With one of the most tumultuous years in the books, what impact did 2020 have on some of the biggest trends in venture capital — and what are the implications for the future of venture?

As we entered 2021, we marked the close of arguably one of the most tumultuous years in a century. The profound changes spurred by the volatility of last year were felt across industries, and venture capital was certainly no exception.

While some media point to a so-called “record fundraising year” in 2020, what few mention is the record resulted from an ambiguity-aversion-driven flight to mega funds, at the expense of smaller, early stage firms. And although 2020 punctuated a number of sharp changes to the venture industry, such changes have been gradually manifesting their effects for years. More funds of a certain type — or fewer funds of another — will have significant consequences. But we’ll only be able to measure the consequences over many years.

Recognizing the profound year we just concluded, in this article we’re highlighting seven major trends that are morphing the VC landscape, looking at how those trends escalated in 2020, and discussing implications for the future of venture.

1. Increasing Dominance of Large & Mega Funds in VC Fundraising

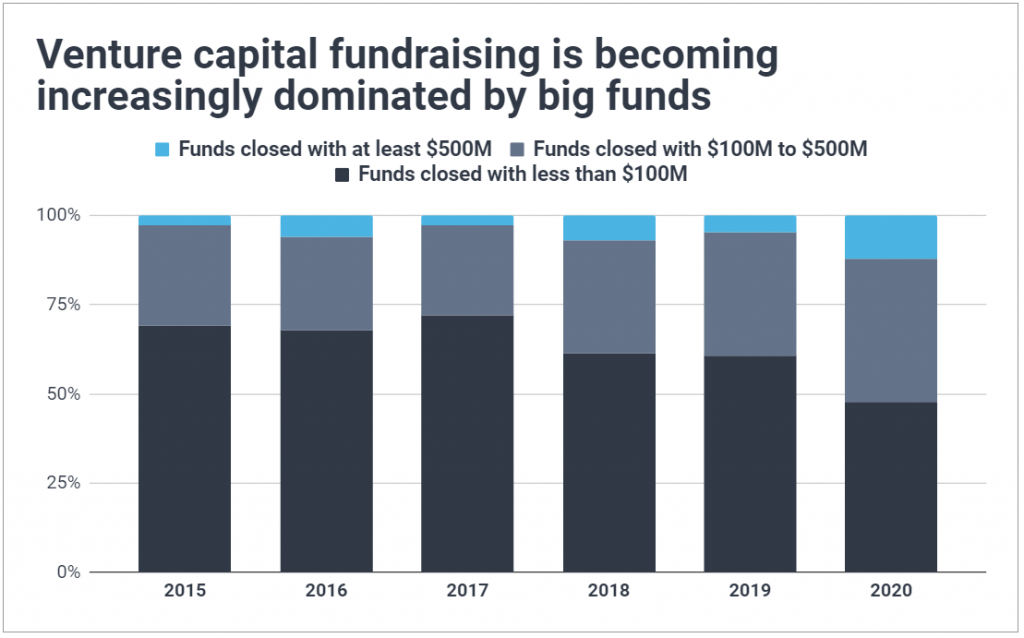

Historically the typical VC fund raised less than $100M, with a fund size any bigger being reserved for the largest quartile of venture. However, recent years have seen a decline in the proportion of VC funds raised in the sub-$100M category, with a relative surge in large and mega funds ($500M+).

2020 accelerated this trend, with last year being the first time on record that more funds were raised in excess of $100M than were raised below $100M. Mega funds had a particularly accelerated year, accounting for more than 12% of the funds raised and sweeping up nearly 70% of all dollars raised by venture capital firms in 2020.

Looking forward, this growing concentration of capital in large funds could have wide-ranging implications across the venture ecosystem:

- The U.S. will experience lower rates of real innovation — large funds tend to eschew DeepTech as too risky; as capital controlled by DeepTech-interested VCs diminishes, so too will the innovative startups these VCs back. What’s more, the economics of large funds prevent them from writing checks to early stage startups, when deal sizes are miniscule relative to a $500M fund; fewer small VCs consequently leads to fewer companies and fewer innovations getting off the ground to begin with.

- LPs will find less dispersion in venture returns — as large VCs have creeped closer in size to PE funds, so too have their return profiles; smaller funds, meanwhile, have historically driven the extremes of VC returns. Fewer small funds thus means fewer funds at the bottom but also at the top of venture performance.

- Founders outside traditional deal flow pipelines may find it more difficult to raise capital — fewer small funds means fewer non-stereotypical VCs (sector specialists, women- and BIPOC-led firms, regional funds, etc.) that look to capture alpha in what large and mega funds deem “niche” markets.

2. Decline of Debut Funds

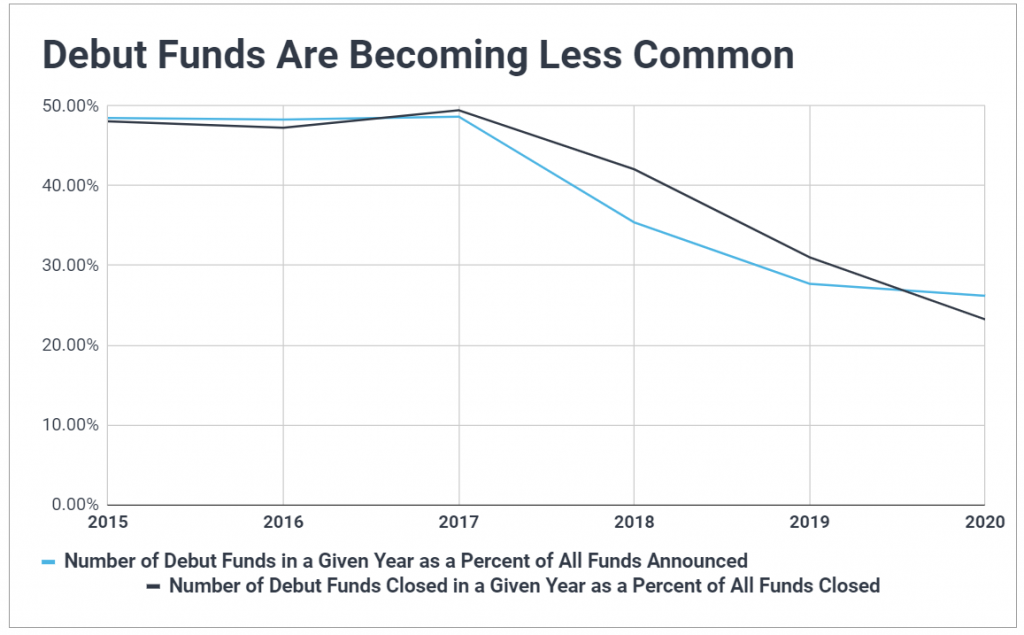

We often remind people that most venture capital firms are emerging managers (Fund I-IIIs). And for the last decade that was absolutely true. But as debut funds account for a smaller and smaller percentage of VC firms that are fundraising in a given year, that reality is changing.

While debut funds made up roughly half of all target funds announced in 2015-2017, they’ve shrunk to just a quarter of new raises in recent years. Similarly, debut funds have fallen from accounting for half of VC funds closed each year in 2015-2017 to just over a fifth in 2020. Extrapolating forward, this implies the emerging manager ecosystem could be a significantly smaller piece of VC in the coming years than it is today.

If debut funds continue to decline, we will see venture capital quickly monopolize as a handful of funds come to dominate the industry — signs of which we’re already seeing today. While fewer emerging managers may make it easier for LPs to prioritize a track-record-driven pattern match to their selection process, it’s worth remembering that smaller funds and first-time funds tend to outperform.

3. The Rise of Impact and ESG

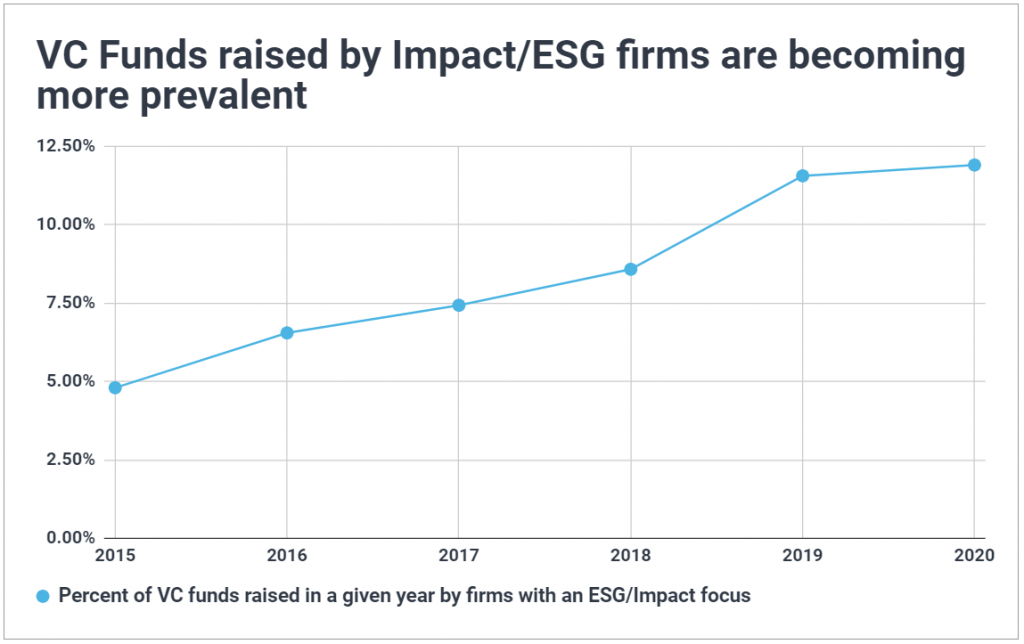

Impact and ESG-focused VCs have been a niche segment of venture for most of the decade (especially following the CleanTech burn of the mid-2000s). But they’ve recently been gaining traction, growing from just 5% of VC funds raised in 2015 to nearly 12% in 2019.

Although 2020 stalled this trend, it didn’t manage to reverse any progress. Given the continued stress placed on environmental and social consciousness by younger populations, along with the deep commitment the Biden Administration has made to climate policy and action, we expect ESG and impact lenses to continue to rise in the coming years.

Read more about this trend in our recent post exploring the rise of ESG in US venture capital.

4. Established VCs are Compressing Fundraising Cycles

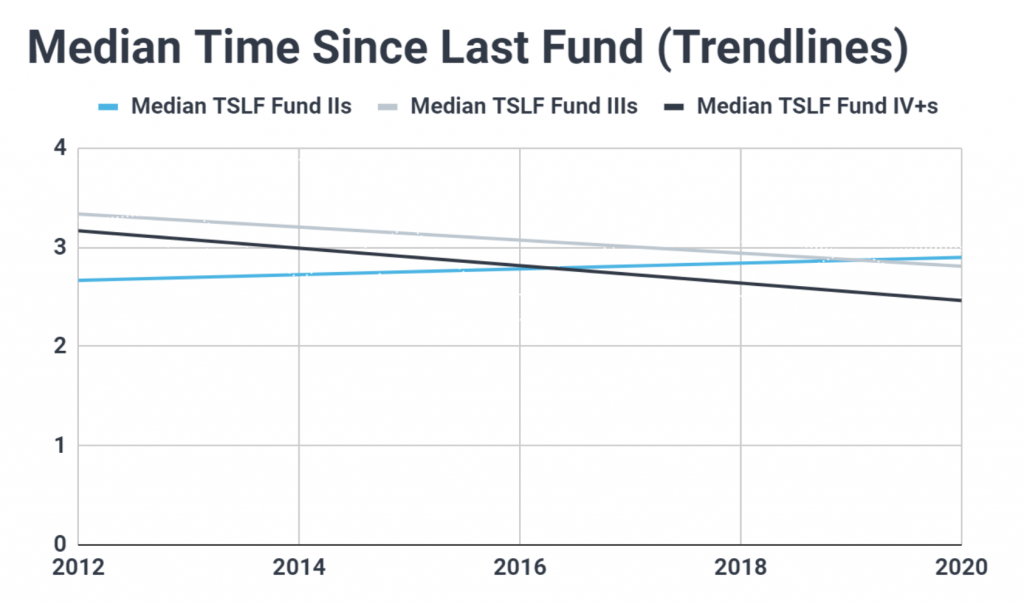

Although it’s taking longer for a 1st-time fund (Fund I) to go back to the fundraising trail for Fund II, established VCs have been compressing their fundraising cycles for the last few years. At the beginning of the decade, the median Fund IV+ went back to the fundraising trail just over every 3 years; today that number has shrunk to about every 2.5 years.

The drivers of a more frequent fundraise environment have yet to be seen. In some cases, the cycle compression is due to VCs missing their target raises but maintaining their deployment strategy (meaning they have less cash to invest, so end up raising again more quickly). In other cases, it’s due to funds investing in more deals and accelerating deployment. In yet other cases, it’s simply a consequence of more VCs acting as “asset gatherers” — finding less interest in the carry and returns that flow to LPs and greater intrigue in the multiple streams of cash flow that the management fees on multiple funds provide.

Either way — for LPs, it means your existing managers are likely to come back for more capital earlier, with fewer performance metrics, requiring you to decide whether to maintain or increase your allocations with fewer years of data.

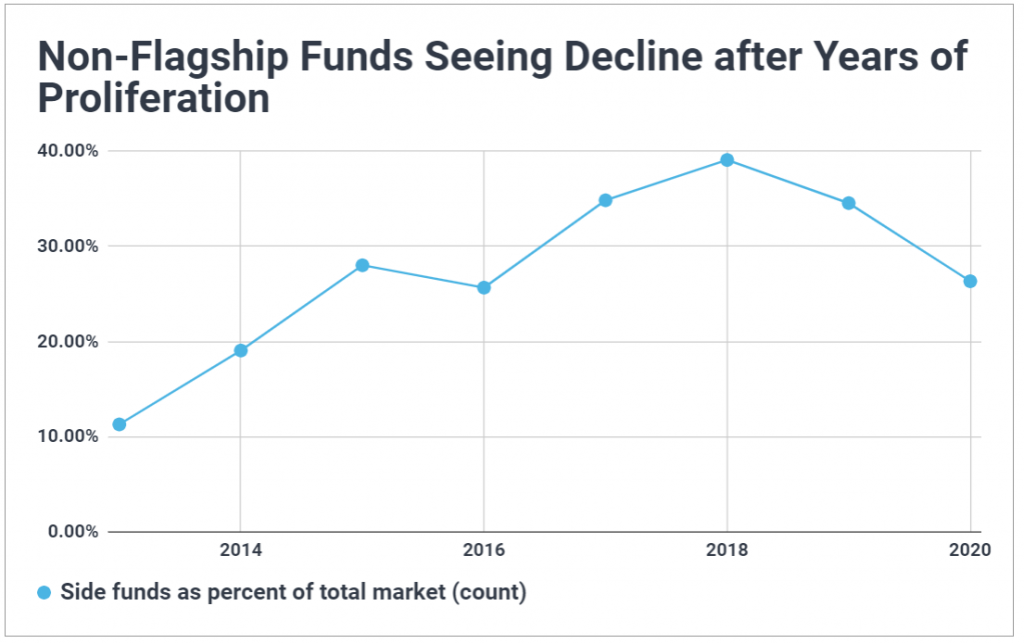

5. The Rise and Fall of Non-Flagship Funds

Through 2018, non-flagship funds (alternative structures like SPVs, opportunity funds, and syndicates) had been steadily growing as a percent of the venture capital fundraising market, nearly quadrupling their share of the count of funds raised within 5 years.

However, with 2020 data accelerating the trend set by 2019, it appears their moment of popularity may have peaked. Non-flagship funds made up just a quarter of VC vehicles raised in 2020, down from 2018’s 40% high and suggesting the 2019 decline wasn’t simply a momentary blip.

Going forward, will more VCs continue to leverage SPV, opportunity, and co-investment vehicles as low-fee alternatives for LPs, or will LPs’ appetite prove to be insufficient to sustain further growth?

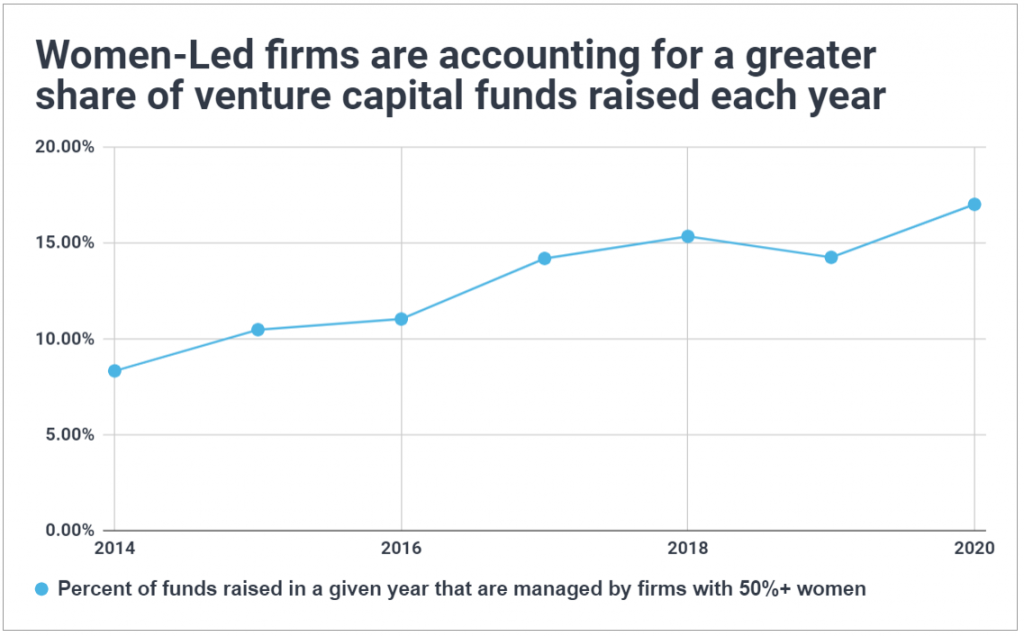

6. The Rise of Women in Venture Capital

Venture capital is notorious for its lack of diversity. And while there is certainly a dearth of both gender and racial diversity among firms, in a positive sign for the industry women-led funds are on the rise.

Whereas less than 10% of VC funds raised in 2014 were managed by firms where at least half the GPs are women, 2020 saw that figure rise to a new high of 17%. That this trend persisted in 2020 despite the overall flee to known, established managers bodes well for the growing acknowledgement of the need to bring more women to the investment decision-making table. There is ample evidence that diverse and women-led teams outperform in other industries — it seems that LPs are finally recognizing the power of diverse thought in venture as well.

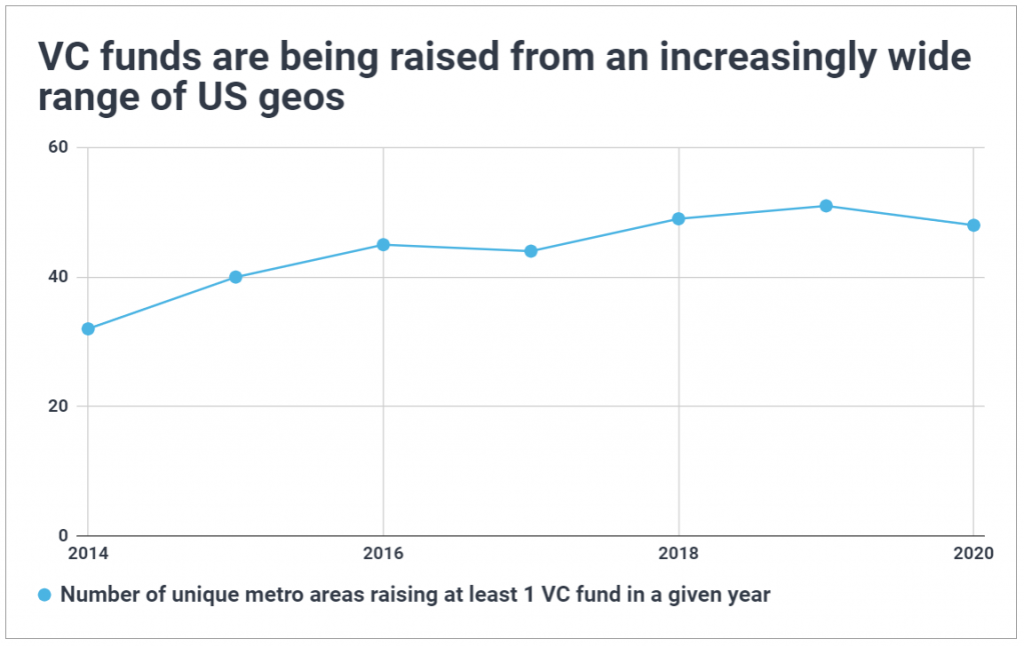

7. The Increasing Geographic Spread of VC

While venture capital is often synonymous with Silicon Valley, the reality of the industry spreads across the country in hundreds of geographic regions. And recent years have seen growth in the number of unique geographic areas raising at least 1 VC fund: whereas just over 30 metro areas were represented by VC funds raised in 2014, by 2019 there were more than 50 metro areas laying claim to at least one new VC fund. This nearly two-fold increase within half a fund lifecycle is a promising sign of capital decentralization for an industry infamous for its geographic centrality.

Though 2020 appears to have stalled, if not reversed, this trend, the longer-term implications of a widening geographic spread of venture capital dollars will likely benefit the early VC entrants to emerging innovation hubs. Firms that establish a strong physical presence, network, and local leadership early on in a nascent innovation hub’s life may experience deal flow advantages later as that region attracts more capital and retains more local founder talent. Given the flight of talent from the Bay that’s already been spurred by a new remote-work environment, will the growth of available venture capital spawn an even greater exodus?

2020 changed the world, venture included. While some of the trends we witnessed last year and over the past decade are promising for continued innovation, industry growth, and LP returns, others are worrisome.

The diversification of geography in venture, the expanding role of women in venture, and the growing prevalence of ESG and impact-oriented VC firms means access to capital is improving and will increasingly flow to startups addressing real societal needs (as opposed to 1st-world-fluff like valets-on-demand, $900 juicers, and unbranded packaged goods).

But the increased role of mega funds, and the decline in debut funds, could counteract much of this progress. Above all — these trends may be the prelude to a decline in pre-seed and seed-stage capital, especially for DeepTech startups, leading to less promising (and less innovative) deal flow for large established VCs to fuel. That could lead not only to stagnating rates of entrepreneurship and innovation in the US, but to an ever more competitive environment among the mega-VCs for fewer growth rounds (and perhaps, ever more mediocre returns).

As these two sets of opposing trends evolve, the ultimate outcome for both innovation and venture returns will fall to a simple question: will small, diverse, early stage managers thrive or be squashed by large, bureaucratic incumbents? That answer has yet to be determined. But what’s certain is that a conscious effort (or unconscious inertia) by the LPs allocating venture capital, as well as the VCs crafting theses and partnerships, will have an all-too-consequential say in the final decision.