How much venture capital does the typical GP manage in the U.S. and how does the industry standard vary by team size, fund number, and fund size?

At Different, we’re constantly looking to optimize how we assess and view venture capital firms. Whether by scoring VC portfolios for science-washing, quantifying their media mindshare, or exploring the implications of having a geographically distributed team, we believe unique data paired with unique analysis ultimately yields differentiated investment decisions.

And with the amount of talk that’s been given to the overwhelming dominance of mega funds this year, we thought we’d bring a fresh lens to assessing fund size in venture capital by looking at capital per partner across the funds of more than 1,500 U.S. firms we track.

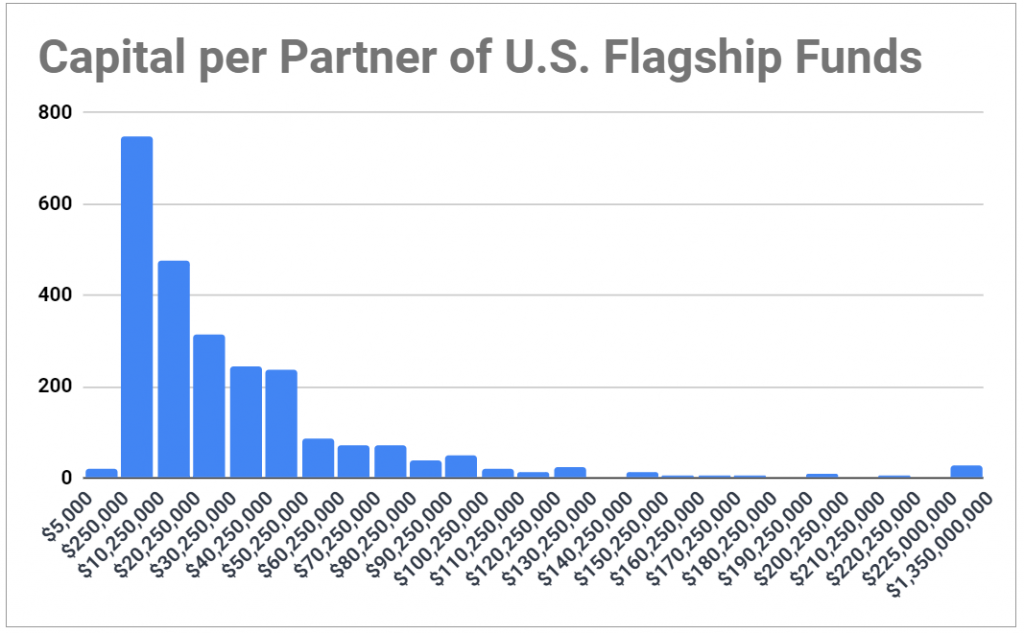

Average Capital per Partner

We found that the average capital per partner raised by U.S. flagship funds is $35.6M, with the median sitting a bit lower at $20.5M. However, this masks quite a bit of variation, with some funds being raised with just a few thousand dollars per partner, all the way up to the $1.35B debut fund managed by the single GP at NEA-spinout NewView Capital. Despite this long tail, the majority of venture funds are raised with $8M to $45M per partner.

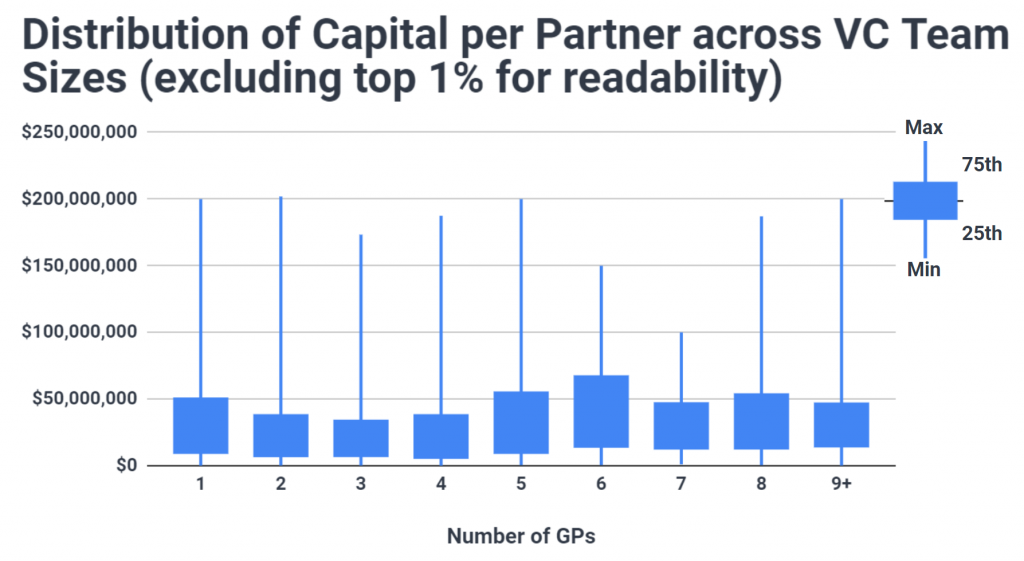

Capital per Partner Across Team Size

VC firms with more GPs tend to manage larger funds. But does capital per partner remain fairly constant even among larger funds, suggesting fund size increases in a predictable proportion to the number of investment decision-making partners?

The following chart shows that yes, the distribution of capital per partner is mostly consistent as team size grows. While there is of course some variation between team sizes (notably, that teams with 2-4 GPs tend to have slightly less capital per partner), the middle 50% of funds for all team sizes fits more or less into the $10M to $50M range.

In some ways, this capital per partner consistency brings a bit of logic to the massive sums managed by some firms: if the capital managed per partner is on-par with that of more modestly sized funds then such a sum may be seen as more reasonable.

On the other hand, this lens makes those funds that continue to be outliers look even more inflated compared to industry standards. Venture capital is a labor intensive asset class, requiring significant time to diligence, monitor, and add value. While certain strategies and stages (early vs late) lend themselves more easily to allocating large sums, it’s worth considering whether exceptionally high capital per partner might exceed GP bandwidth.

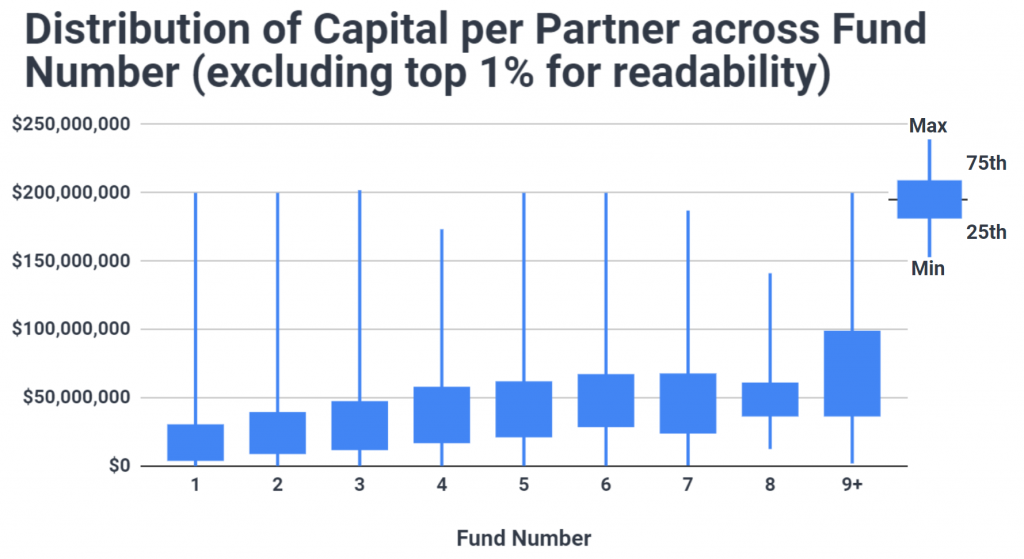

Capital per Partner Across Fund Numbers

Although capital per partner is fairly consistent across team size, by comparison we see a very clear trend in capital per partner as firms raise progressively more funds.

While the average capital per partner of a Fund I is $26.7M, that figure rises steadily to $78.6M for firms that have raised at least 9 flagship funds. Whether their experience is an accurate qualification for managing progressively more capital is debatable (emerging funds consistently rank as some of the best performers); but clearly LPs become more comfortable with each GP managing an increasing sum as they log more funds under their belts.

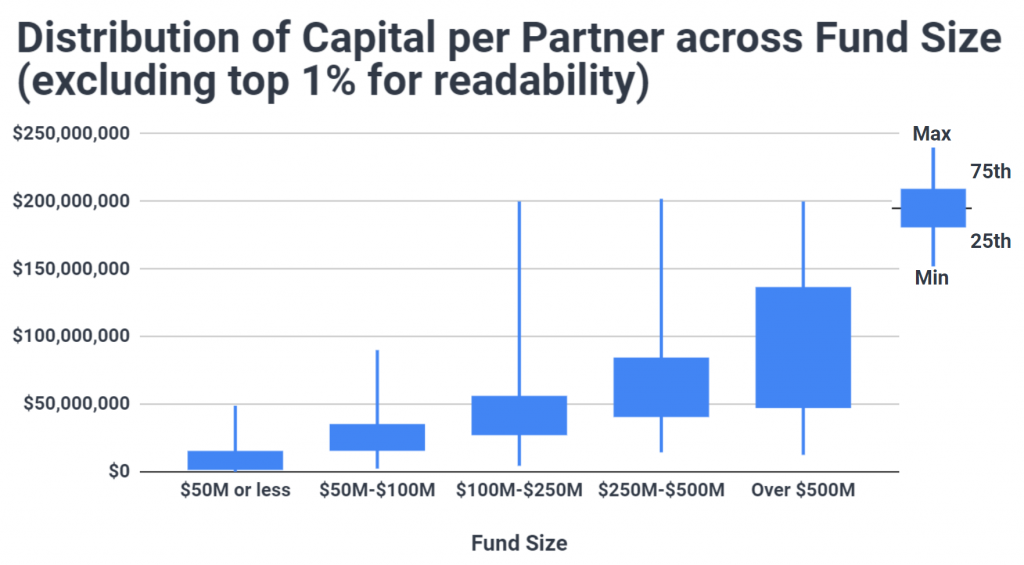

Capital per Partner Across Fund Size

Even more pronounced, we see a sharp increase in capital per partner as fund size increases.

Whereas the average capital per partner is just $9.7M for funds with $50M or less, it swells to $130M for mega funds (those raising more than $500M). This is hardly surprising since larger VC firms generally invest in larger, later stage deals — deals that require more capital, and potentially more capital per partner.

That said, there’s no guarantee that a mega VC or PE firm is actually investing at later stages, isn’t dabbling across multiple venture stages, nor that it will generate returns. And it’s worth considering that some firms with exceptionally large funds might just be exceptionally good at fundraising and not necessarily fund deploying. The GPs of such firms thus persuade LPs they can effectively manage more capital than the average VC — whether or not the execution follows. Given the historical outperformance of smaller funds, LPs may want to think carefully about capital per partner ratios.

Considering Capital per Partner as a Diligence Tool

There’s certainly no hard-and-fast rule for what qualifies as an ‘appropriate’ level of capital per partner. Depending on their experience, expertise, and investment strategy (e.g. diversification vs conviction, early stage vs late growth, capital light vs capital heavy sectors), some GPs are able to effectively deploy more assets than the average VC.

And of course, “capital per partner” is an overly simplistic view of the capital allocation dynamics within VC teams. Particularly for large teams, control over capital isn’t spread evenly across each GP, with certain partners inevitably making more (or larger) investments or having greater sway on the investment committee. Nor is capital mutually exclusive between partners, with many (especially smaller) teams genuinely making joint decisions.

But just as deals per partner is a common lens used to assess cognitive load and partner ‘bandwidth’, capital per partner could prove an interesting screen for sourcing and selecting funds.

It’s always worth knowing how a firm compares to the market and its comparables — capital per partner is just another metric for comparison. And while it likely shouldn’t be used as a primary screen, it’s important to ask whether a fund’s capital per partner makes sense for the target stage, strategy, and sectors.

Capital per partner may have limited importance in your process, or you may think it warrants some weight. We’re happy to discuss this with you further if so.