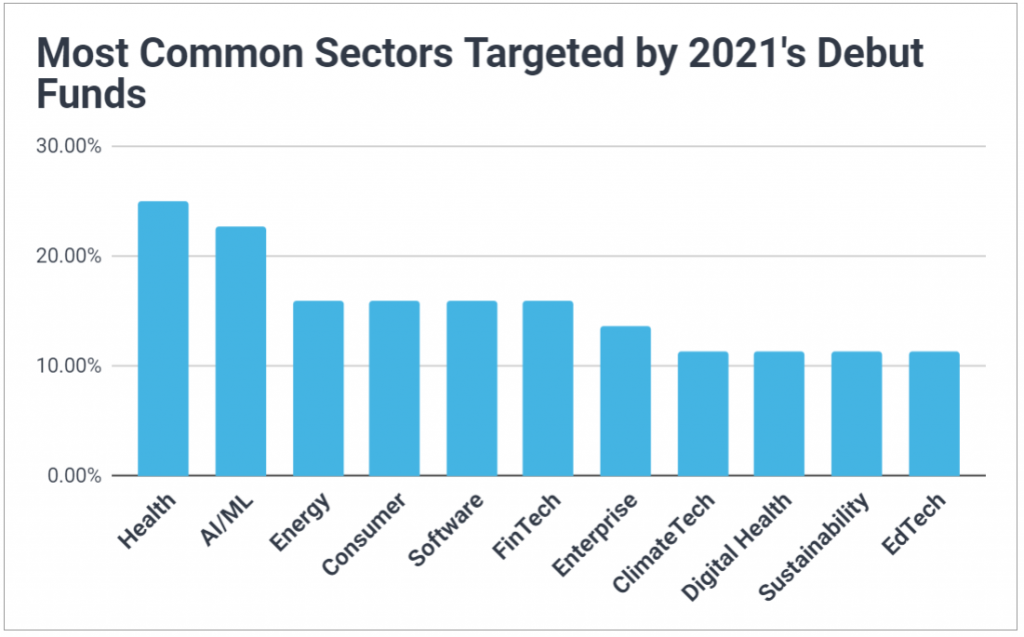

Drilling down to a more specific analysis of thesis strategies, the following chart lays out the 10 most common sectors targeted by 2021’s debut funds (in total, we’ve identified 95 unique sector focuses for the 2021 cohort of first-time managers).

Although a number of these overlap with the most common sectors for established firms (namely, Health, AI/ML, Consumer, Software, FinTech, and Enterprise), debut funds are showing a propensity for several sectors largely ignored by the name-brand VCs.

In particular, debut funds are much more likely to target environment-related sectors: 16% are setting out with a focus on Energy (compared to 4% of non-debut funds raising in 2021), 11% with a focus on ClimateTech (vs 1% of non-debut funds), 11% with a focus on sustainability (vs 3% of non-debut funds), and 5% with a focus on the circular economy (vs <1% of non-debut funds).

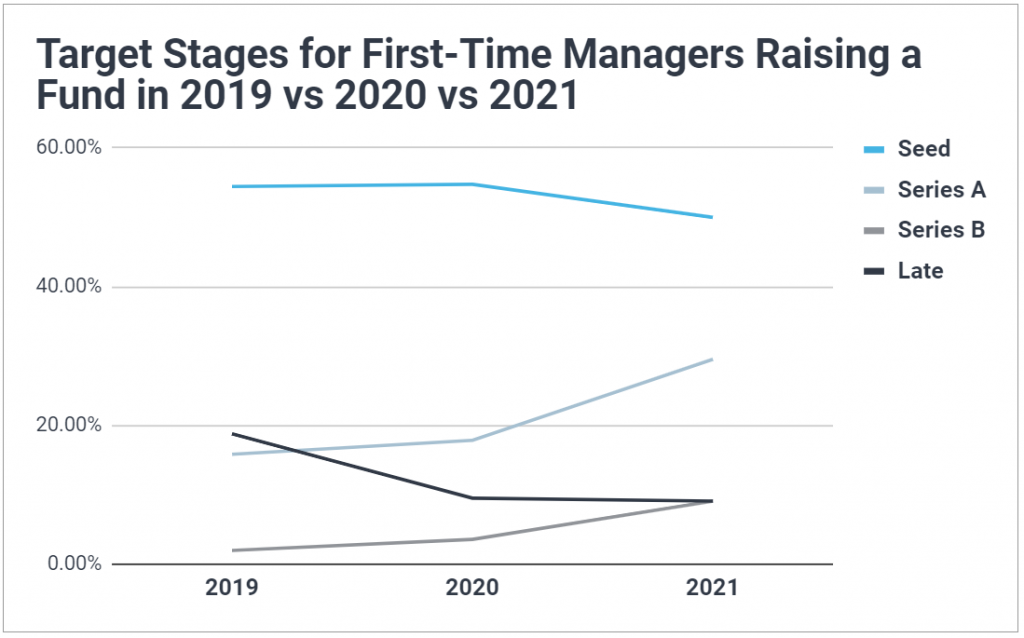

In another interesting trend, our data suggest debut funds are actually shifting towards making initial checks at later stages.

Whereas about 16% of debut funds in 2019 and 2020 set out explicitly targeting startups at the Series A stage, that figure has risen to 30% in 2021. And, the proportion stating they seek startups at the Series B stage rose from 2-3% to 9%.

Given the proportion targeting the seed/pre-seed stage has remained rather constant (at ~50%), it’s reasonable to conclude debut funds are starting to expand the range of investment stages they’ll consider (at least in public-facing marketing materials). VC funds can, and frequently do, target multiple stages — consequently, the increasing frequency of debut funds with a stated openness to writing first checks in Series A/B rounds likely reflects new VCs adding this later-stage focus while maintaining a core pre-seed/seed focus.

This may be an attempt to appeal to LPs who are watching established VCs diversify across stages (and are expecting their emerging managers to do the same, despite having fewer resources).

Can Debut VCs Compete in the New Deal-Making Environment?

Although early signs of a resurgence of first-time managers is promising, the recent shift in the nature of the deal-making environment presents the question of whether debut funds can still compete.

With Tiger Global the most prominent example, deep-pocketed non-traditional investors are accelerating their venture investment pace at break-neck speed. These multi-billion dollar funds, which dwarf the typical $50M first-time manager, historically restricted their VC investments to late stages and growth equity — but now, they’re moving up the deal pipeline, encroaching on the early stage space normally occupied by smaller firms. In fact, PE firms led nearly a quarter of all Series A/B rounds in Q1 2021.

For the class of debut funds taking a generalist approach and increasingly seeking to make initial investments at the Series A/B round, there’s reason to wonder if a shift in strategy will be necessary to produce outperformance: as massive players continue ruthlessly pushing up startup valuations, it’s becoming tough for a sub-$100M to participate in highly sought-after, over-priced rounds. (As an extreme example, recall Transmit Security’s $543M Series A round, with a $2.2B pre-money valuation).

But for those taking differentiated strategies in overlooked markets and sectors, the “threat” of non-traditional investors may actually prove an incredible boon — if the aggressive firms begin watching the seed-focused, niche debut funds for signal, their entrance into a portfolio company’s round can present an opportunity for handsome exits. And, if founders become disillusioned with the hands-off approach made popular by Tiger, small value-add funds may increasingly be the investor of choice for top startups.