Are VC firms fundraising more frequently than they used to? With the flood of big venture brands announcing the close of new funds this year, it certainly feels that way.

From Lightspeed and NEA to a16z, Insight, Greycroft, and Khosla — it’s difficult to think of a major VC firm that didn’t announce or close a few hundred million (if not billion) in the middle of the pandemic. And wait, didn’t Kleiner Perkins just close $600M last year? Has Lee Fixel’s new VC firm Addition already deployed its $1.3B first-time fund it closed this past June? (Yes… Addition just announced in October that they’re raising a $1.4B Fund II.)

This barrage of name-brand VC fundraises certainly conveys an increased fundraising cadence, but what does the data say? How have VC firms’ fundraising cycles changed, if at all, and who’s driving that change?

On average, VCs are fundraising more frequently — but the median firm is holding steady

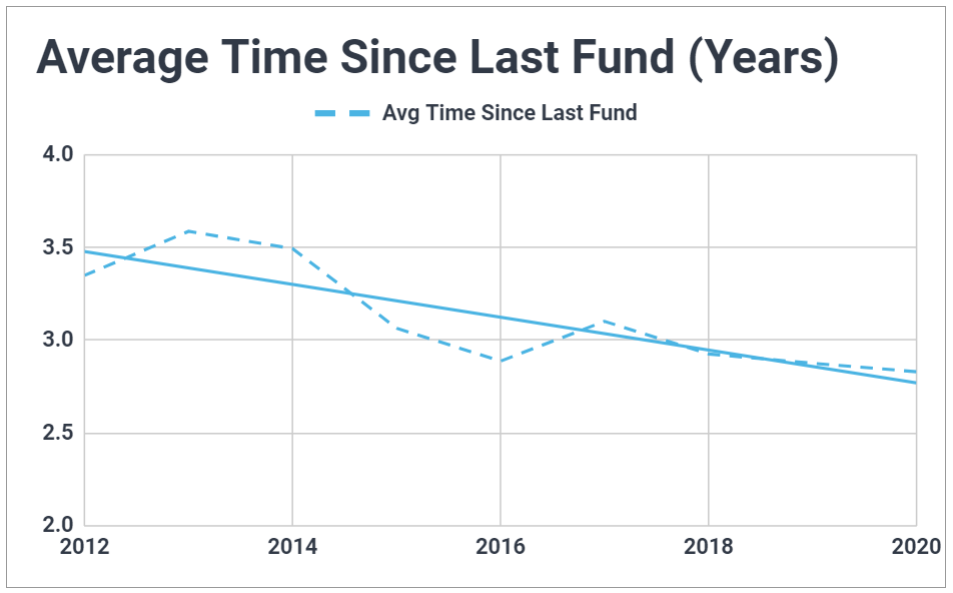

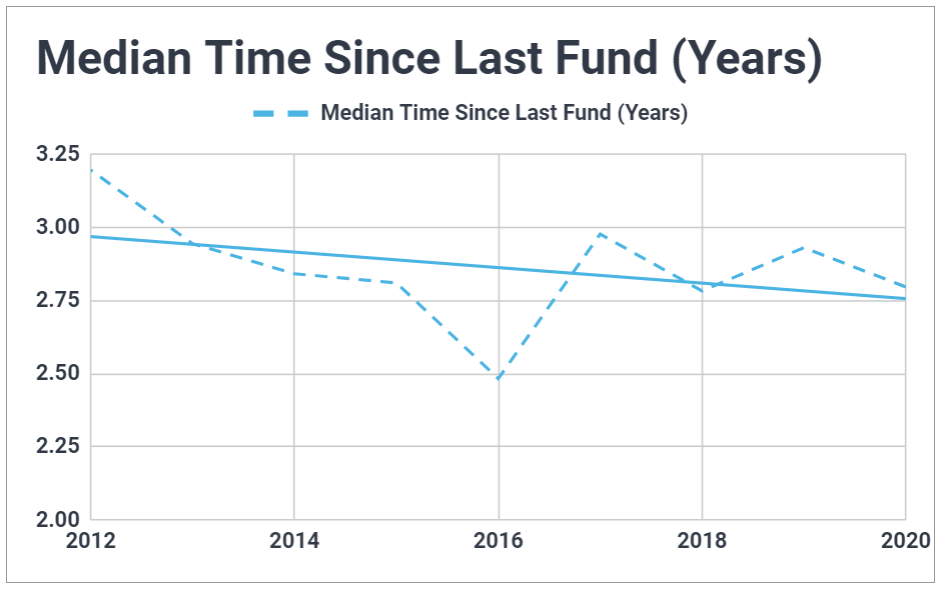

Based on our data tracking thousands of funds raised by more than 1,500 venture firms, the average fundraising cycle has compressed by about 6-9 months between 2012 and 2020. While funds raised in 2020 have, on average, come about 2.8 years after their predecessor, that figure was closer to 3.5 years at the beginning of the decade.

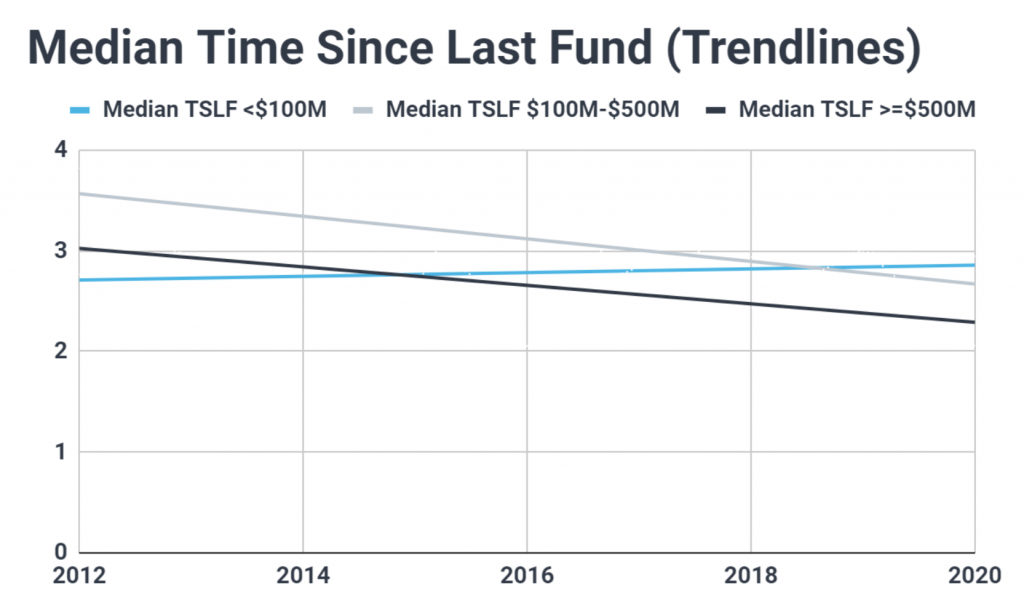

However, despite the average having compressed a rather significant amount, the median firm has stayed on roughly the same fundraising cycle throughout the decade, raising a new flagship fund every 2.75 – 3 years.

One important note is we’re looking specifically at the time between flagship funds — that is, how many years pass between when a firm announces, say, a Fund II and a Fund III, ignoring any opportunity funds, SPVs, syndicates, or other (smaller) funds not being used as a primary investment vehicle. Some sources have looked at time-between-funds without narrowing in on firms’ primary flagship raises. This skews conclusions towards compression: non-flagship vehicles are often scattered between flagship raises, so as these non-flagship funds have become more common, time-between-any-fund has more significantly contracted.

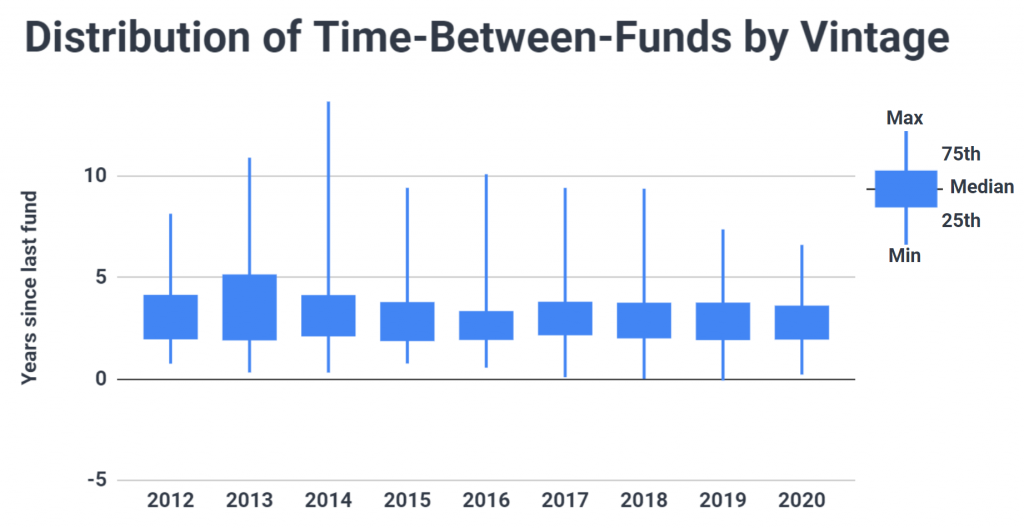

So what’s accounting for the decline in the average fundraising cycle while the median holds steady? Our data suggests that rather than the “typical” fundraising cycle trending shorter, what’s actually going on is a shift in the extremes of cycles. Extremely lengthy fundraising cycles are becoming less common while extremely short fundraising cycles are emerging.

The below chart plots the minimum, 25th percentile, 75th percentile, and maximum time-between-funds each year since 2012. This view shows a clear reduction in the maximum fundraising cycle length and a shrinking in the minimum fundraising cycle. Meanwhile, the bulk of fundraising cycles (the middle 50%) are showing slight compression, though are largely staying within a very similar range.

How do fundraising cycles differ in different corners of venture?

Of course, such a high-level view ignores the complexity of fundraising dynamics for different segments of the venture ecosystem. Have the fundraising cycles of larger firms shifted more than that of smaller firms? Have more established VCs started contracting their cycles while emerging managers have expanded theirs?

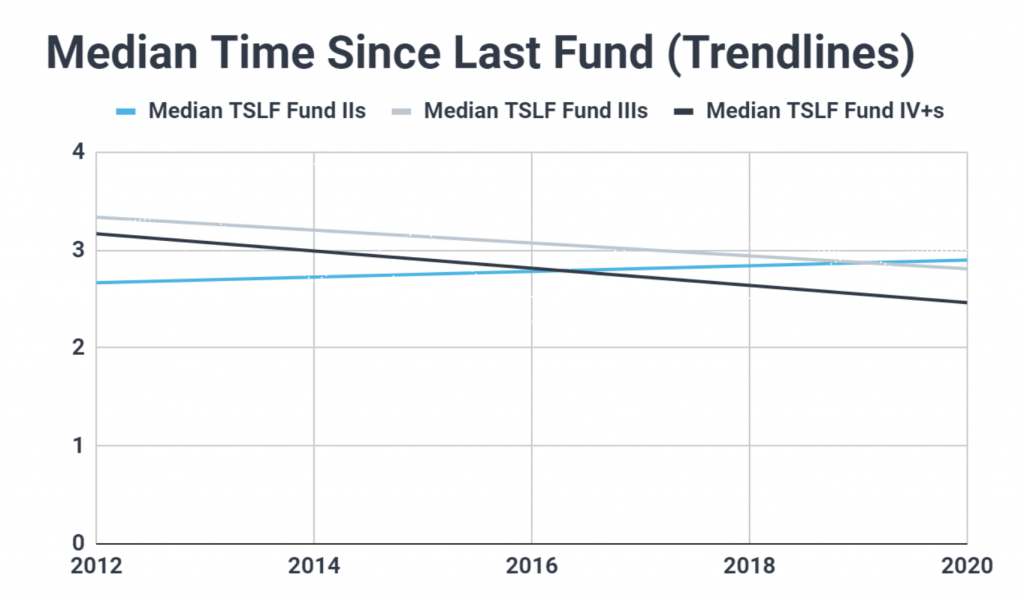

We found that while the median fundraising cycle length across venture capital has been roughly constant throughout the decade, the cadence of Fund IIIs and Fund IV+s has trended more significantly downwards (more frequent fundraises). Simultaneously, Fund IIs have been trending towards longer median time-between-funds.

This could help explain why it anecdotally feels like fundraising cycles are compressing: for the more established VCs that dominate media attention, fundraising cycles really are compressing. Yet at the same time, the emerging managers that represent the overwhelming majority of the VC world are taking longer to reach their second fund (whether that’s an active decision or a reflection of an increasing hesitancy by LPs to back new managers is up for debate).

Similarly, we see a clear downward trend in the median time between funds for firms raising large and mega funds, while sub-$100M funds are trending towards expanded fundraising cycles. Put simply — large established VCs are raising funds more frequently, while emerging VCs are taking more time between funds.

This dichotomy furthers the narrative of large, established VCs (the minority of venture capital firms) experiencing increased ease on the fundraising trail (raising more frequent vehicles with more massive sums of capital), while small, emerging managers (the bulk of VC) continue to struggle. Based on our findings from the first months of lockdown, the pandemic is even accelerating this trend.

Two different VC realities

Ultimately, there’s no single trend dominating fundraising cycles in venture capital. At the aggregate level, most VCs are staying within a fairly consistent range (2 to 3.5 years between flagship funds). It’s becoming less common for a firm to have an extremely long cadence between funds, with a few notable firms having extremely short cycles.

However, these aggregate numbers mask two very different fundraising cycle realities for two different segments of VC. Large, established firms are showing clear cycle compression while emerging managers are showing cycle expansion.

The discrepancy between established and emerging managers in fundraising cycles is only a piece of a broader narrative suggesting that what it means to be a “venture capitalist” is vastly different depending on whether you’re an established or emerging VC.

And the classic conception of VC (the one that’s rich, white, and male in Silicon Valley, swimming in cash and doling out millions to software startups) really only holds for one side of that line. In contrast, the emerging manager ecosystem is incredibly vast, diverse, and specialized. It consists of hundreds of modestly sized funds with differentiated theses in geographies across the country, managed by women, BIPOC, and GPs of a myriad of backgrounds. They consistently rank as some of the best performers. And yet, many indications suggest they’re struggling more and more to gain investment from LPs.