A data-driven profile of VCs headquartered in Atlanta, from fund sizes and investment cadences to target sectors and stages.

Atlanta has gained a lot of attention this year for promising signs of growth in its startup and venture capital ecosystems.

Amid record-breaking levels of activity across the US, the Atlanta market, too, experienced a surge in startup funding. It led the way as Georgia startups raised almost $2B in the first half of the year (surpassing their total for all of last year). Atlanta-based VCs also led their state to near-records in venture capital raised, counteracting the common critique that Atlanta lacks a local VC ecosystem.

And critically, the ‘28th best city in the world‘ for startups is witnessing growth not just in small seed-stage funding rounds, but in the exponentially-powerful presence of unicorns. As companies like Calendly, SalesLoft, OneTrust, and Flock Safety all pass the much-talked about $1B mark, they convince more and more unicorn-hunting name-brand VCs to bring their Sisyphusian-style search to the Atlanta market (as Insight Partners already has).

But with the headline unicorns still being funded largely by VCs outside the region (e.g. Calendly led by Boston-based OpenView, SalesLoft led by NY-based Owl Rock, and Flock Safety led by Silicon Valley-based a16z), it seems Atlanta-based VCs have yet to experience the tailwinds of their city’s growth (though there are certainly exceptions).

With all this as context, we’re continuing our market profile series by taking a data-driven deep dive into the Atlanta venture capital ecosystem.

Robust Fund Counts for an Emerging Market, But Dominated by Micro-VCs

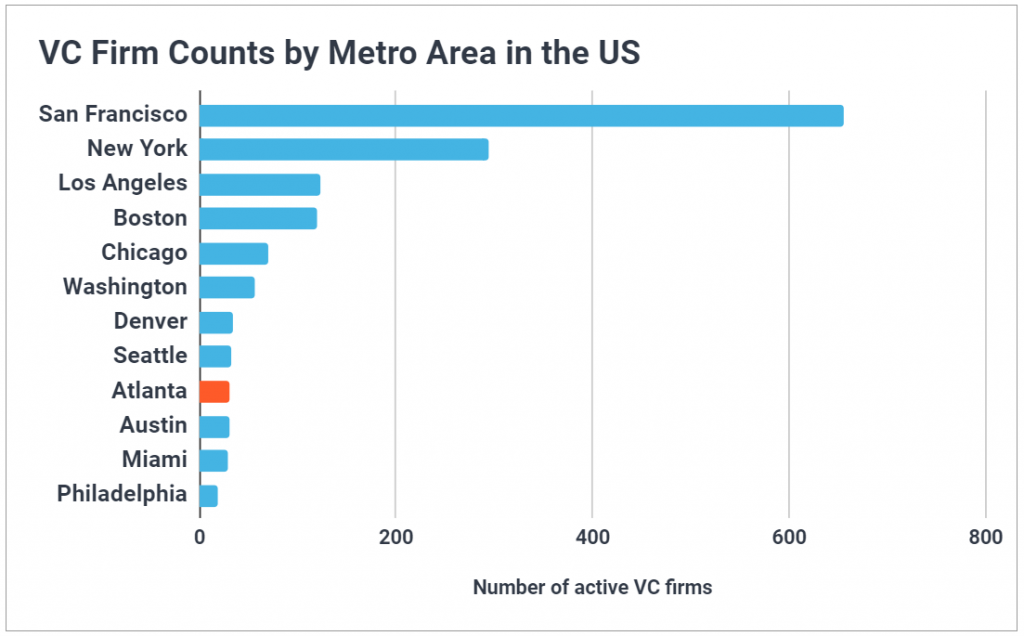

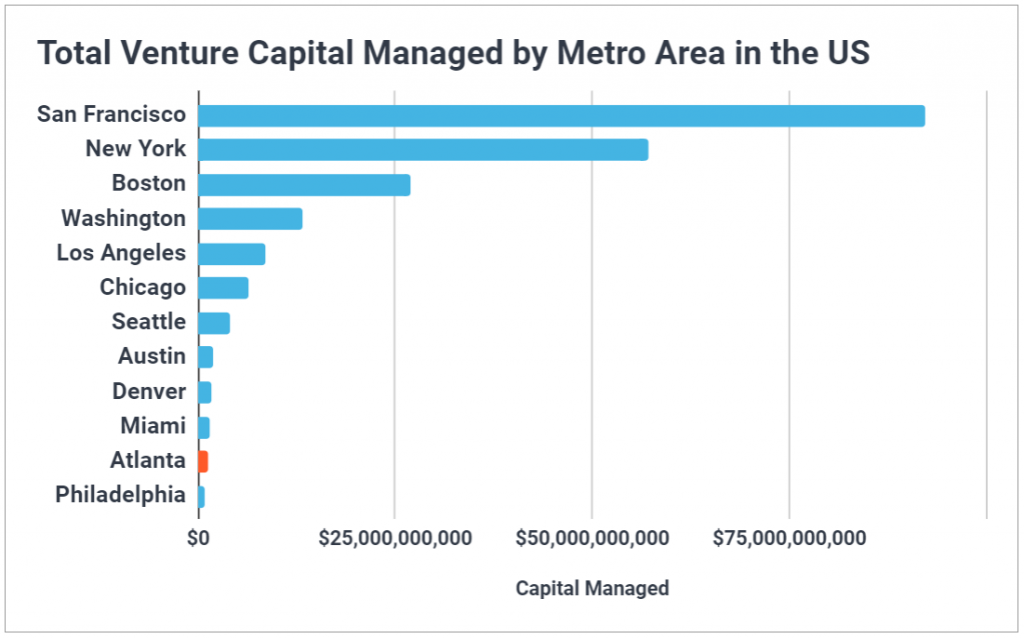

We estimate there are just over 30 Atlanta-headquartered VCs, managing a combined $1.4B out of their most recent flagship vehicles. This puts them in 9th in the US for VC firm count, nestled between Seattle and Austin.

But when looking at capital managed, Atlanta falls in the ranks, being passed by both Austin and Miami. This points to smaller typical fund sizes in the Atlanta market compared to other emerging regions: indeed, with an average fund size of $61M and a median of $29M, Atlanta VCs are generally smaller than those in other growing markets. And compared to the nationwide average of $171M and median of $50M, Atlanta VCs are working with quite a bit less capital. This could potentially pose a challenge for the ecosystem’s investors as the local startup scene matures and becomes more competitively priced, with big-pocketed outside investors leading the largest, highest-return rounds.

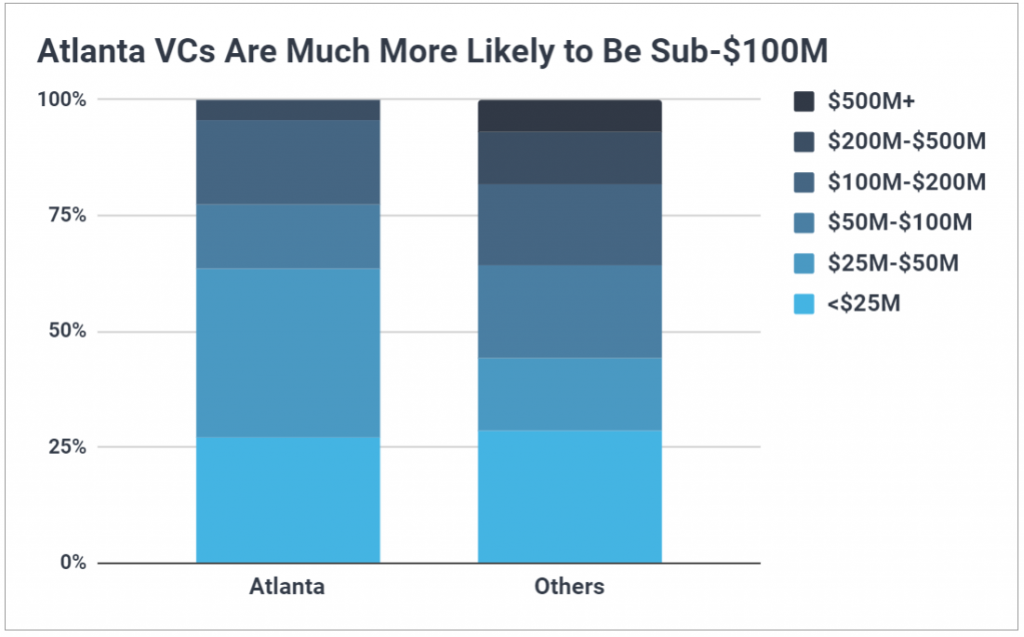

Drilling down more specifically into fund sizes, the following chart shows Atlanta-based VC firms are much more concentrated in the $25M to $50M range than are VCs throughout the rest of the US. And importantly for attracting institutional LPs, nearly 78% of Atlanta VCs manage funds below $100M, a common cut-off for institutional capital. This requires many of the region’s funds, then, to seek investment from smaller-check-writing individual LPs, which can increase the difficulty of scaling into larger, later-stage firms.

Atlanta VCs Are More Diverse, and Drive Investment into More Diverse Founders

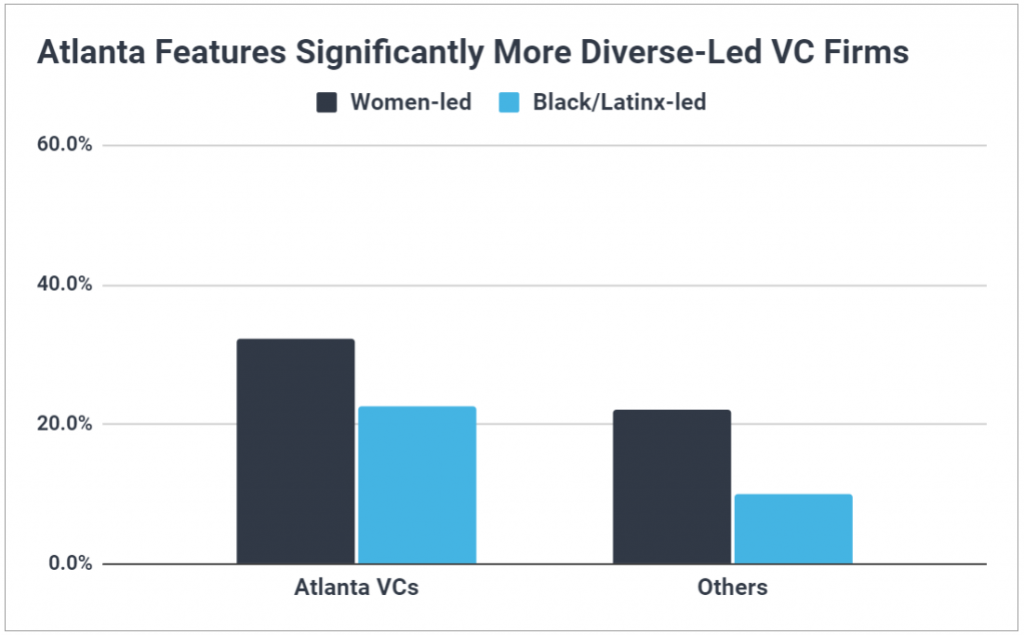

As we’ve written before, the US VC market is pitiful when it comes to gender and racial GP diversity. But such a macro lens of course ignores quite a bit of variability at the city level — and Atlanta is one of the most promising regions for creating a more equitable VC market.

Across the US, just 22% of VC firms are women-led (where at least a third of GPs are women), and just 10% are Black/Latinx-led. Comparatively, a much-improved 32% of Atlanta VCs are women-led and nearly 23% are Black/Latinx-led.

This represents a 46% improvement in gender equity and a crucial 127% improvement in racial equity. However, without significant increases in the fund sizes of Atlanta VCs, it’ll be difficult for this GP diversity to translate into a more equitable distribution of capital to diverse founders.

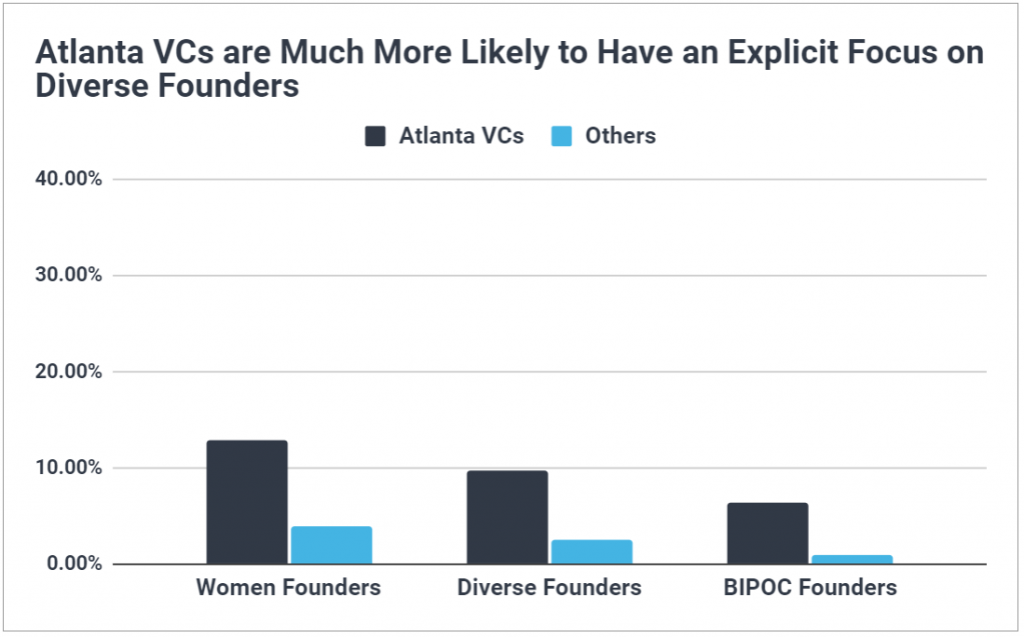

If Atlanta VCs do experience a surge in fund sizes, though, it’s likely they would push significantly more capital to underrepresented founders than VCs in other regions, given their increased propensity to having a thesis with an explicit focus on diverse founders.

Whereas less than 2.5% of all US VCs have an explicit focus on diverse founders generally (with less than 4% specifically targeting women and less than 1% targeting BIPOC), a promising 9.7% of Atlanta-based VCs have a diverse founder focus, with nearly 13% targeting women founders and 6.5% targeting BIPOC founders.

Atlanta VCs Lean Earlier and Make Fewer Investments per Year

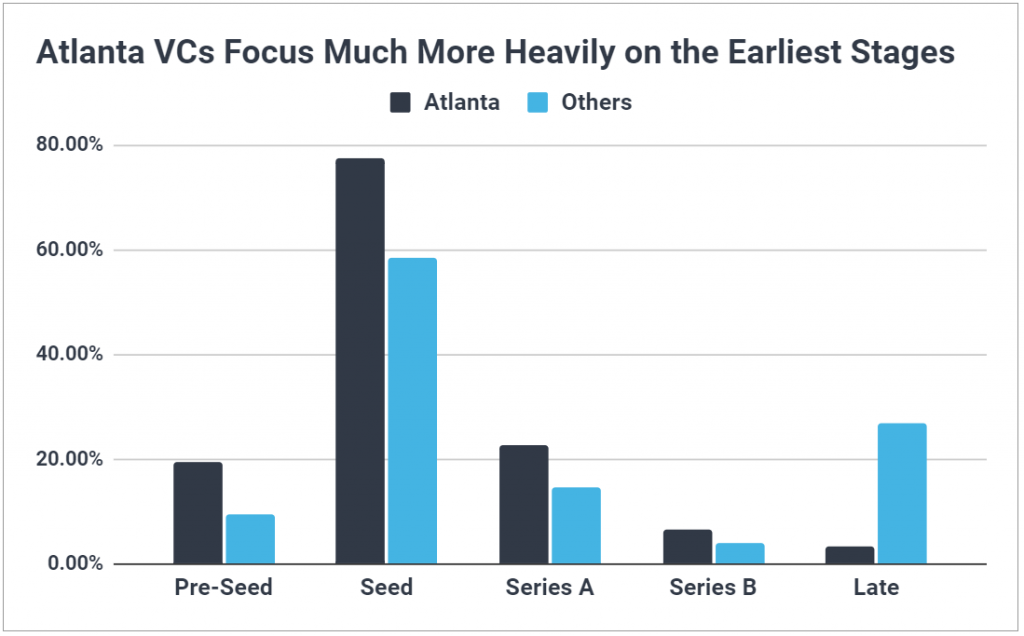

Unsurprisingly given fund sizes, Atlanta VCs are much more likely to make first checks at the seed/pre-seed stage, with very few continuing to later growth stages.

Across the US, we estimate 59% of VCs invest at the seed stage or earlier, but in Atlanta that figure jumps to 77%. Further, while less than 10% of US VCs focus on pre-seed, nearly 20% of Atlanta VCs venture that early.

On the other end of the spectrum, just 3% of Atlanta VCs invest at the late stage (Series C+), compared to a healthy 27% for US VC at-large. This helps explain why the most mature Atlanta startups are commonly backed by non-Atlanta-based VC firms.

Also related to fund size, we find Atlanta VCs have slower typical investment cadences, making, on average, 5.5 new investments per year (across all other regions, that figure rises to 8.2 per year). While this could reflect a preference for hands-on, conviction investing, it may also simply be a function of fund size.

Preferred Sectors of Atlanta VCs

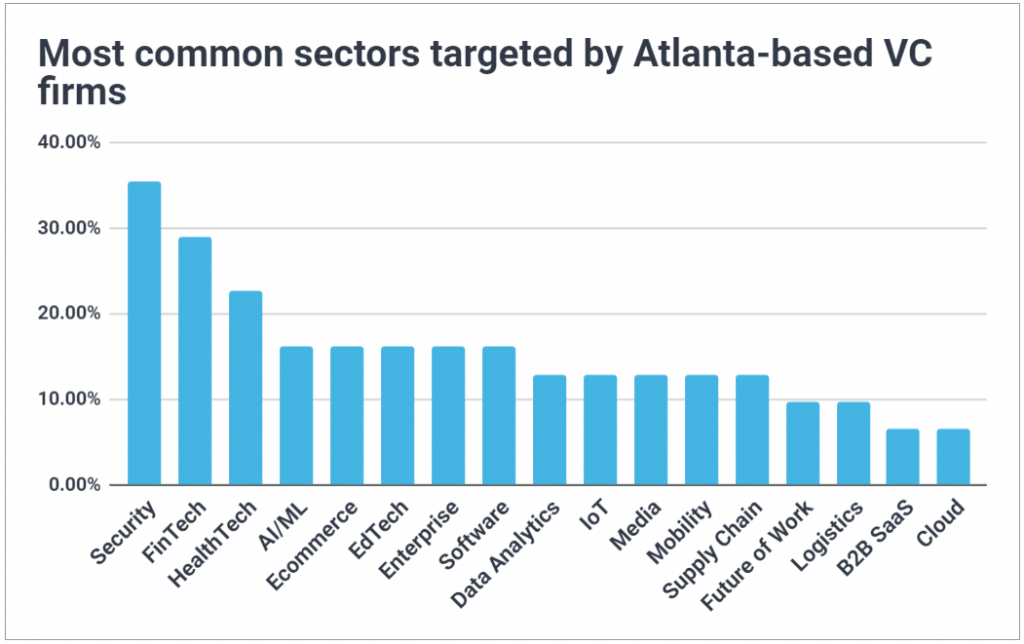

Although a number of the top Atlanta sectors are common to the rest of the US (e.g. FinTech, HealthTech, Ecommerce, AI/ML, etc.), a few sectors appear that are less prevalent in other areas. Namely, Atlanta VCs have a tendency to target Security, Supply Chain, Future of Work, and Logistics.

It’s likely no coincidence that these sectors are particularly relevant to large corporations: corporate LPs are noticeably more common in Atlanta than other regions. The presence of UPS and Delta headquarters offers further reason to target startups innovating across the central business activities of these large companies (supply chain and logistics). And, Georgia Tech’s position as the top university for cybersecurity undoubtedly drives ample startup opportunities in the space.

Atlanta’s Role in the Future of VC Diversity

Atlanta’s venture capital ecosystem, then, appears speckled with micro-VC funds, focused mostly on seeding the earliest stages of startups relevant to the large corporations headquartered in the region.

But perhaps most importantly, Atlanta stands out for its position at the forefront of VC diversity. Although diverse VCs and firms focused on underrepresented founders exist across the US, the atypical concentration of diversity-focused VCs in Atlanta presents a unique opportunity to see the compounding impact of an ecosystem roundly centered on creating social change.

Whereas a single diverse-focused VC in a sea of traditional firms can find its ability to move the needle negated (as is the case in other geos), the potential impact of an entire ecosystem pushing for a more equitable distribution of capital is exponentially greater.

If LPs who care about diversity begin redirecting their capital to the Atlanta market, boosting the AUM of the currently capital-constrained VCs in the region, Atlanta could quickly lead the charge in improving gender and racial equity for startups throughout the US. With more capital, Atlanta VCs could move up the startup pipeline, not just seeding underrepresented founders, but catalyzing rapid growth.

And if Atlanta matures to serve as a model for equitable VC, it’s not unlikely we may see other metros follow.